At MarshBerry’s annual 360 Forum, attendees received an in-depth report on the current and potential future state of the insurance brokerage industry’s mergers and acquisitions (M&A) landscape. With shifting market dynamics and innovative deal structures, firm leaders are eager to understand the emerging trends and best strategies for maximizing value.

A rising trend in insurance brokerage M&A

In 2024 there was a significant trend of notable large buyers acquiring other large buyers. In April 2024, Aon completed its acquisition of NFP, Corp. In May 2024, Truist completed an investor-led buyout to become independent. Another large transaction was Marsh McLennan’s acquisition of McGriff Insurance from Truist Insurance. Blackstone acquired a minority stake in Higginbotham. Gallagher signed an agreement to acquire AssuredPartners, which is expected to close this year.

For 2025 and 2026, MarshBerry expects the level of activity to be similar to 2024, with private capital-backed buyers driving a high level of activity. Already in 2025, public broker Brown & Brown announced (on 6/10/25) a definitive agreement to acquire Accession Risk Management Group, which includes both Risk Strategies and One80 Intermediaries – two major players in the specialty brokerage and wholesale insurance markets. The transaction is valued at approximately $9.8 billion. The deal follows earlier interest from global brokers including Howden and Marsh McLennan, reinforcing the growing trend of large strategic acquirers driving consolidation in the insurance brokerage sector.

Middle market firms are feeling the pressure

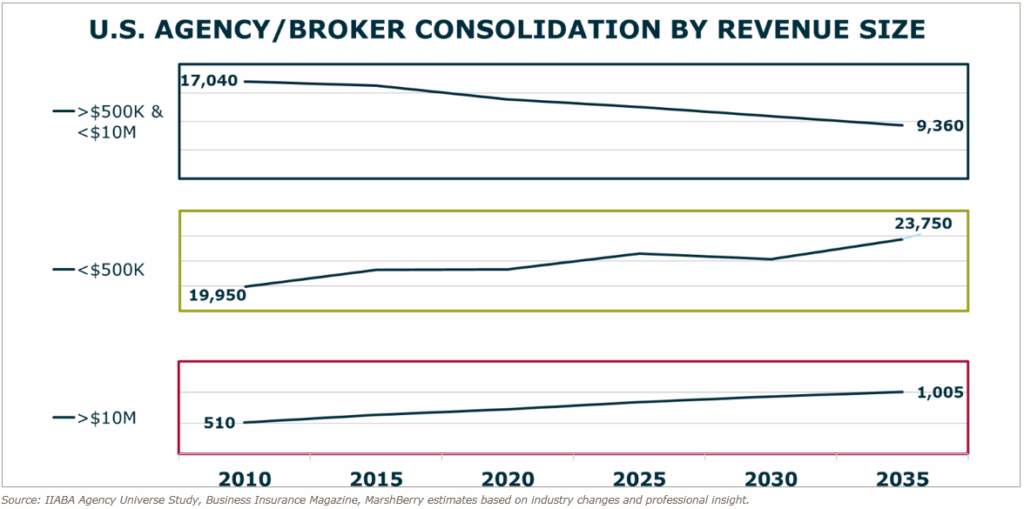

As the competitive landscape continues to evolve, those firms with revenue between $500K to $10 million are starting to feel strategic pressure to grow, which will drive even further consolidation. By 2035, MarshBerry predicts that both larger firms (over $10 million in revenue) and smaller firms (less than $500,000 in revenue) are likely to increase in number. The $10 million+ group is likely to increase from 510 in 2010 to 1,005 in 2035. The under-$500,000 group is projected to grow from 19,950 in 2010 to 23,750 in 2035, partly driven by new entrants. One phenomenon to watch for is when direct writers go through changes in strategy by market or region; sometimes this can increase the number of brokers, thus this smaller group is constantly replenishing.

However, those firms in the middle – between $500K to $10M in revenue – will likely face the most pressure to consolidate. These firms need resources to be able to hire and develop multiple producers. They also experience challenges competing with larger firms on issues like technology, carrier partnerships, and service efficiency. Such competitive pressures may drive the smaller firms to join larger firms to gain these resources and solutions, and to become more competitive.

Valuations are at a high plateau and are unlikely to trend down in 2025

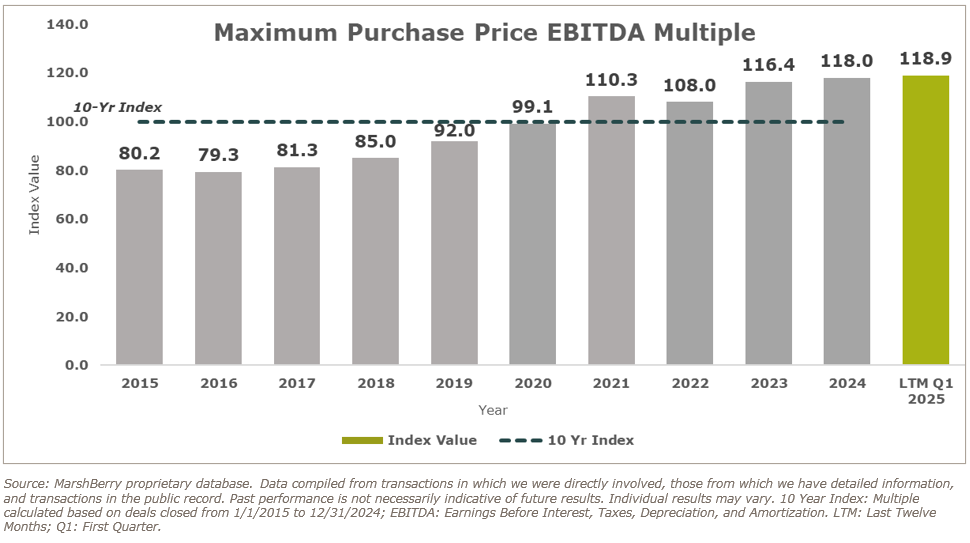

Currently valuations of insurance brokerage transactions are almost 19% above the level of the 10-year index. Whether these levels continue will depend on various factors that influence the EBITDA multiple paid for an acquired company. There are many criteria that buyers consider: organic growth, sustainable profit, diversified book of business, age of employees, sales management, and more. Ultimately, the valuation paid for an acquisition depends on the buyer’s perception; if it’s a perfect fit for that buyer, they will tend to pay a higher premium for the firm.

While valuations are quite high currently, they are unlikely to return to lower levels over the medium term. There are many drivers for these high multiples, and the potential of additional interest rate cuts towards the end of 2025 could also impact the number of transactions and demand.

One of the most important factors that can maximize the value paid for a firm is its predictable, profitable growth. There are many strategies a firm can take to maximize its value and improve growth, and working with an advisor can help with this process. At its highest level, the core benefit of working with an experienced M&A advisor is to ensure a deal meets your objectives and leads to the best possible outcome for you. There are many specific benefits of working with an advisor if you are considering selling your insurance brokerage.

Overall, don’t be surprised when the next big deal is announced, as large insurance brokerage firms continue to acquire other sizable competitors. Increasing strategic pressure is driving consolidation in insurance brokerage firms. And private equity will likely continue to be quite active in the sector, with sizeable dry powder to be deployed.