Top performing firms are always searching for advantages in their growth strategies. Whether it be finding the best talent, developing high-performing producers or utilizing the right technology – it all starts with creating the right strategic plan.

At MarshBerry’s annual 360 Forum, a key topic was how to use strategic planning to embed success in your firm, using data-driven discussions, effective meeting structures, and involving key decision-makers.

The insurance industry has seen rapid consolidation and rising valuations over the past several years – and there is a widening gap between firms that show sustainable long-term organic growth and those that are just riding a hard market wave. Those high-performing firms are the ones that have thoughtfully and intentionally used strategic planning as a way to put themselves in the best position for exceeding average metrics and garnishing top-tier valuations.

Strategic planning is something that should be implemented regardless of firm size. But for firms under $20 million in revenue, an effective (and continuously updated) strategic plan, with realistic growth targets, represents the best opportunity for creating a significant edge in this very competitive marketplace.

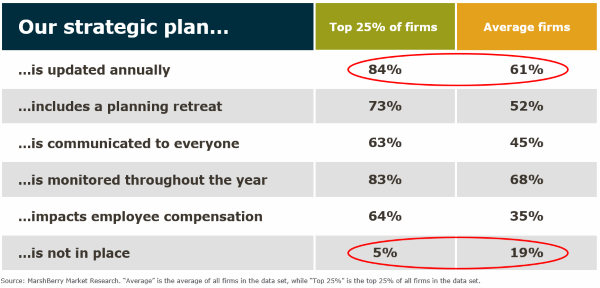

Based on MarshBerry’s 2025 Insurance Agency & Brokerage Compensation Report, 25% of insurance brokerage firms do not have an established strategic plan in place. And even among those that do have a plan, there are a lot of areas for improvement. For high-performing firms (the Top 25% based on organic growth), data shows that 84% are updating their strategic plan annually – compared to just 61% of average firms.

The numbers

Why doesn’t every firm do regular strategic planning?

So why do so many firms forgo long- and short-term strategic business planning, or neglect updating their existing plan? Complacency is really the primary reason. This is a great industry, with recurring revenue, controllable margins and stability during uncertain economic conditions. Many look at their business and assume their growth is 100% the result of their hard work and current process. There’s an “if it ain’t broke, don’t fix it” mentality.

There’s also something daunting about the strategic planning process. Many don’t know how to get started or understand who needs to be involved. Planning is only as good as the people who participate in it.

Lastly, prioritization is also a problem. Many firms prioritize items that aren’t important, while the most important items (such as strategic planning) are not prioritized.

How to get started

Before strategic planning can begin, understand that its effectiveness will be difficult without senior leadership’s support. Senior leadership needs to embrace the idea, have a sense of urgency about its importance to the organization and be willing to make changes based on output.

Once executive leadership is behind the initiative, there is often a belief that a strategic planning meeting means sitting in a room with senior executives and brainstorming for an entire day. This is the wrong approach and often results in all words and no action. The purpose of any strategic planning meeting is to come away with decisions on a plan and action items that can be implemented.

To be effective, a strategic planning meeting requires very specific rules of engagement. Before the actual “planning” meeting, it’s important to do some pre-planning, pre-work and brainstorming. MarshBerry recommends a “what, who and how” best practices approach before you plan your meetings:

- WHAT are you trying to accomplish? Also decide what you are NOT trying to accomplish and what you want to leave the meeting with.

- WHO needs to attend? It’s important to have executive level decision makers in the room. But less equals more. MarshBerry recommends ten people or fewer. Making sure you have the right people in the room to execute the eventual plan ensures that the output doesn’t need to be translated to others who could hinder execution of the plan. Carefully consider whether producers should have a role in planning meetings. Often, those in client facing roles are focused on personal output and lack a comprehensive view of the firm and it’s challenges. Also consider having someone deemed a financial steward of the firm.

- HOW do we get there? Make “numbers” part of your pre-work. What are the metrics the firm is trying to accomplish? What data will help drive the conversations and decisions? Develop a financial plan, not necessarily dictated by a budget. Focus on sales velocity and financial goals. Working with an experienced facilitator, who understands the business, can help keep agendas, tasks and goals on track. They can also ask the tough questions and keep senior leaders in check. Location is also important. Having strategic planning meetings offsite can prevent distractions, and ensures commitment, focus and engagement.

Getting the most out of strategic planning to deliver on your goals

Once the pre-work and brainstorming is complete, and the planning team is identified, it is time to dive into strategic planning. There are three fundamental questions that firms should focus on during their strategic planning meetings, which should lead to better outcomes and chances for achieving strategic goals.

- Where are you? This is a very important question to answer accurately and honestly – as it sets up the potential answers for the second question. Use the firm’s historical data and external competitive benchmarking, key performance indicators (i.e., organic growth, sales velocity, EBITDA), and a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to identify your starting point. Plan to spend only 20% of your time assessing the current state of your organization. Pre-work on this step can help create a productive discussion.

- Where are you going? Based on an understanding of how you got to your current state, plan to spend another 20% of your time on identifying goals for your organization. Where do you want your revenue, value, staff, leadership, geographic footprint to be in five years? Establish specific, measurable, accountable, realistic, and timely (SMART) goals.

- How are you getting there? The remaining 60% of your time should be spent on the execution roadmap. This is where the strategic planning team maps out action plans, implementation plans, and accountability plans. There is an exhaustive list of areas that firms can look at that can help strengthen a true organic growth infrastructure. The key is to prioritize those areas that are identified as most critical and most impactful.

Execution is the key to success

Strategic planning for an insurance brokerage sets the tone for everything that comes after. Don’t treat it like any other meeting. While the process of assessing where your company is today and formulating a plan of where you want to be tomorrow is no easy task – executing that plan is even tougher. This is where most strategic plans fall apart and why it can be so beneficial to utilize strategy consulting services.

A key tip for keeping on track is to remember to refer to the plan often. Keep the strategic plan out and in the open. This will help ensure you are always seeing and thinking about it, rather than it gathering dust on the shelf. Make it your roadmap to growth and success. With this roadmap in hand and the support of your team and advisers, you can help transform your business and unlock its true potential.