The insurance industry has often been the subject of lighthearted jokes and dismissive remarks. From its reputation for mountains of paperwork and confusing jargon to frustrating claims processes, it is an industry that is portrayed as dull, bureaucratic, and perhaps even predatory. Yet behind this unglamorous image lies one of the most quietly powerful, indispensable and resilient industries in the global economy – supporting nearly every facet of modern life. At a minimum, insurance is a critical lubrication for the world economy. At its best, insurance might be the greatest industry in the history of mankind.

A large industry without the respect

With a market value estimated to be approximately $8 trillion (based on gross written premiums)1, the insurance industry is positioned as one of the very largest industries globally, comparable to or even exceeding the automotive and core energy sectors. Insurance also represents a significant component of the broader financial services market, which contributed approximately 21% to the U.S. gross domestic product (GDP) in 2024.2 Yet, despite this global representation the insurance industry is frequently dismissed.

Part of the reason is because insurance deals with risk and uncertainty. Its product is “a promise” or “peace of mind” – something that is intangible. For most, insurance is a necessary evil, whose value is often invisible until it’s needed.

The concept of insurance has roots that go back thousands of years, across all cultures, and has endured and adapted to technological and societal changes. As the world made advances in technology it was suggested that the need for insurance, or at least insurance brokers, might become diminished.

In the early 1990s a state insurance commissioner was quoted by the Wall Street Journal calling insurance agents “the buggy-whip makers of the 20th century” – suggesting that technology would make them obsolete.3

Thirty years later, the opposite has happened. Technology has accelerated the value, profitability and importance of insurance (and insurance brokers), due not only to improved risk assessment and management, but also to the introduction of new risks – such as cyber threats, climate change, and global supply chain vulnerabilities. Rather than rendering this industry obsolete, technology has made the need for insurance even more critical for individuals and businesses to operate, and even thrive.

The resiliency of the insurance industry

The past quarter-century has tested the global economy with a series of unprecedented shocks: from the dotcom market crash of the early 2000s and the devastating 9/11 tragedy in 2001, to the profound financial markets collapse of 2008, to the global disruption of the COVID-19 pandemic in 2020.

Through each of these global disruptions, the insurance industry has demonstrated remarkable resilience, proving its foundational role as a shock absorber for society. Not only have insurers survived these events, but they have adapted and, in many cases, emerged stronger. This resilience is rooted in the industry’s foundational principles of risk management, diversification, and long-term capital stewardship.

The dotcom crash and 9/11 (2000-2002)

The bursting of the dotcom bubble in early 2000 led to massive losses in the equity markets, with the Nasdaq falling nearly 77% from its peak (from 3/10/00 to 10/4/02).5 Thousands of tech startups declared bankruptcy, leading to widespread layoffs and hiring freezes. While insurers with significant investment exposure to tech stocks experienced short-term losses, the industry as a whole remained stable. Diversified investment strategies and the long-term nature of liabilities within the industry generally cushioned the blow. This period also highlighted the inherent stability derived from the core business of underwriting risk, rather than speculative trading.

In the middle of the dotcom crash, the 9/11 terrorist attacks threatened to push an already fragile economy over the brink. It became a critical turning point for the insurance industry, solidifying it as the cornerstone for economic stability.

9/11 resulted in an estimated $32.5 billion in insured losses (over $58 billion in 2025 inflation adjusted dollars) across multiple lines of business – becoming the largest single loss event in global insurance history.4 While the insurance industry demonstrated its ability to absorb massive losses and adapt in the face of a catastrophic event, 9/11 also accelerated modernization, improved risk governance, and reinforced the industry’s role as an economic safety net.

The global financial crisis (2008-2009)

Just a few years later the 2008 global financial crisis hit, sparked by the housing bubble, bank-issued subprime mortgages and mortgage-backed securities. Dubbed “The Great Recession” – it lasted 18 months (December 2007 to June 2009), making it the longest and most severe economic downturn since the Great Depression. Millions of Americans lost their homes as home values plummeted, wiping out trillions in household wealth, while stock markets crashed. At its bottom, on 3/9/09, the three major equity indices – The Dow Jones Industrial Average, The S&P 500 and the Nasdaq Composite – were down 54%, 57% and 56% respectively from their previous highs.

For the insurance industry, this presented a different challenge. While some insurers faced severe distress – particularly those with exposure to mortgage-backed securities – the broader insurance industry largely weathered the storm better than many banking institutions. This was due in part to robust state-level regulations, which traditionally mandated more conservative investment portfolios for insurers compared to banks. While capital levels declined and net income dropped for many, the industry as a whole demonstrated an ability to recover relatively quickly, reinforcing the strength of its underlying business model.

COVID-19 Pandemic (2020–2022)

The global disruption caused by the COVID-19 pandemic in 2020 again showcased the insurance industry’s resiliency. In the beginning, even the industry itself was unsure of how the global shelter-in-place mandates and subsequent economic impact would affect it. Early estimates on losses from business interruption claims and event cancellation insurance due to the lockdown were in excess of $100 billion (which would have made it the largest catastrophe in history). In the end, the pandemic resulted in an estimated $44 billion in insured losses, the third largest behind Hurricane Katrina and 9/11.7

One of the biggest impacts the pandemic had on the insurance industry was the acceleration of a digital transformation for the industry, including the growth and rapid adoption of insurtech. 2021 saw the largest investment into the insurtech space with over $15 billion invested.8 As the pandemic forced remote work arrangements for insurance employees, compounded by the rapid increase in claims and customer services needs due to the pandemic – the industry quickly adapted. There was an increased need for digital platforms and automation, operational efficiencies, and better customer interactions. In the end, the insurance industry came out of the COVID period even stronger.

The next stress test?

Could today’s current environment – marked by a prolonged inflationary period, geopolitical unrest, and President Trump’s renewed tariffs campaign and reconciliation bill – the One Big, Beautiful Bill Act (OBBBA) – be the insurance industry’s next stress test? If so, the industry should once again prove its resiliency and continue to be a safety net for individuals, businesses and investors alike.

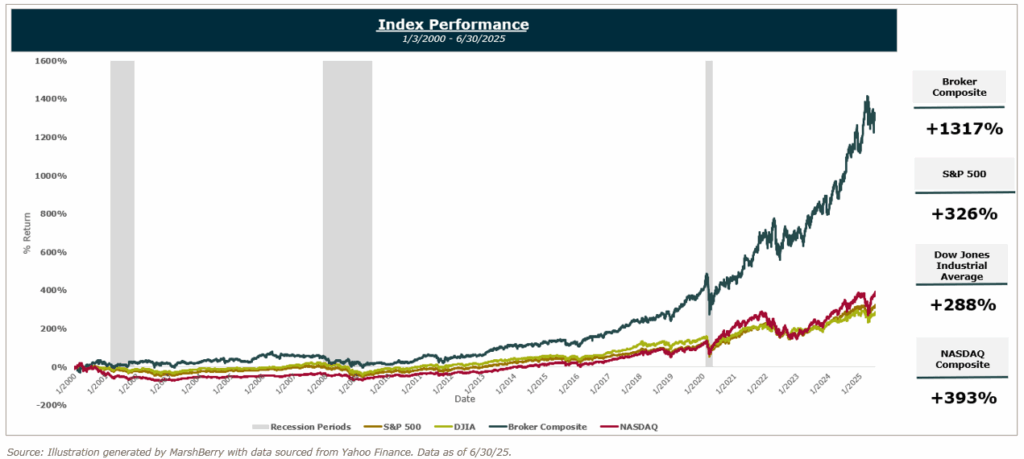

The resiliency of insurance brokers during global disruptions and down economies is best illustrated in the historic performance of the largest publicly traded insurance brokers over the past 25 years.

The MarshBerry Broker Composite Index is a composite of market data (sourced from Yahoo Finance and prepared for analytical purposes only) on six publicly traded brokers: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and The Baldwin Group (BWIN).6

Over the past 25 years, across global economic stress tests, the Broker Index has significantly outperformed the three major equity indices. Since January 1, 2000, the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite delivered returns of 326%, 288% and 393% respectively. Meanwhile, the Broker Composite Index delivered an over 1300% return.

While the insurance industry may not always garner public admiration, its quiet strength, immense scale, and profound stability are undeniable. It is an unsung pillar of the global economy, discreetly enabling progress, innovation, and peace of mind by transforming unpredictable risks into manageable certainties. To dismiss it is to overlook one of the most vital and ingenious financial inventions in human history.