Over the past few years, a hard market and high recurring revenue have provided tailwinds for growth. But as conditions potentially change – due to trade tariffs, softening markets, or challenges in finding good talent – firms may start facing new headwinds. Attendees of the MarshBerry 360 Forum discussed these and other topics related to maximizing value and increasing profits. Here were four key takeaways from this event:

Strong sales culture is a necessity

A recurring question at the event was “How can we be viable for the future?” One common answer focused on talent, particularly producer development. Many firms say that they offer the best service or can get the best rates, but none of that matters if the sales structure isn’t strong. In a panel discussion, leaders from top buyers shared that when exploring potential targets for acquisition, a strong sales culture is an attractive quality and could be a dealbreaker if the culture isn’t right. These buyers are looking to see if a firm has a well-defined value proposition – one that gives producers a competitive advantage, with access to a wide range of carriers and robust sales tools.

Sales teams should have clear expectations for how they will succeed, and how they will be held accountable. Accountability can sound intimidating but it’s about empowering teams to take ownership of their success. To drive accountability, firms need to appoint dedicated sales leaders to help set direction, reinforce expectations, and lead with support, not control.

Driving organic growth: The never-ending story

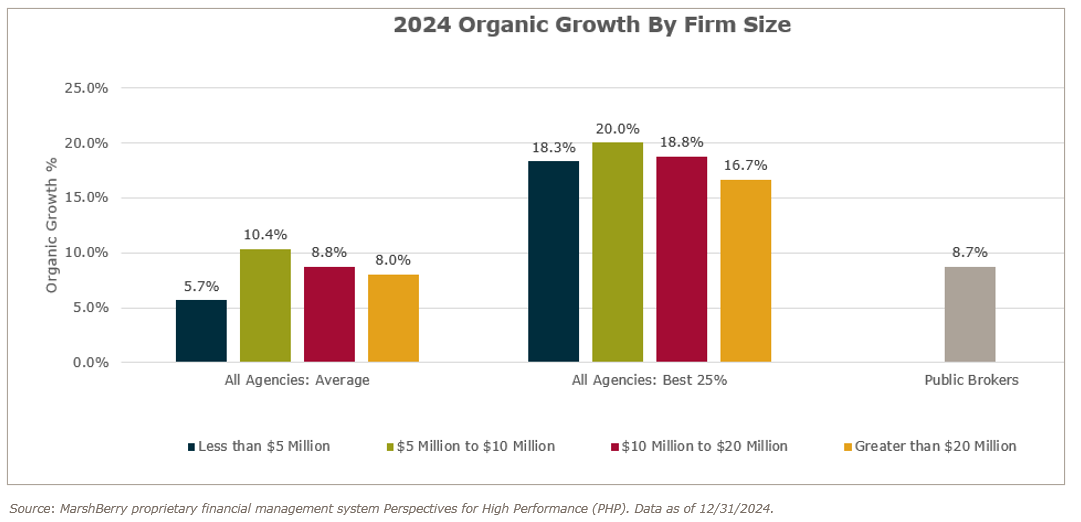

Driving organic growth was a recurring theme at 360, particularly since there are indications that the 15-year supercycle may be coming to an end. To combat this, MarshBerry recommends targeting 15% growth every year, if you achieve this then your firm will double in size in five years. This chart compares the numbers of top-performing firms against the average firms, showing that double-digit organic growth is possible for firms that strive to achieve it, while revealing an abundance of opportunity for those that haven’t.

The most common reason cited for lack of growth is non-producing producers. Shifting to a growth mindset is a key strategy for addressing this core issue. A “growth mindset” includes defining processes to address underperformance, creating a robust systematic sales process, gathering insightful data, and remembering that there is no growth without some level of risk.

Run your business like it’s for sale

Regardless of size, all firms need some form of strategic planning to be successful, yet most firms in the industry do not have an established strategic plan. By comparison, 84% of top firms update their strategic plan annually.1 To develop a blueprint for sustained growth and long-term success, firms should ask themselves three questions:

- Where is the firm today? When it comes to business performance, don’t guess, use data to benchmark performance, capitalize on strengths and uncover weaknesses.

- Where is the firm going? Firms need to set realistic, data-driven goals, refine strategy, and establish a vision for the next five years.

- How will the firm get there? Establish action plans, set timelines, identify urgencies, and be transparent.

This framework can help insurance brokers build long-term success, driving higher valuation if the time comes to sell. Considering that 2024 was the third most active year on record for insurance brokerage mergers and acquisitions (M&A), many business owners have found that selling or partnering offers opportunities to access capital to invest in upgrades and initiatives. This is particularly true as decreasing returns are putting immense pressure on consolidators to integrate, diversify, and grow organically.

Future trends: highs and lows

There will be continued acceleration in insurance brokerage M&A, and private capital-backed buyers will still dominate. High demand for specialty and employee benefit firms will continue and the buyer market appears to be crowded for the foreseeable future, creating multiple selling opportunities for firms dedicated to high growth.

Many consumers are experiencing an “affordability crisis” choosing to forego insurance completely in some markets. (Uninsured motorists are at an all-time high.) Use data to discover beneficial value-adds, then invest in them. This could mean improving technology, enhancing a value proposition, or holding sales teams more accountable. Find a way to adapt to pricing pressures and industry trends to win back lost clients.

Insurance is the greatest industry for many reasons, but it can also offer a false sense of security. Confront the firm’s current state – what’s its vantage point today? Times are good. Investing in upgrades that create strength and advantages today – can help when times aren’t so good tomorrow.