The opening months of 2025 saw uncertainty in the financial markets and U.S. economy, driven by tariffs, elevated inflation, and declining growth. There’s also concern around stagflation, as tariffs could boost prices on goods, leading to slower growth and higher inflation. U.S. stock markets have been fluctuating amid higher policy uncertainty, with the S&P 500 ending the quarter down nearly 5.0%. As this macro-level volatility occurred, one trend within the specialty intermediary mergers and acquisitions (M&A) market remains stable: the continued outpacing of demand over the supply of quality sellers.

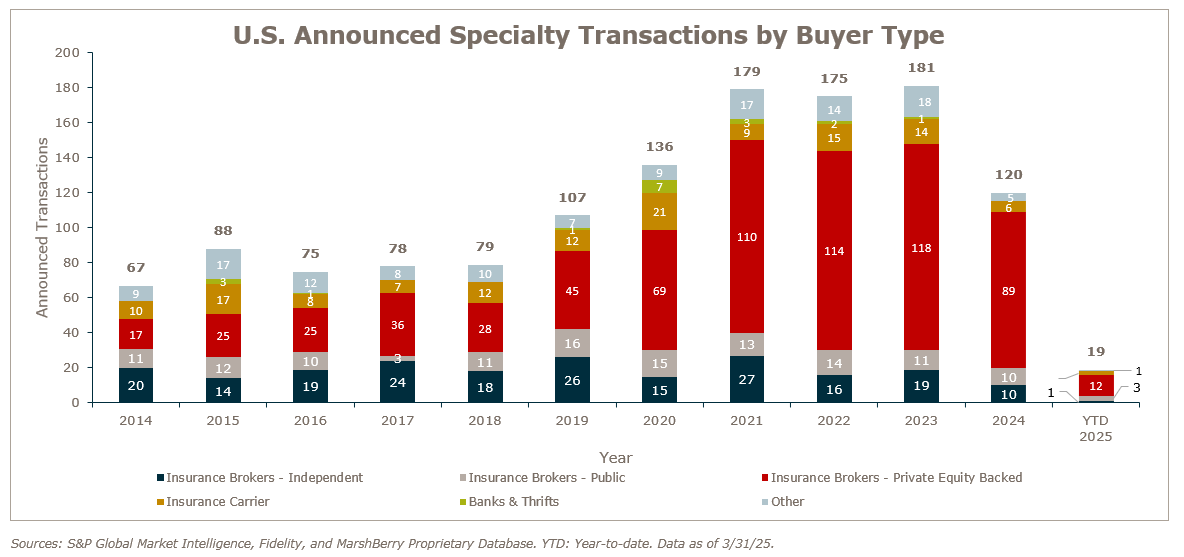

Following 2023’s all-time high of 181 specialty insurance intermediary transactions, 2024 experienced 120 total transactions, representing a 33% decline. Despite what this trend may imply at face value, buyer demand for specialty intermediaries remains robust. However, the continued consolidation of the specialty marketplace is driving an ongoing lack of seller supply.

As an example of how prolific the consolidation trend has been – in 2009 there were less than five specialty firms with $1 billion or more in property & casualty (P&C) premium. In 2024, that number exploded to at least 28 firms over this threshold, of which eight of these firms have at least $5 billion in premium and the top three each with over $25 billion in premium. Acquisitions have been the primary catalyst for this growth, specifically over the last several years. For instance, from 2020 to 2024, specialty firms consolidated at an estimated rate of 7%, 9%, 9%, 10% and 7% in each of the respective years. Compared to the relative M&A activity for retail brokers during this time, the population of specialty firms is consolidating at roughly three times the rate.

As a result of acquisitions and other growth trends, the top ten specialty firms are placing approximately two-thirds of specialty P&C premium in the marketplace. For context, MarshBerry estimates the total specialty P&C premium to be approximately $210 billion in 2024.

M&A Market Update

As of March 31, 2025, there have been 19 announced specialty distributor M&A transactions in the U.S. This activity through March was flat compared to the 19 transactions announced in Q1 2024.

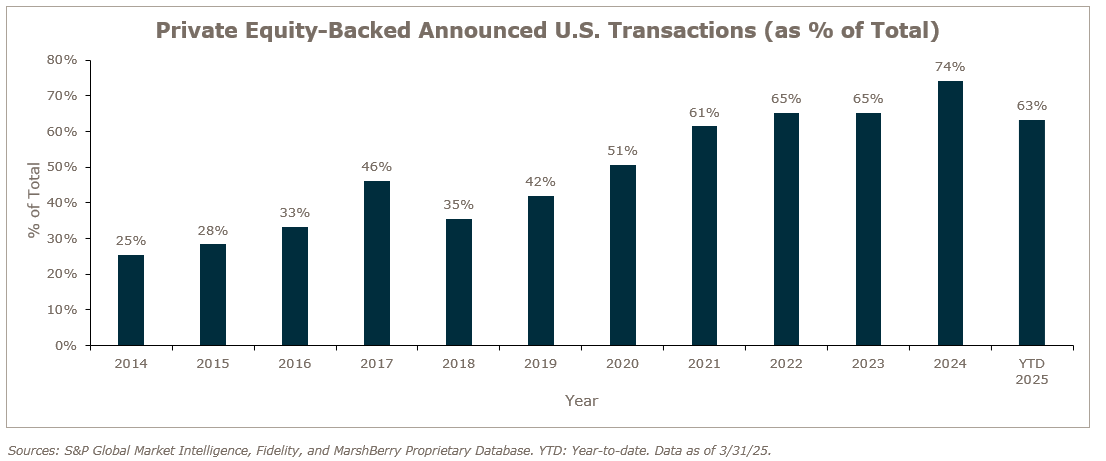

Transaction activity during the last year continued to be driven by private equity-backed organizations that totaled 12 transactions in Q1 2025 – down from 15 deals in Q1 2024. All other buyer types collectively registered only seven deals in Q1 2025.

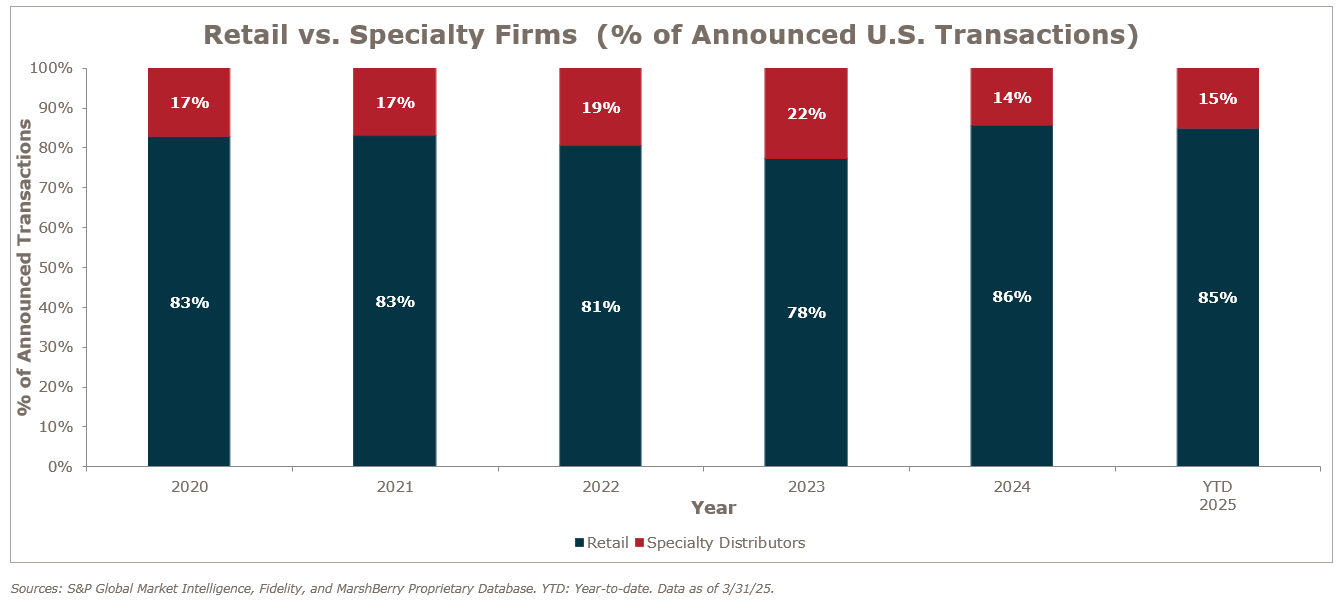

When compared to the insurance distribution marketplace as a whole, specialty transactions comprised approximately 14% of total deal activity in 2024 and 15% in Q1 2025. Prior to this, 2023 saw a record high with specialty firms driving 22% of total deal activity. Even with the material decline of transactions in 2024, transaction activity of specialty firms still increased by a CAGR (compound annual growth rate) of 7.2% from 2018 through 2024. This increase in M&A activity is largely supported by the emergence of traditional retail brokers as buyers of specialty firms as they continue to expand into the wholesale and delegated authority space.

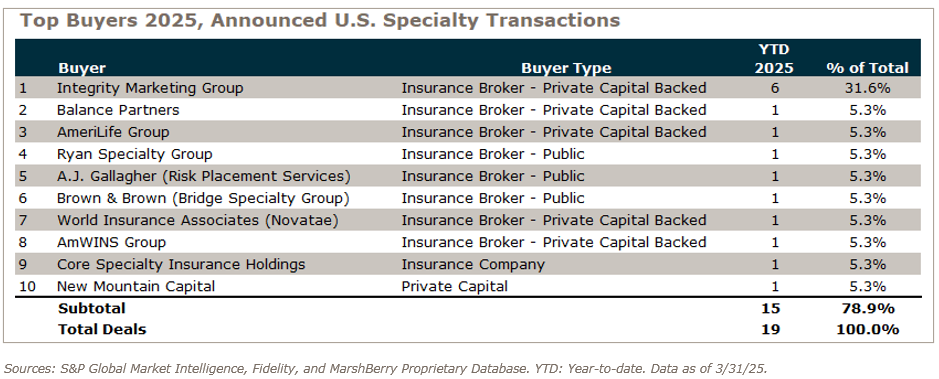

Deal activity from the top ten buyers accounted for 15 of the 19 announced transactions (or 78.9%) in Q1 2025. The top ten buyers in all of 2024 accounted for 59.5% of total transactions. Notably in Q1 2025, only the top buyer (Integrity Marketing Group) was able to complete multiple acquisitions, with 13 other buyers completing just one each. This highlights the heightened competition buyers of specialty firms are facing amidst the current limited supply of sellers. MarshBerry anticipates the percentage of deals attributed to the top buyers to decrease by year-end 2025, partially driven by the emergence of several new buyers for specialty firms who will likely increase their market share in the coming years.

Notable transactions:

- January 7: Ryan Specialty bought Velocity Risk Underwriters from funds managed by Oaktree Capital Management L.P. for $525 million. Velocity is a leading managing general underwriter (MGU) providing first-party insurance coverage for catastrophe exposed properties. Velocity will become a part of the Ryan Specialty Underwriting Managers division of Ryan Specialty. This deal highlights the continued trend of carriers diversifying and/or separating from their affiliated MGA operations with FM Global being the seller of Velocity in this transaction.

- March 3: AmeriLife Group, LLC officially acquired Crump Life Insurance Services and Hanleigh Management (Crump) from TIH Insurance Holdings. MarshBerry estimates this transaction represented the largest life insurance distribution deal ever sold to a strategic buyer (not a standalone PE investment). Crump is one of the largest providers of life insurance and retirement products in the U.S., with more than 30,000 financial professionals offering whole solutions in life, annuities, long-term care, disability insurance, linked benefit, and other specialty offerings.

- March 7: Balance Partners, LLC announced the acquisition of Vanguard Specialty, LLC, an MGA and program manager platform. As one of several newer buyers in the specialty space, this transaction allows Balance Partners to scale up its professional liability offerings and add a meaningful amount of GWP to their current premium volume. MarshBerry served as the financial advisor to Vanguard Specialty.

As the volatility of current macro-economic trends continues, demand will likely continue to outpace supply for specialty firms. For the time being, buyers in the specialty marketplace will continue to face an increasingly competitive landscape amid a shortage of high-quality sellers. In turn, the all-time high valuations experienced by specialty intermediaries in 2024 are expected to continue as well.