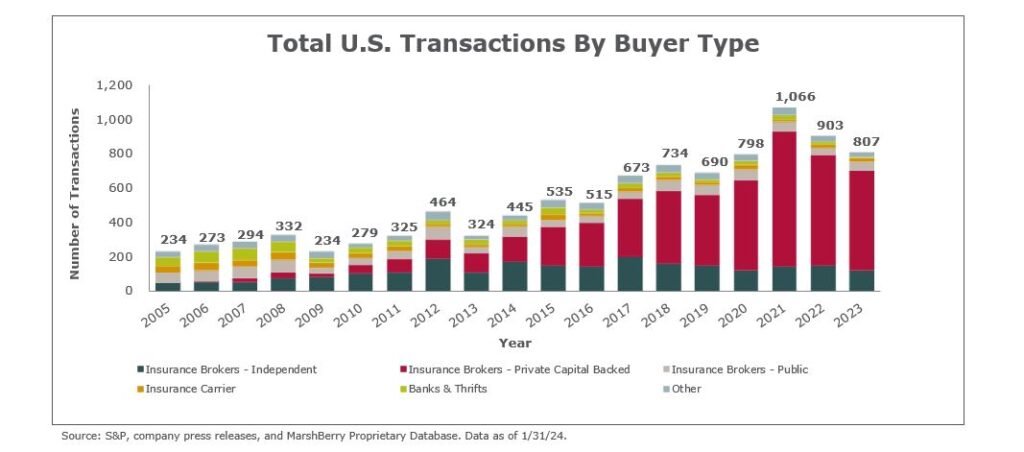

As January flew by, year-end merger and acquisition (M&A) deal data for 2023 continues to roll in. The current count shows that 2023 delivered a total of 807 insurance brokerage transactions – a 10.6% decline compared to 2022 – and the third highest year on record.

M&A Market Update

With 2023 in the rear-view mirror, focus is now on 2024, which continues to garner optimism for deal activity with several factors potentially influencing the economic environment and capital markets. Buyer demand is expected to increase with any interest rate cuts and related improvement in access to capital. There is also a possibility for an increase in the seller supply who may be motivated by the impact of tax changes as the Tax Cuts and Jobs Act expires at the end of 2025.

M&A activity in 2024 has started off slow, with only 29 insurance brokerage transactions in the U.S. announced in January. As the year progresses, it is anticipated that there will be additional deals that are announced retroactively.

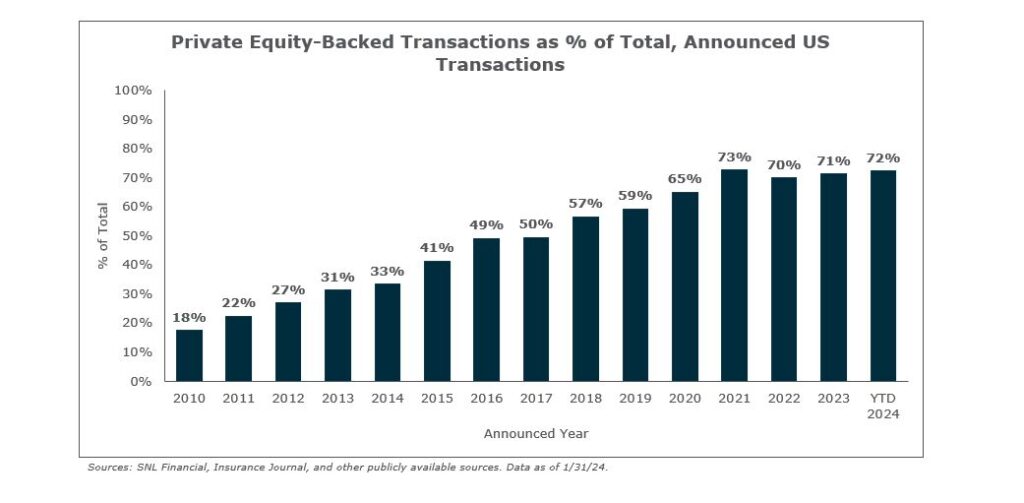

Private capital-backed buyers have accounted for 21 of the 29 transactions (72.4%) through January. This represents a significant increase since 2019 when private capital-backed buyers accounted for 59% of all transactions.

Deals involving specialty distributors accounted for 21% of the total (six transactions) of the total 29 deals in January. Transactions involving specialty distributors have been increasing at a compound annual growth rate (CAGR) of 18% since 2018, a trend that is anticipated to continue as traditional retail brokers expand into the wholesale and delegated authority space.

Independent brokers accounted for three deals so far in 2024, representing 10.3% of all announced activity, a slight decrease from 2023 when independent brokers represented 15.6% of the deal count. Acquisitions by banks continued to fall, declining from 18 transactions in 2022 to nine transactions in 2023 – an all-time low – and no announced transactions so far in 2024.

Deal activity from the marketplace’s most active acquirers has remained strong in the beginning of 2024. Ten buyers have accounted for 75.9% of all announced transactions, while the top three (Inszone Insurance, Arthur J. Gallagher & Co., and Patriot Growth) account for 41.4% of the 29 total transactions.

Notable transactions:

- January 5: Johnson & Johnson Insurance announced that it has acquired Mid Valley General Agency LLC, headquartered in Salem, Oregon, with operations in Idaho, Montana, and Washington. Mid Valley General Agency LLC, a family-owned managing general agency, specializes in catering to retail insurance agents with difficult-to-place risks. Based in Charleston, South Carolina, Johnson & Johnson is also a managing general agency.

- January 9: Unison Risk Advisors-owned Oswald Companies announced that it has acquired Brieden Consulting Group. This integration strengthens Oswald’s presence in Michigan, complementing its existing operations in Bloomfield Hills. Brieden brings a significant portfolio of employee benefits business to Oswald, while Oswald specializes in property & casualty, employee benefits, life insurance, and retirement plan services.

- January 31: Arthur J. Gallagher & Co. announced it has acquired The John Galt Insurance Agency, comprising John Galt Commercial Insurance Agency, LLC and John Galt Insurance Agency, Inc., both based in Fort Lauderdale, Florida. The John Galt Insurance Agency specializes in offering comprehensive property and casualty insurance solutions, with a particular focus on commercial and multi-family real estate throughout Florida.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230