Growth is essential to the survival and success of any business. It’s not only about increasing revenue or scaling operations—it’s about increasing the value of the business itself. Why should you be concerned with growing business equity value? Growing equity value is essential and beneficial at every stage of the business. Ultimately, regardless of the goals you’ve defined for your business, higher equity value creates greater optionality and potential outcomes for you and your business.

This three-part series on Pathways to Increasing Equity Value will explore three fundamental approaches to growth that, despite market conditions, can drive increases in equity value through sustainable expansion and scale: organic growth, operational structures and capital structure.

This first installment focuses on organic growth, exploring how companies can leverage internal resources, especially people, to grow organically—without acquisitions, debt, or equity. The next two installments in this series will cover operational efficiency and capital strategies that are key to driving scale, inorganic growth and long-term sustainability. It’s important to note, however, that organic growth should be a focus at every stage; there is no substitute. Organic growth should remain a strategic focus even as businesses pursue these other pathways to increasing equity value.

Maximizing Growth through Strategic Market Positioning and Specialization

Over time, many businesses naturally develop expertise in specific areas, finding competitive advantages within a given niche. Businesses that identify their niche and tailor their solutions to that specific target market can strategically position and differentiate themselves in a crowded market. Differentiation allows a business to position itself as an expert, becoming the go-to solution for specialized needs and driving referrals and outside growth.

Businesses must also have a clearly defined approach to expansion and diversification. Whether they rely on relationships and referrals to guide growth or actively engage in outreach to new demographics, success comes from understanding the market landscape while identifying clear objectives to target ideal clients with appropriate solutions and referrable experiences.

Account Size and the 80/20 Rule

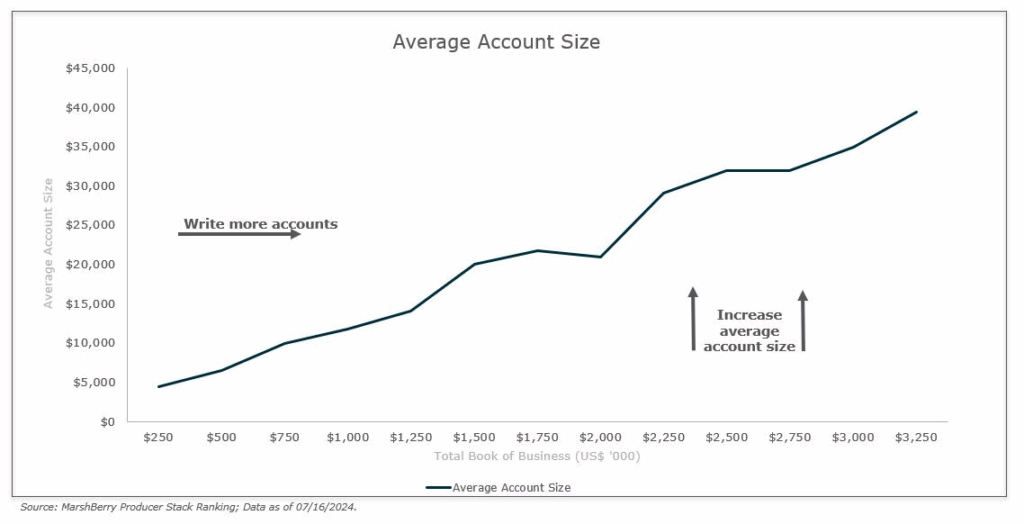

With market expansion and growth often comes the capacity conundrum. The 80/20 rule, or the Pareto Principle, is important when evaluating how to spend your time and to whom to direct resources. It asserts that 80% of outcomes are generated by 20% of the inputs. In the insurance industry, smaller accounts often contribute minimally to the business’s revenue and profit margin yet consume significant amounts of time and resources. Meanwhile, the top 20% of the book, typically composed of larger accounts, may contribute 80% of the revenue.

A book of business analysis can provide leadership with a deep understanding of these factors. After identifying the least profitable accounts, businesses can create space for organic growth and higher profitability by delegating or shedding low-impact accounts. In doing so, they can free up capacity to focus on better opportunities—namely, larger accounts—that ultimately drive sustainable revenue growth and greater equity value.

As a next step, introducing account minimums for new business can help increase the average account size, which can help limit these inefficiencies and increase equity value.

Gaining Ground in Uncontrollable Market Conditions

To drive steady organic growth in a changing market environment requires a deep understanding of the impact the market can have on revenue. Businesses must distinguish between revenue driven by market conditions—premium rates and renewals—and revenue generated by new sales. This distinction, often described as growth rate versus sales velocity, can help uncover risk exposure in market downturns. And while favorable market conditions are a boon for growth rates, relying too much on external conditions for growth can create a false sense of security. Sales velocity is a more reliable measure of growth and sustainability.

Leading firms aggressively pursuing organic growth typically implement forward-thinking strategies anticipating future needs and challenges. They build protections against inevitable market fluctuations, maintaining a proactive and resilient approach to growth. Diversifying their revenue streams, whether through product offerings, market positioning (going after new segments) or carrier partnerships, helps mitigate the risk of overreliance on any one market factor, ensuring long-term stability throughout volatile conditions.

Forward-thinking strategies and built-in protections direct efforts toward variables within the firm’s control. These might include:

- The aforementioned market positioning strategies, along with a sales-centered culture and a focus on securing larger accounts

- The diversification of revenue streams

- The prioritization of client relationships and the client experience

- The development and implementation of referral programs

- The optimization of operational efficiencies

Firms that employ such strategies are strategically positioned to drive sales velocity and organic growth even as they weather market fluctuations.

Achieving Organic Growth through Human Capital Strategy

A company’s greatest asset is its people. Successful organic growth relies on effective human capital management. At a minimum, this includes:

- Sales leadership: One or more key individuals should drive long-term growth by defining expectations, establishing accountability, and setting effective compensation models.

- Recruiting: Firms must develop a hiring strategy that outlines how they approach attracting, training, and developing top talent. Hiring must also strategically align with the firm’s needs and growth goals. For instance, recruiting inexperienced producers requires a deeper investment in training yet provides age diversity, creating a pipeline for future leadership. On the other hand, hiring seasoned professionals can deliver quicker results but can also affect long-term positioning.

- Accountability: Sales leaders should set clear expectations and create a culture of accountability that not only pertains to sales personnel but also extends to the teams and resources that support the sales team.

Opportunities and Risks

Growth is great, but the leadership group has to be willing and prepared to expand and invest in human capital as the business grows. We’ve seen that, on average, one employee should be added to the team for every additional $250K in sales. This number could be lower or higher depending on your niche expertise and market. MarshBerry advisors typically recommend that about 2% of revenue be dedicated to the net unvalidated producer payroll, such as support or service staff.

According to the U.S. Bureau of Labor Statistics projections, the insurance industry is expected to lose around 400,000 workers through attrition by 2026.1 The industry is also projected to lose about 50% of its workforce to retirement by 20282. With an aging workforce on the cusp of retirement, businesses risk losing experienced sales professionals, which could result in a production slowdown and a subsequent decline in sales—unless they make strategic, proactive hiring decisions to future-proof their workforce.

Well-developed and effectively managed human resources provide the innovation, expertise, and agility needed to capitalize on emerging opportunities and mitigate risks. The next installment of this series will explore this topic at length.

Ultimately, the success of any organization depends on its ability to empower its people—especially its salesforce, whose contributions are key to achieving sustained growth.

Prioritizing Organic Growth at Every Stage

You might have heard the common phrase, “Organic growth is king.” This is an apt description. While there is no shortage of best practices and approaches to organic growth, market positioning, sales leadership and effective human capital management create a solid foundation for growth and scale at every stage.