Specialty distributors in 2022 outpaced the rate of consolidation of their retail broker counterparts, ending the year with a record number of deals. Driven by greater interest from large insurance brokers, specialty distributors consolidated at a rate of over 4x compared to retail firms.

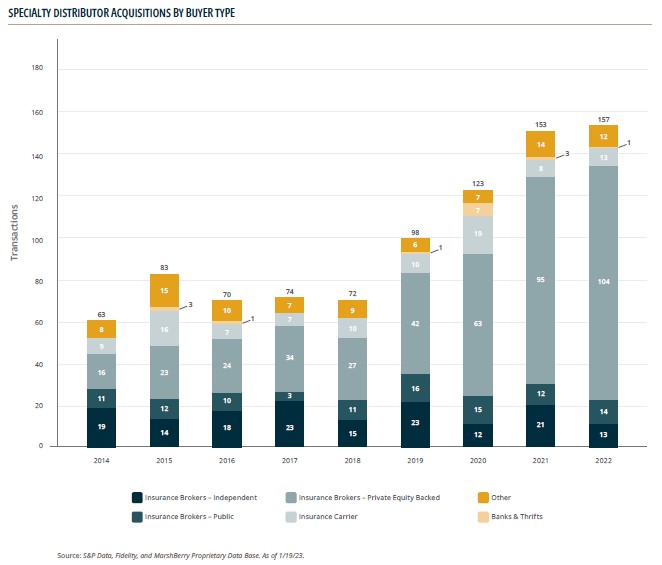

While 2022 presented economic headwinds for insurance brokerage mergers and acquisitions (M&A) activity overall – transactions involving specialty distributors as targets were quite strong. Specialty distributors again outpaced the rate of consolidation of their retail broker counterparts, with total M&A transactions going from 123 in 2020 and 153 in 2021 – to 157 in 2022. This represents a 2% increase year-over-year and a five-year Compound Annual Growth Rate (CAGR) of 17%. Specialty firms consolidated at a rate of over 4x compared to their retail counterparts.

Valuations remain steady for specialty firms.

Despite challenges such as geopolitical conflict, record high inflation, rising interest rates and recession concerns, specialty firms remain highly sought after in the insurance sector. There is talk in the market that buyers may become more selective in 2023, given the higher cost of capital. However, that has not yet impacted valuations. In 2023, the specialty firms with solid management teams, strong organic growth, and effective business plans will likely continue to command premium valuations.

Record transaction activity during the last year continued to be driven by private capital-backed organizations that totaled 104 deals in 2022, up from 95 deals in 2021 and 63 deals in 2020. All other buyer types collectively registered 53 deals in 2022. To emphasize the influence private capital has had in the specialty segment, in 2018 there were only 27 private capital-backed specialty deals – a 285% increase in four years. Given the current rising inflation and interest rate hikes, it will be interesting to see if private capital-backed acquirers are able to continue dominating the league tables or if public brokers, who generally carry lower debt levels, will emerge as significant buyers in 2023.

Also notable, there was a 38% decrease in deals done by independent brokers compared to 2021. This can likely be attributed to historically high valuations outpricing brokers who do not have sufficient capital.

Buyers are pursuing specialty firms for their attractive operating structures, which can be highly leveraged for growth.

One growing driver of demand is that large brokers are looking to specialty distributors to take advantage of concentrations of premium in the retail divisions of these brokers. By partnering with niche focused specialty distributors, large brokers can funnel premium concentrations to the wholesale brokers or delegated authority affiliates (i.e. Managing General Agents or MGAs). This often results in more clout with carrier partners, optimal commission structures, enhanced profits share and contingent arrangements, and/or the creation of proprietary products.

As premium within the Excess & Surplus (E&S) and delegated authority segments historically has grown at a rate of over 3x that of the general admitted marketplace, specialty distributors tend to have good growth on a stand-alone basis. In the right scenario, partnering with large brokers can supercharge these already attractive growth results. These synergistic results have emphasized the need for large brokers to partner with firms offering capabilities that are typical in MGAs, and as a result – 16 of the largest 20 brokers in the U.S. have established specialty platforms.

Specialty market to see a continued firm rate environment.

Specialty firms, specifically in the surplus lines arena, have generally continued to experience meaningful rate increases in 2022, even as rates in the general admitted marketplace have moderated. This is a result of risks becoming more complex, heightened natural catastrophes, wartime conflict, and admitted markets constricting underwriting standards, which pushes products previously placed in the admitted marketplace into the surplus lines arena. Furthermore, carriers have been experiencing lackluster underwriting results and (until recently) paltry returns on their fixed income portfolios. Coupling these points with significant declines in the equity markets has continued to put pressure on the capital adequacy and return on equity of the risk takers. This supports a firm to hard rate environment, which is already very long in the tooth (starting in 2019) from historical norms.

Although the current hard rate environment is protracted and carriers continue to increase rates, such increases have become harder to achieve as more competition has entered the market, putting pressure on prices. As a result, equilibrium – defined as loss-free accounts renewing at expiring rates, with no increase or decrease, has not been achieved yet. MarshBerry forecasts that certain E&S lines will see further rate increases in the 5%+ range for accounts without losses. There are potentially much higher increases for loss prone accounts. Driving these continued rate increases are an increase in current loss costs and increased claims activity contributing to carriers’ needs to secure higher premiums for the risks they are insuring.

Premium growth in the specialty sector is expected to continue migrating from carrier owned MGAs to the independent brokerage sector. This represents a massive shift of value as carriers, who are valued as a multiple of book value (i.e., 1-2x), lose underwriting talent to independent brokers who are able to heavily incentivize entrepreneurial underwriters who can establish and grow books of business. In part, these incentives are made appealing by the massive run up in valuations of insurance brokers, who are valued on a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization).

The E&S sector is likely to see continued growth with an expected increase of over 10-15% in 2023, after increases of over 25% in 2021 and 2022. One of the factors driving this growth will be the (catastrophe-exposed) property market. This segment will experience unprecedentedly high rate increases due to a very challenging January 2023 reinsurance renewal period. The market challenges are a result of poor underwriting performance due to various material natural catastrophe events over the last several years. This has left the secondary/ILS (Insurance Linked Securities) markets disenfranchised on the long-term profitability prospects of these risks. As such, reinsurance capacity has materially constricted, if not left the market altogether.

Specialty Market Outlook for 2023

Even with rising interest rates and rumors of tightening capital supply, buyers still appear poised for aggressive dealmaking in 2023 within the specialty distribution segment, thanks to many buyers still having plenty of dry powder at their disposal. While there is risk of market conditions deteriorating more than expected, thus further impacting the availability of capital (debt and equity), for the time being there continues to be tailwinds driving demand for specialty distributors.

Overall, the specialty M&A marketplace continues to show robust demand. MarshBerry sees specialty firms continuing to command premium valuations and see greater buyer demand as traditional brokers expand their business to include wholesale brokerage and delegated authority practices.

If you have questions about Today’s ViewPoint, or would like to learn more about recent activity in the specialty markets, please email or call George Bucur, Managing Director, at 440.392.6543, or Gerard Vecchio, Managing Director, at 860.916.4149.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230