Understanding compensation costs for your firm.

As you can imagine, given the importance of human resources in the insurance brokerage industry, understanding how to handle payroll, headcount, and hiring — essentially understanding compensation costs for your firm — has become a requisite item in the insurance strategy consulting and short-term planning process.

However, one item that continues to be overlooked in strategy discussions, regardless of COVID-19, is producer compensation or sales compensation models, which is most likely your biggest and most significant expense. It’s interesting how little this topic is brought to the table when it comes to refining and improving value for an insurer or brokerage. After all, producer compensation is most likely your biggest, and most important, expense. A well-designed compensation plan in the insurance industry, especially sales compensation models, can tremendously impact growth, perpetuation, culture, value creation, and certainly the performance of the business during turbulent times. During stable environments, it’s easier to avoid the elephant in the room. But, with uncertainty and continued threats to your firm, now is the time to address the topic on your next planning meeting agenda.

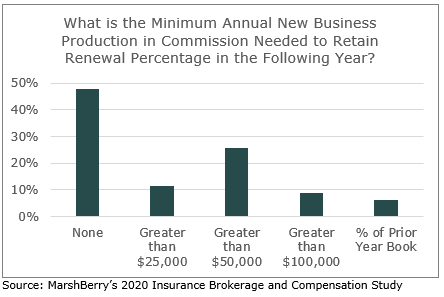

According to MarshBerry’s 2020 Insurance Brokerage and Compensation Study, nearly half of respondents indicated that they do not have a minimum annual new business production threshold that producers need to reach in order to retain the renewal percentage in the following year.

As you venture down the path, consider the following MarshBerry fundamentals:

- Measure twice, change once. Far too often, our clients don’t ask the holistic questions as it relates to producer compensation. This leads to ineffective changes being made, and unwanted behaviors (and suboptimal results) due to lack of strategic forethought.

- Ensure you have a measurable spread between new and renewal commission percentages. This spread differential helps focus the producer on new business production over renewal compensation. The job of a producer can be difficult. We recognize that account retention is important for both the producer’s personal income and firm revenues. New business production, however, is critical to the future viability of the organization. Producers must be incented to generate new business.

- There is no one size fits all approach to compensation design and structure. Take everything in consideration.

- Long-term goals around growth and perpetuation of the business should always be factored into why, when and how to implement changes.

- The best performing firms in the insurance industry have built sales compensation models that incent and reward high performing originators that are able to generate sustainable new business. These same firms, and models, protect the firm from overpaying non-performing salespeople on the residual, due to lack of new business performance.

- Creativity and differentiation, as it relates to your sales model, can impact how you attract and retain talent. Technology, marketing, tiered sales roles, mentorship and implementing salary (vs. commission) models are just a few examples of items that can be inserted into the strategy that could be considered differentiators.

Producer compensation strategy and changes are not for the faint of heart. But, the best firms in the industry attack this challenge head-on and have built cultures that embrace change, no matter how difficult and uncomfortable it can be.

The insurance industry, along with its competition and customers, have evolved considerably over the past 10 years. To stay ahead, understanding compensation costs for your firm, including the development of effective sales compensation models, is critical. Has your compensation plan in the insurance industry kept up with these changes?

If you have questions about Today’s ViewPoint, or about creating a compensation strategy for your firm, please email or call Tommy McDonald, Vice President, at 440.392.6700.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.

Investment banking services offered through MarshBerry Capital, Inc., Member FINRA and SIPC, and an affiliate of Marsh, Berry & Co., Inc.