In the past few months, two of the largest wealth management merger and acquisition (M&A) transactions in recent memory closed within weeks of each other. LPL Financial announced its acquisition of Commonwealth Financial Network for $2.7 billion, potentially adding roughly 2,900 advisors and $285 billion in assets to its already formidable platform. Not long after, Osaic acquired CW Advisors, a Boston-based RIA platform managing approximately $13.5 billion in assets, previously backed by Audax Private Equity. CW Advisors has been an active acquirer in 2025, with six acquisitions completed. These headlines sparked a new conversation: Is this the start of a consolidation wave at the top of the market?

MarshBerry believes these headline-grabbing deals are not isolated events, but rather early signs of a broader shift in how firms are competing and what it takes to stand out in an increasingly crowded field. What we’re seeing now is a reshaping of the competitive landscape. Large buyers are pursuing scale and national presence, because in wealth management, geography matters. This is still a zip code business. Acquiring established platforms with strong regional or national density allows firms to accelerate growth more efficiently than building from scratch. For buyers struggling to differentiate or facing a lack of alignment post-recapitalization, transformational M&A has become a path to relevance.

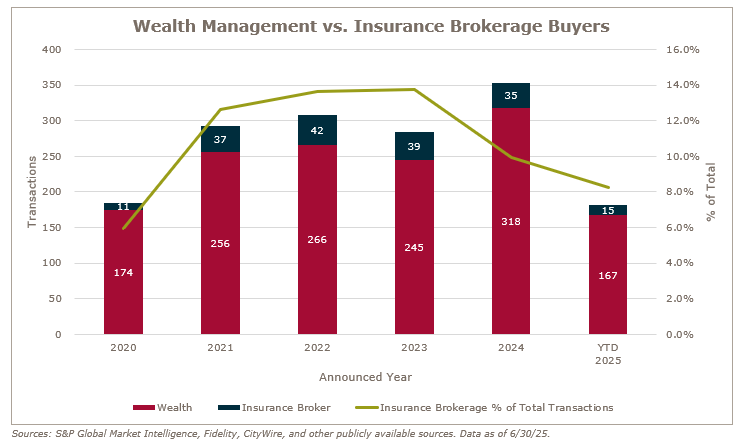

Since the post-COVID boom began in 2020, the wealth management M&A market has surged, driven by a wave of private equity (PE) capital, the rise of institutional M&A teams, and a “great awakening” among advisors re-evaluating their future. Since 2020 deal volume has nearly doubled, going from 185 transactions to 353 in 2024. Yet buyer diversity hasn’t contracted. As of Q2 2025, 98 distinct buyers have already completed a transaction and 36 have done more than one, further evidence that the buyer engine remains strong.

A shifting landscape for buyers

In the wake of this surge in M&A activity, there is a shift occurring in the profile of the buyers themselves. As competition intensifies, firms are recognizing the need to differentiate themselves through brand, strategy, and structure – to remain relevant in a market that is beginning to favor scale and clarity of purpose.

This shift isn’t surprising. Several large consolidators most recently recapitalized three to five years ago, and many are now approaching the natural inflection point where their sponsors are evaluating exits, partnerships, or new strategies. For firms that can’t clearly differentiate themselves in an increasingly competitive market, combining with a larger player becomes an attractive next step. And PE capital remains ready to support that evolution. In a space where hundreds of advisory firms still present acquisition opportunities, scale has become a serious competitive advantage.

For the high growth advisor (>10% annual growth) the decision to stay the course in this shifting competitive landscape demands a heightened sense of strategic awareness. Technology investments made by large PE backed firms have raised the bar, offering these firms opportunities to gain scale, grow their business, and attract new clients. Even the highest performing firms could be left behind if they don’t take steps to innovate and enhance operational efficiency. The decisions made in the next 12 to 24 months will have a lasting impact. Firms should be asking questions now about where they fit, how they grow, and what it will take to stay relevant. The opportunities that exist today will not look the same in five years and waiting to evaluate your position until the dust settles may mean missing the moment altogether.

Of course, what comes next may not be predictable. New capital pools or unexpected entrants could emerge and change the game entirely. For now, the race to build and scale is well underway. And for those who figure out how to win on geography, talent, and brand, the rewards could be significant.

M&A Market Update

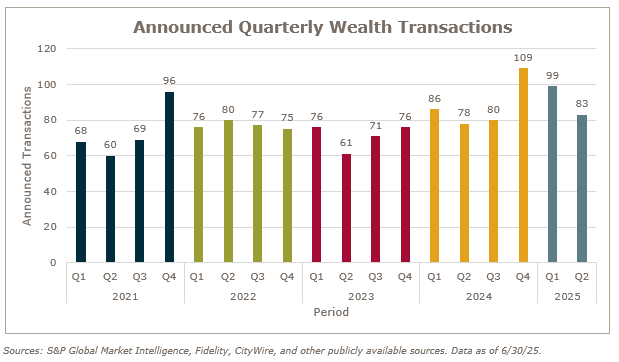

As of June 30, 2025, there were 182 announced wealth advisory M&A transactions in the U.S, with 83 transactions being announced in Q2. This represents the highest second quarter of any year on record and the fifth highest total quarter for any year. The 182 deals represent a 16.7% increase over the 156 deals announced as of Q2 2024, which ended up breaking the deal count record.

Strong M&A activity driven by both buyers and sellers

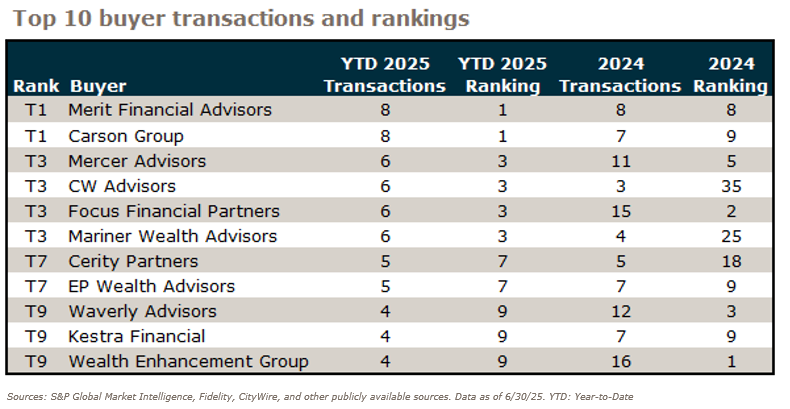

As of Q2 2025, the top three buyers (Merit Financial, Carson Group, and Mercer Advisors) accounted for 12.1% of all wealth advisory M&A transactions. The top ten buyers collectively represented 31.9% of total market activity, reflecting a strong level of engagement among active acquirers. At the same time, the data continues to show that the buyer market remains highly diverse, with a large number of firms each contributing to overall deal flow. While this snapshot highlights early momentum among some buyers, it’s important to note that it’s still early in the year. M&A activity often accelerates later in the year, and rankings can shift meaningfully as more firms enter the market or expand their acquisition strategies. The Q2 leaderboard provides an early look, but it is likely to evolve as 2025 progresses.

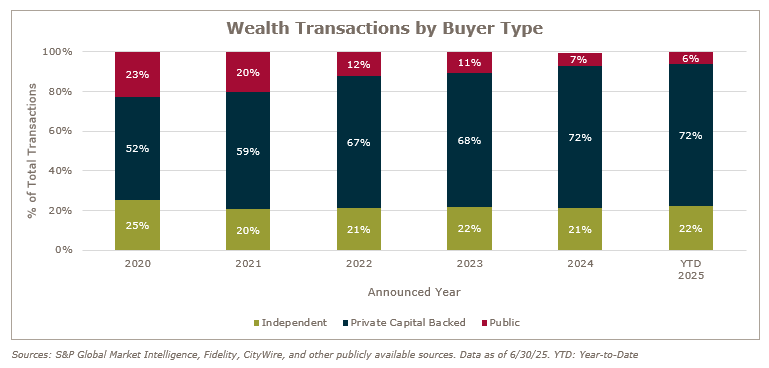

Independent and public acquirers see an uptick in activity

Public wealth managers have represented 6% of M&A activity in 2025, down from 7% in 2024. This comes on the heels of four consecutive years of market share declines. Independent wealth acquirers sustained their previous market share, with a slight increase to 22% of total activity. In total, 35 independent firms have made acquisitions in 2025, with only 4 of them completing more than one deal. This dispersion of activity suggests a growing comfort with M&A as a growth lever among independent firms, many of which are entering the market without institutional capital. It’s a strong reminder that PE isn’t the only path to deal-making.

PE-backed wealth acquirers continued to drive a majority of the total deal count, representing 72% of all announced deals, the same as 2024. From 2020 to 2024, PE-backed wealth managers increased their market share every year, so it remains to be seen if this upward trend will continue in 2025.

Retirement industry M&A update

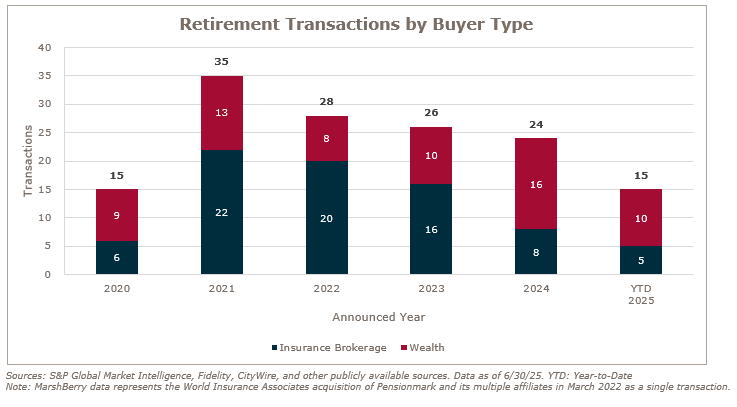

There were 15 announced retirement transactions as of June 30th, already encompassing 62.5% of last year’s total. In recent years, retirement-focused advisory firms were most often acquired by insurance brokerages, drawn to the natural synergy between retirement planning and annuity or insurance product distribution. But that trend is shifting. Increasingly, these firms are being acquired by wealth-focused platforms instead. One reason is that more wealth firms are now building robust retirement income and decumulation planning capabilities to serve aging client bases, making these acquisitions highly strategic. Additionally, retirement-focused firms bring deep, trust-based client relationships and sticky AUM—characteristics that align well with the recurring revenue, high-retention models that wealth buyers increasingly prioritize. As wealth firms look to expand their service offerings and deepen client wallet share, acquiring retirement-centric practices has become a natural extension of their growth strategy.

Insurance brokerage insights

Transactions in which insurance brokerages were buyers has seen a slight dip in 2025, with these transactions representing 8.2% of the market. This percentage of insurance brokerage activity has consistently been between 10% to 14% since 2021. This decrease may signal a shift in the strategic priorities of insurance brokerages, as they adapt to changing market conditions. However, with strong fundamentals in the industry, it remains to be seen whether this trend will persist or rebound in the near future.

Notable Transactions

March 31: LPL Financial has entered into a definitive agreement to acquire Commonwealth Financial Network, the largest independently owned wealth management firm in the U.S., for approximately $2.7 billion in cash. The transaction, expected to close in the second half of 2025, will add around $285 billion in brokerage and advisory assets and 2,900 financial advisors to LPL’s platform. Commonwealth will retain its brand post-acquisition, with CEO Wayne Bloom continuing to lead the advisor experience and joining LPL’s Management Committee. The deal aligns two advisor-centric firms and aims to enhance services, scale, and long-term value for advisors and clients across both organizations.

May 30: Cerity Partners has expanded into Arizona with the acquisition of Canopy Wealth Management Arizona, a Scottsdale-based advisory practice managing approximately $433 million in client assets. The deal, which closed shortly after being announced, brings advisors Chad Wing and Dustin Brutton, along with four team members, into Cerity Partners as partners. Originally launched in 2021 as an extension of Wisconsin-based Canopy Wealth Management, the Arizona office marks Cerity’s latest move in its ongoing national expansion strategy. Financial terms of the transaction were not disclosed. MarshBerry represented Canopy Wealth Management in this transaction.

June 17: Osaic, Inc. has acquired CW Advisors, LLC, a Boston-based registered investment advisor managing $13.5 billion in fee-only client assets. Serving high-net-worth and ultra-high-net-worth clients through a family office platform, CW Advisors operates with 140 professionals across 17 offices. The acquisition aligns with Osaic’s strategy to broaden its reach across advisor models and client segments while enhancing its presence in the high-net-worth market. CW Advisors will retain its name and remain operationally independent, gaining access to Osaic’s capital and expanded resources. The deal marks a key step in advancing Osaic’s signature employee model and long-term growth plans.

Looking ahead

The second quarter of 2025 kept up the momentum from Q1, with similar drivers of consolidation—rising demand for scale, advisor succession, and the strategic advantages of platform affiliation. Buyers remain well-capitalized and eager to grow, and today’s market presents an opportunity for firm owners to capitalize on still-strong valuations, differentiate themselves, and secure long-term growth. The market continues to evolve as new players emerge and PE flows to firms eager to grow and scale. Overall, the ongoing momentum suggests meaningful opportunity ahead.