In 2012, the industry experienced a surge in Merger & Acquisition (“M&A”) activity, up to 325 insurance agency and broker deals compared to 268 in 2011. The 21% increase was fueled by the scheduled 33% increase in the capital gains rate (from 15% to 20%) on January 1, 2013. In 2012, many of those contemplating a sale in the near or mid-term made the decision to accelerate the process and take advantage of the lower capital gains rate.

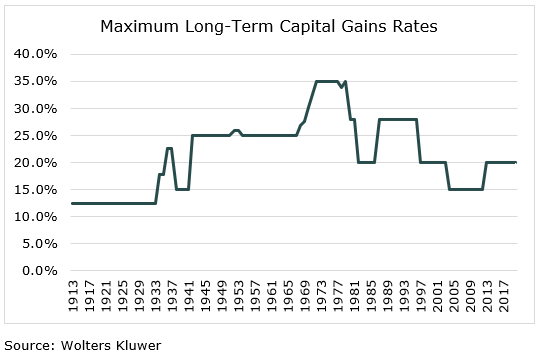

While the median capital gains rate between 1913 and 2019 was ironically exactly 20%, there have been periods where the rate has been much higher than it is today. Never in history has the rate reached 39.8% – the capital gains rate proposed in the Biden Tax Plan. But the rate did hold at 35% during the mid-1970s.

M&A activity, as of this moment, is on overdrive – as are valuations. At MarshBerry, over 50 of the sell side transactions we have in our pipeline are slated to close by year end. As an industry, the number of deals targeted to close by the end of the year is absolutely staggering. Prior to the last three months, the decision to sell was mostly prompted by a desire to align with a partner, solve a perpetuation challenge, or divest while valuations are very high. Now, many of the deals in the market and coming to market are born from a concern that no matter who wins the upcoming election, taxes may need to go up to pay for the stimulus money that has been doled out, or committed to, as a result of federal COVID-19 relief efforts.

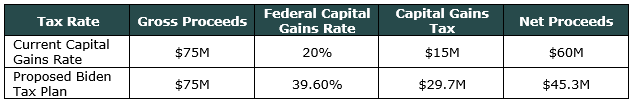

Let’s assume the proposed Biden plan is implemented and understand the downstream impact of a $75M transaction.

Should this scenario happen, organic growth at the firm would need to be 10% per year for the next three years in order to have the same after-tax value as of today. When discussing this potential impact with a current client who chose to go to market and explore an external sale, they said the tax impact would require them to start “running to stand still.”

While we have no ability to predict the outcome of the election, nor future tax rates, we do know that the Biden Tax Plan calls for a 199% increase in the long-term capital gains tax (from 20% to 39.8%) for higher earners.

There are a number of reasons that support going to market sooner rather than later – if that is your ultimate perpetuation or exit strategy. Buyers value continuity in leadership post-sale and the younger the leadership/ production talent, the less perceived risk and therefore the greater the multiple that can be negotiated for the business. Multiples continue to be at/near historical highs for high quality firms and no one can predict how long this will last. That being said, there are plenty of firms that will continue to remain committed to private ownership given the proven quality of this fine industry. Billions upon billions of investment dollars have and will continue to enter this industry for that very reason.

To bring you meaningful and timely insights into how insurance brokerage firms are performing, MarshBerry periodically conducts Market Pulse surveys. Pulse surveys are intended to capture industry sentiment and insights around a particular topic. This week – we’re looking for your insight on perpetuation. Take a 1-minute MarshBerry Pulse survey to have your thoughts included in the industry’s outlook.

If you have questions about Today’s ViewPoint or would like to learn more about perpetuation options in the insurance marketplace, please email or call Christopher Darst, Senior Vice President, at 949.234.9648.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.

Investment banking services offered through MarshBerry Capital, Inc., Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, Inc. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)