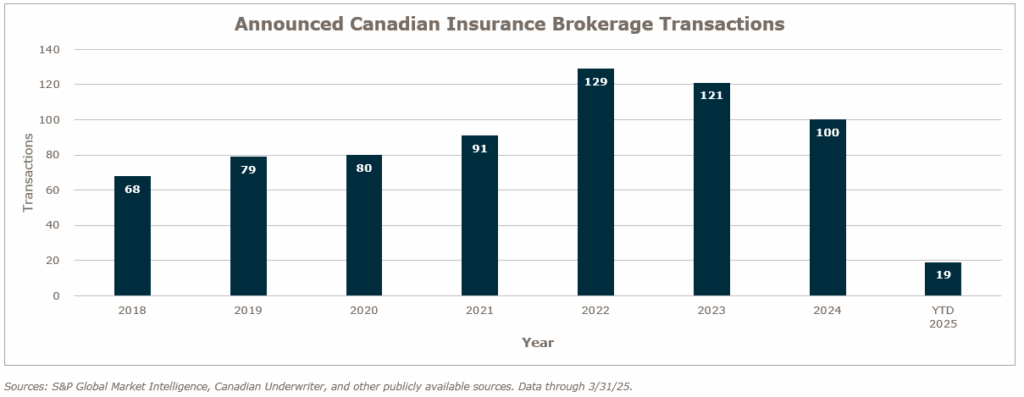

The Canadian insurance brokerage mergers and acquisitions (M&A) market entered 2025 following a multi-year deceleration in deal activity, easing from 129 transactions in 2022 to 121 in 2023, and landing at 100 in 2024. Through the end of the first quarter in 2025, there have been 19 announced M&A deals in Canada, down slightly from the 21 deals announced at the end of Q1 2024.

This deceleration trend in deal activity is now facing further tests as a wave of new U.S. tariffs – targeting key sectors like automobiles, steel, and aluminum – injects renewed economic uncertainty into the cross-border landscape. With North American supply chains deeply integrated, these measures are raising input costs and creating operational challenges for Canadian industries. Coupled with recessionary pressures, elevated inflation, and fragile consumer sentiment, the current macro environment presents a more complex and cautious backdrop for insurance brokerage M&A activity than the industry has seen in recent years.

This tariff-driven trade turbulence is amplifying fears of an economic slowdown on both sides of the border. Analysts warn that a protracted U.S.-Canada trade war could significantly dampen Canadian growth, outweighing the temporary uptick in prices from import taxes. Business confidence has been rattled, as evidenced by rising expectations of a potential recession in 2025.

Despite these headwinds, the evolving landscape is also creating openings for strategic dealmakers. Paradoxically, trade-induced volatility can reinforce the appeal of insurance distribution as a defensive, cash-flow-stable sector. Brokers generate recurring revenue from policy renewals, so they tend to weather economic storms better than many industries – a trait not lost on investors. In fact, private equity interest in Canadian brokerage remains high, evidenced by Axis Insurance Managers, Consilium Insurance, and Synex Insurance all raising private equity capital in the last twelve months. Likewise, large industry consolidators (including insurer-owned broker affiliates and cross-border brokerages) continue to pursue acquisitions to expand their footprint and fuel growth. Additionally, economists anticipate that policymakers will act to cushion the downturn – the Bank of Canada is expected to cut interest rate if recession risks continue to materialize. Easier monetary conditions later in the year would improve financing availability and could re-energize deal activity. In sum, even as buyers become more judicious, ample dry powder and strategic rationale remain in place to keep driving deal activity and has the potential to push more activity in the latter half of 2025.

M&A MARKET UPDATE

As of March 31st, there were 19 announced insurance brokerage M&A transactions in Canada in 2025. This is down from the 21 deals announced at the end of Q1 2024.

Private capital-backed buyers have accounted for eight of the 19 announced transactions (42.0%). Independent agencies were buyers in nine deals, or 47.4% of the market. Bank buyers have not completed a transaction in 2025 – a consistent pace from the one transaction reported per year from 2019-2024.

There were three acquisitions of specialty distributors, 16% of the total announced deals. This percentage share is in line with the share of specialty distributors in the U.S., which is at 15%.

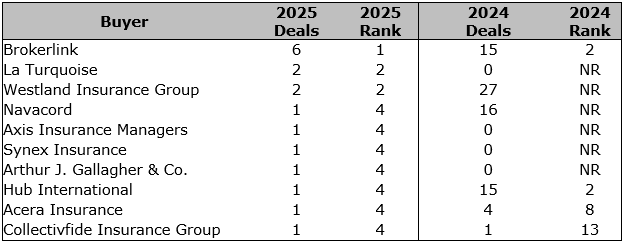

The top 10 buyers accounted for 89.5% of all announced transactions, while the top three (Brokerlink, La Turquoise, and Westland Insurance Group) accounted for 52.6% of the 19 deals.

Top Buyers (As of Mar. 31, 2025)

2025 Acquisition Detail (As of Mar. 31, 2025)

Retail vs. Specialty:

Retail: 16

Specialty: 3

What’s Being Bought:

Full Service: 2

P&C: 15

Employee Benefits: 2

Who’s Buying:

Insurance Brokerage: 18

Insurer and Other: 1

Bank & Thrift: 0

Provinces:

Alberta: 6

British Columbia: 2

Manitoba: 0

New Brunswick: 0

New Foundland & Labrador: 1

Nova Scotia: 1

Ontario: 4

Prince Edward Island: 0

Quebec: 3

Saskatchewan: 2

Buyer Countries:

Canada: 16

United States: 3

NOTABLE TRANSACTIONS

- January 1: La Turquoise, Harmonia Assurance, and DPJL have officially merged, forming one of Québec’s largest general insurance firms and a leading Intact Authorized Agency in the province. Effective January 1, 2025, the alliance brings together over 550 employees, 17 branches, and more than $525 million in premiums, with a service area spanning key regions across Québec. The new entity will be led by La Turquoise President Jean-François Desautels, supported by Harmonia’s Annette Dufour and DPJL’s Diane Joly as Senior Vice-Presidents. The merger strengthens local service capabilities, expands product offerings, and ensures continued community involvement, while maintaining all current jobs and operations.

- February 24: Axis Insurance Managers Inc. has acquired Calgary-based Fuse Insurance, a digital-first commercial insurance brokerage known for its expertise in managing complex risks in sectors like ecommerce, healthcare, and cannabis. The deal enhances Axis Insurance’s presence in Alberta and strengthens its technology capabilities. Founded in 2017, Fuse brought innovation to the insurance space through its integration of insurance knowledge and software development. Co-founder Kevin Lea will join Axis’s commercial sales team, supporting program development across specialized practice areas. The acquisition aligns with Axis Insurance’s growth strategy, which combines strategic acquisitions with organic expansion to serve a broad range of clients across Canada.

- March 7: Westland Insurance has acquired Loewen Agencies Ltd., effective March 1, 2025, expanding its footprint in Saskatchewan. With offices in Radville, Ceylon, and Minton, Loewen Agencies has been a trusted provider of property, vehicle, business, and farm insurance since 1947. The firm will integrate into Westland’s operations, allowing clients to maintain existing services while accessing a broader range of insurance solutions. This acquisition is part of Westland’s ongoing national growth strategy, which includes recent deals in Ontario and Alberta, as the company continues to strengthen its presence across Canada through strategic acquisitions.