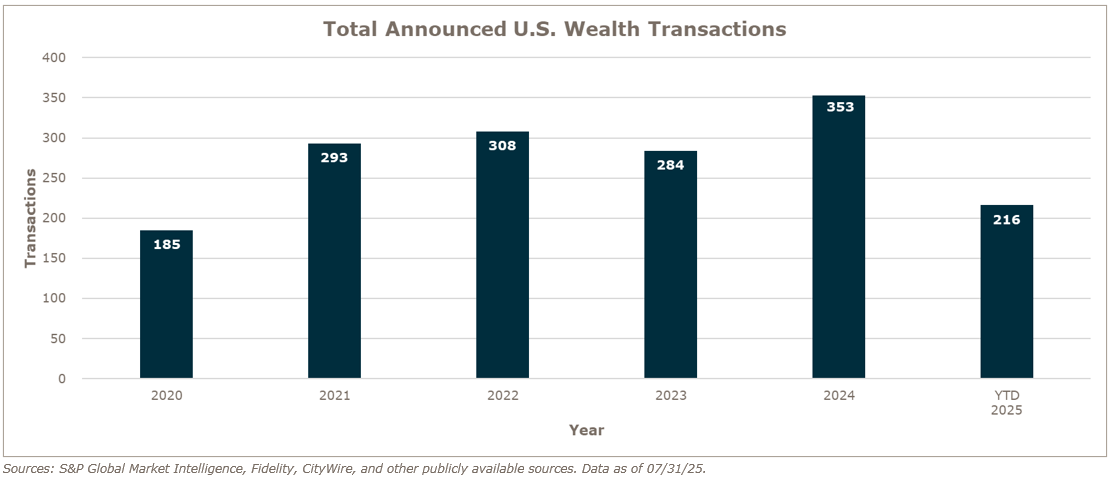

Wealth advisory merger and acquisition (M&A) activity has continued to build momentum in 2025, with 216 announced transactions in the U.S. through July – an 18.6% increase over the same period last year. This growth comes on the heels of a record-setting 2024 for deal count, underscoring the sector’s sustained expansion. Private capital-backed wealth management firms remain the primary drivers of this activity, further cementing their dominant role in reshaping the industry’s landscape. With deal volume tracking ahead of last year’s pace and strong interest from both strategic and financial buyers, MarshBerry remains optimistic about the trajectory of wealth management M&A for the remainder of 2025.

The wealth management M&A landscape continues its rapid evolution, moving beyond its succession-planning roots into a mature, capital-driven marketplace. Private equity has firmly established itself as a central force, bringing disciplined growth strategies, operational rigor, and heightened expectations for integration success. Valuations remain resilient for high-performing firms, as buyers prioritize consistent organic growth, scalable infrastructure, and cultural fit over simple deal volume. In this competitive environment, the firms commanding the strongest interest are those that can both protect the client experience and deliver sustainable growth in an increasingly sophisticated investment landscape.

M&A Market Update

Private capital-backed buyers accounted for 156 of the 216 transactions (72.2%) through July, a figure similar to what was reported in 2024. Independent firms accounted for 48 deals and 22.2% of the market, an increase from 2024’s final percentage of 21.0% (on 76 total independent deals). Insurance brokerages have acquired 16 wealth management and retirement firms in 2025 as of July.

Notable transactions:

July 1: Steward Partners has acquired Consilium Wealth Management, adding $1.1 billion in client assets to its platform and strengthening its presence in Northern California. Founded in 2010, Consilium serves high-net-worth individuals and families with holistic financial planning, investment management, and integrated tax and estate strategies. Led by Partner John H. Seo, the team joins Steward’s Legacy Division, which supports established advisory firms seeking succession planning and long-term growth. The acquisition aligns with Steward’s national expansion strategy and underscores its focus on culture, advisor independence, and high-caliber client service.

July 18: SEI, a PA-based fintech and managed accounts provider overseeing $1.6 trillion in assets, is acquiring a 57.5% controlling stake in Stratos Wealth Holdings for $527 million, with the option to purchase the remaining 42.5% later. Stratos oversees $37 billion in assets and includes registered investment advisors (RIAs) like Stratos Wealth Partners, serving 360 advisors across 26 states. The firm will continue operating under its brand with CEO Jeff Concepcion remaining in place. SEI will gain access to Stratos’ advisor network and maintain existing custodian relationships while integrating its own technology and asset management services. The U.S. portion of the deal is expected to close in the second half of 2025, with the Mexico division closing in early 2026.

Looking forward

MarshBerry remains confident in the outlook for another strong year of M&A activity in 2025, with the potential to surpass previous records. Many business owners are seeking to proactively shape the future of their firms, rather than waiting for external market forces to dictate their options. While policy shifts such as potential tariffs under the Trump administration have introduced uncertainty, they could also prompt strategic sales in sectors aiming to mitigate financial headwinds. Although public sector layoffs may place upward pressure on unemployment, the steady influx of private equity capital into the RIA space continues to fuel optimism. MarshBerry will continue to track these developments closely and provide insights on how they may influence the M&A environment in the months ahead.