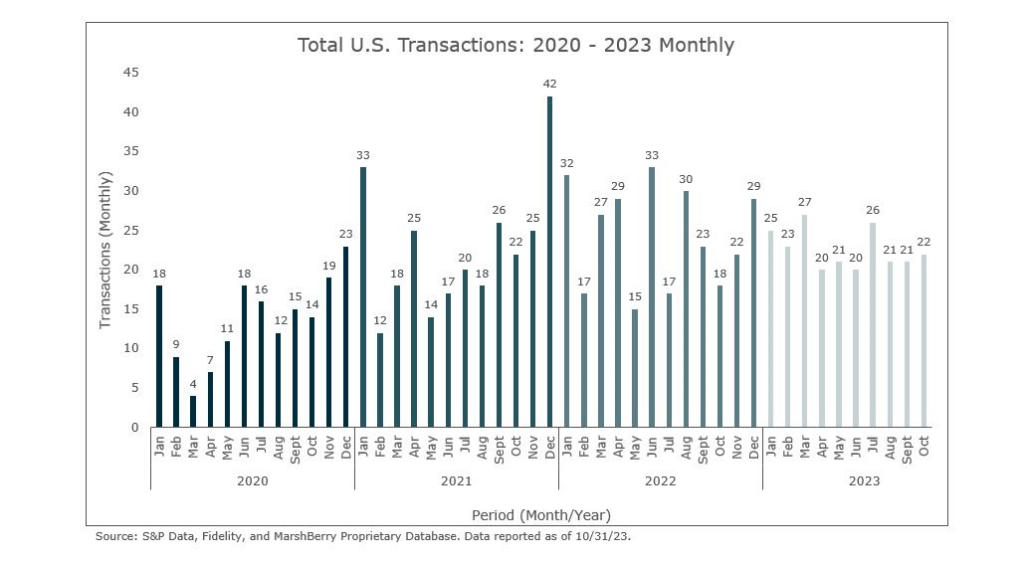

Q4 kicks off with a solid performance – 22 announced merger and acquisition (M&A) transactions, maintaining the average monthly deal volume for 2023. The 22 deals in October 2023 are slightly higher than this time last year, with only 18 deals announced in October 2022. Activity from October brings the year-to-date (YTD) total deal count up to 226, compared to 241 deals through October 2022. The YTD gap between 2022 and 2023 is now 15 deals, representing a decrease of approximately 1.5 deals a month – not a materially different amount.

While 2022 and 2023 were vastly different years in trends and storylines – the overall results may end closely similar. As 2022 M&A activity was driven by a month-to-month rollercoaster ride of varying economic news and conditions – 2023 displayed a more consistent and deliberate pace for acquisitions.

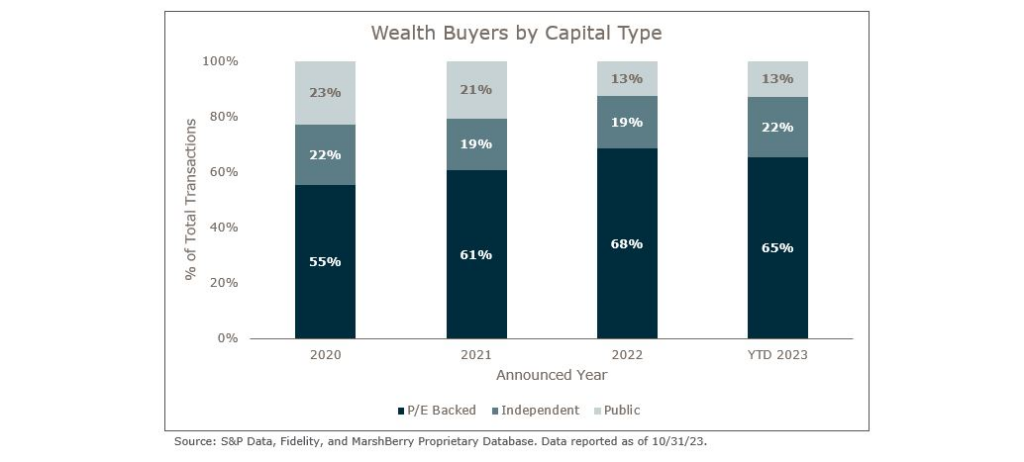

Buyer types

Private equity-backed buyers have accounted for the majority of wealth advisory transactions YTD through October 2023, with 148 (or 65%) of the 226 transactions. Independent firms accounted for 49 (or 22%) of the total deals so far, with public firms making up the remainder with 29 (or 13%) deals YTD.

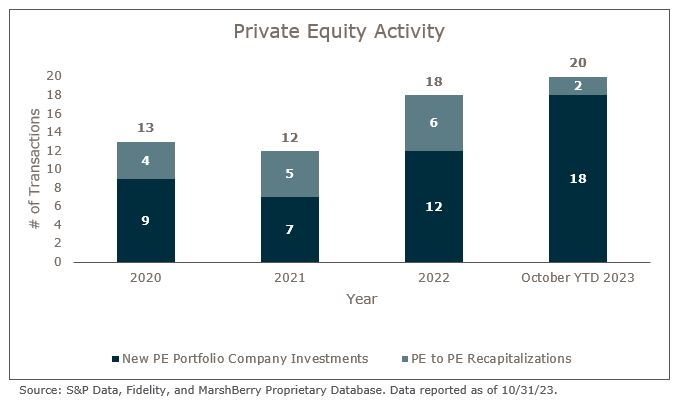

Private equity activity

There were 20 private equity investments YTD through October 2023, compared to 17 private equity investments at this time in 2022. Of the 20 investments, new money represented 18 of the investments, or 90%. This highlights the increased focus that private equity firms have placed on the industry, with a majority coming in as new investments.

Deal Spotlight: BDO Wealth Management

October 31, 2023: Choreo, LLC (Choreo), announced their acquisition of the wealth management business BDO USA (BDO), a global accounting firm. BDO’s wealth management business had approximately $8.1 billion of client assets split between assets under management (AUM) or advisement (AUA). In addition to the acquisition, Choreo also partnered with BDO’s Business Resource Network (BRN) to provide services to BDO, BDO’s clients, and their affiliate members. The acquisition of BDO’s wealth business increased Choreo’s AUM/AUA to approximately $23.2 billion.

Larry Miles, CEO of Choreo, had this to say about the strategic rationale behind the acquisition and partnership: “One of our long-term goals is to be the preferred wealth provider to the tax professional community. The addition of BDO USA’s affiliated wealth management business is an important step in that direction. Our membership in BRN combined with integrating the knowledge and experience of their business will help us with our mission of translating wealth into fulfillment for our clients and their communities.”

Choreo history goes back over 20 years when they were a subsidiary of RSM, a national CPA and professional services firm. Today, Choreo is an independent firm focused on redefining the RIA’s place in the wealth advisory industry while staying true to their roots of servicing the tax professional community.

Looking forward

Historically, the months of November and December continue to ramp up in volume of announced deals, with December often delivering the most. In light of improving economic conditions, it will be interesting to see how 2023 ends for M&A activity. As is always the case, the final results will come down to the final stretch.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230