Imagine an insurance brokerage firm running like a finely tuned machine in which every interaction propels growth. Building that machine begins with improving workflow efficiencies—to unlock the hidden potential in operations. MarshBerry has identified three proven methods for improving productivity and maximizing available resources.

Method #1: Define and document key processes

Start with a workflow analysis. Review all processes, including client requests. Why do clients typically call or request help? What tasks are necessary to address their requests? How much time is spent on these tasks? From there, create standard operating procedures (SOPs) for those processes, including required steps, templates, or other helpful resources. Involve team members in reviewing, testing, and validating the SOPs. Their feedback will ensure the most realistic and effective documentation.

Creating complete and accurate SOPs has numerous benefits, including more thorough training, regulatory compliance, reduction of bottlenecks, and a more seamless and consistent client experience. Consistency is a key outcome, driving faster processing with fewer errors and creating more time to adequately address complex client needs.

As part of this process, also make sure to define service level expectations. If a $500 account is receiving the same level of service as a $20,000 account, that’s a sign of misalignment in priorities, growth strategies and goals. Matching the level of service to the size of an account helps staff prioritize tasks, take on a larger workload and generate more revenue.

Method #2: Introduce or upgrade technology

Many tasks that once required extensive manual work can now be automated. The best processes to automate typically have the highest transaction volume and don’t require a lot of creative thinking. For example, there are AI bots that can handle the invoice process, create custom reports and analytics, uncover cross-selling opportunities, identify unusual patterns in claims, create proposals, and more. Automating processes can increase accuracy in operational workflow and drive faster and more reliable service, which can help increase profits and improve brand reputation. It also allows employees to focus on more complex and value-added tasks, such as customer service initiatives or firm revenue goals.

Consider if the current firm technology is being used to its fullest capability or whether some systems need to be upgraded or better integrated to create a comprehensive solution. Such an analysis might uncover ways to avoid the time-intensive and costly step of replacing the entire system.

Method #3: Cultivate a team of high performers

People can make or break the success of insurance brokerage firms. Well-defined expectations and clear communication improve productivity, customer service, and problem-solving. In turn, those results enhance client trust, which helps uncover true new business. Methods to drive these results include:

- Effective team structures: Many firms segment service personnel by the level of assets they serve. This includes high-level account executives, who tend to handle the largest and/or most complex accounts; account managers who handle routine account management; and processors, who process applications and assist with routine account management. This approach ensures that clients are served by those whose experience and knowledge align best to their needs. Plus, a better definition of roles creates a career trajectory for those seeking promotion.

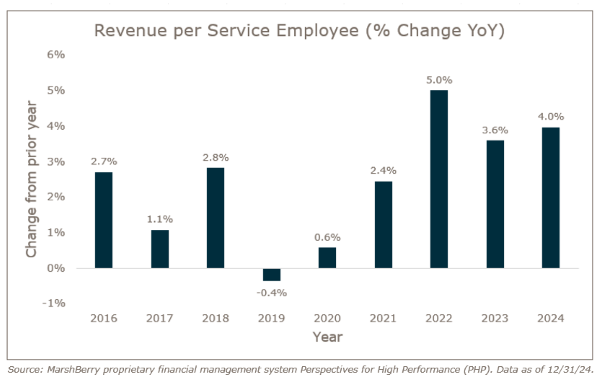

- Key Performance Indicators (KPIs) and measurement: On service teams, customer satisfaction and performance are intimately linked. KPIs eliminate ambiguity, providing clear and objective benchmarks against which employees can measure their contributions. The chart below, showing total revenue (commissions and fees) by service staff, reveals that service personnel productivity has gone up across the industry since 2021. This is a valuable benchmark for both comparison and goal setting.

- Outsourcing: Accounts that fall below the minimum threshold should have different service standards. Those smaller accounts, or any accounts with minimal or basic needs, can be outsourced to a virtual employee (VE) or carrier service center.

Change management is a major factor in making this “operational efficiency” process successful. Communicate and check-in frequently to prevent new bottlenecks from arising, coach struggling staff, and reward people for getting on board.

High-growth firms double every five years, but they can’t do that if their processes are inefficient or disorganized. Many business owners wonder how to make time for this review process. Remember, the time invested, and the efficiencies instituted actually create time, and the energy and resources saved can be reinvested into strategic initiatives, fostering a cycle of continuous growth and improvement across the organization.