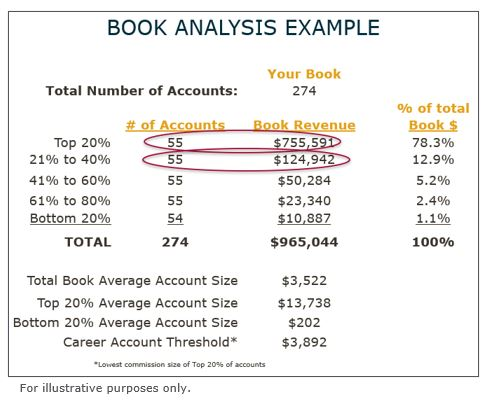

Most of the insurance brokerage industry tends to follow the 80/20 principle – 80% of the average firm’s revenue is driven from 20% of their customers. The inverse of that formula is that 80% of a firm’s customer list accounts for only 20% of the total revenue. That means losing a top 20 account immediately and directly impacts company value.

Building a value proposition and proactive strategy to retain the top 20% of accounts is essential for brokers serious about growth. It’s also important to write additional accounts of equal or greater size to add a buffer if one is lost. A firm’s producers should make it a priority to target larger accounts for new business. MarshBerry strongly recommends creating a brokerage Small Business Unit (SBU) to balance these factors while maximizing client retention and internal profitability.

How an SBU Profits Insurance Brokerages

A Small Business Unit (SBU) typically refers to a specialized department or division within an insurance brokerage that focuses on serving the insurance needs of small businesses: those that have a relatively low number of employees, minimal annual revenue, and limited assets compared to larger enterprises. While it may sound counterproductive initially, developing an SBU can be a wise investment in the long term. Here are some benefits of a strong insurance brokerage SBU:

- Better client service: One of the core reasons high growth and high-performing brokerages build an SBU is to help create a more efficient, stronger value proposition for their smaller accounts.

- More attention to larger accounts: By adding a dedicated SBU, tenured producers can work on larger and more complicated accounts, boosting growth.

- Cross-selling opportunities: An SBU is another venue to sell additional insurance products to established clients.

- Competitive advancement: Since most of today’s insurance broker landscape has neglected the SBU strategy, smaller clients are taking notice and have ultimately gravitated towards an SBU broker model by purchasing more of their products, increasing loyalty and improving retention rates.

Without a dedicated unit to properly improve this business’s servicing capabilities, brokerage owners risk losing large, potentially profitable blocks of business. Firms that avoid building a specialized unit to service those account thresholds should reevaluate their long-term commitment to this type of business.

Developing Your SBU

Refining the servicing process should be a year-one priority when establishing an SBU. Start by ensuring quality service personnel are in place, and the carrier strategy for placing small businesses is concrete. A well-defined SBU brings immediate efficiency to small business accounts, but the overall effect the unit can have on the company’s long-term value should not be overlooked. Growth costs money, so balancing growth with shareholder return is a challenge for brokerage owners, which is why when executed correctly, a brokerage SBU complements both organic growth and profitability simultaneously.

Typically, the SBU comprises specialized staff with expertise in the unique insurance needs and risk profiles of small businesses. They work with business owners to assess their risks and recommend appropriate insurance coverage.

Once the unit is established, your firm should establish a five-year growth plan similar to other niches or verticals within the business. A brokerage’s growth plan should involve:

- Creating an SBU value proposition consistent with the brokerage’s current branding and marketing collateral.

- Developing a dedicated sales professional(s) responsible for driving SBU growth.

- Building a profitable list of executable value-added services that scale the unit.

- Creating a different sales model to handle smaller accounts.

- Defining and documenting what types of accounts qualify to be handled by the SBU. This includes identifying which accounts require low-touch and low-cost client interaction, bringing in minimal revenue, etc.

As you can see in the chart below, dissecting a producer’s book of business can help identify the bottom 80% of accounts that belong in the SBU:

Contact MarshBerry Today for Insurance Brokerage SBU Assistance

There are only so many accounts that a producer can service before new business and book growth plateau. Implementing a brokerage SBU results in smaller accounts being transferred to other staff, thus freeing the producer to sell more and service less.

As an insurance brokerage owner, establishing or refining your SBU goals should be a focus if you plan to drive long-term sustainable value. Building an SBU can consume a lot of organizational time and resources, but the returns are worth the output in the long run.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230