Organic growth has taken center stage as the number one driver of value for insurance brokerages. But not all organic growth is created equal. It’s important to understand what is driving organic growth and whether it is profitable and sustainable for the long-term. As brokerage owners focus on building a successful business, they shouldn’t lose sight of the most important growth strategy of all: growth in value. Building a profitable and sustainable organic growth engine is key to growing value for all stakeholders. Here are some methods to consider as firms map out a path to increase the overall value of their firm.

Maximize operational performance

Looking into potential barriers to – and possible levers for – profitability is a good first step toward creating a business that naturally increases in value over time. Uncovering both impediments and opportunities can help refresh the business’ brand and inspire all teams to rededicate themselves to business objectives. Start by:

- Identifying strengths and weaknesses: Benchmarking is imperative to staying competitive in multiple areas, including recruiting new talent, expanding product and service offers, and maintaining productivity. Comparing your company to the industry’s best will help to identify business opportunities and stagnant areas.

- Cutting unnecessary expenses: The average firm is able to control costs across several main areas, such as compensation and operating. When considering what to invest in, choose a spending approach that focuses on growth-based initiatives while cutting waste that eats into profits.

- Improving efficiency: Leaders should connect with all employees to uncover barriers preventing them from meeting sales goals or supporting clients. For example, survey producers to get honest feedback regarding gaps in processes, expectations, and communication. Firms should also consider investing in technology or AI programs that enhance results. Optimizing operations can lead to increased output, contributing to higher profitability and value.

As part of this process, have discussions with staff so they understand business KPIs, trends in the industry, and the “why” behind these measures. Make sure they understand how their role directly contributes to broader firm goals, because engaged and productive employees are a key driver of value.

Drive greater producer results with strategic commission splits

Intentional growth is driven by producers who can write new accounts, implement aggressive marketing efforts, and proactively retain existing clients. Rewarding them with appropriate compensation can help drive engagement and productivity. But compensation can also have the opposite effect – enabling stagnation and reducing motivation. One of the most common mistakes is creating commission rates without enough spread between new and renewed business.

Statistics show that the slowest growing agencies are typically those that pay the highest renewal commissions. On the surface, this may seem counterintuitive, if producers are the key to growth, then shouldn’t higher renewal commissions help attract and retain top producers? The problem is that higher renewal commissions force producers to spend more time on account-management activities and less time on new business production. Additionally, firms that pay higher renewal commissions often lack the reinvestment capital for quality resources and support. MarshBerry recommends a 15 to 20 percentage point difference between new and renewal rates. Producers with the highest W-2s in the industry are often the producers with the lowest commission splits.

Offer ownership opportunities to further incentivize staff

Peak performing companies hire and develop producers to be potential shareholders, not just employees. Successful producers are often entrepreneurial and have a desire for ownership. Sharing ownership can be a difficult proposition for existing shareholders. However, it is not only helpful for the recruitment and retention of producers, but it is key to overall growth in value.

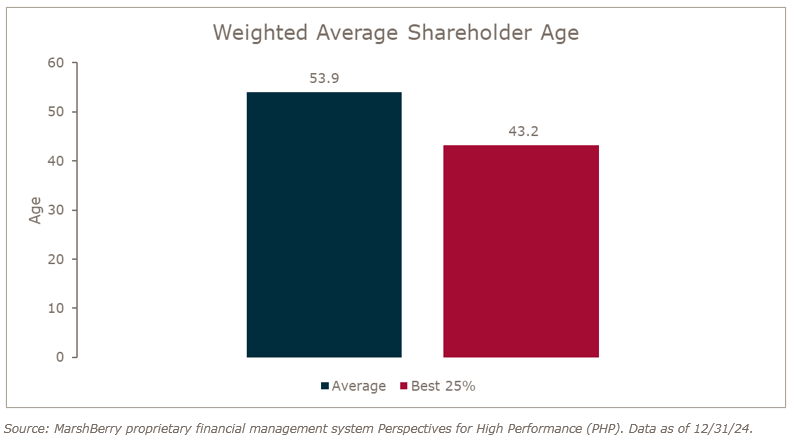

Start by looking at the firm’s Weighted Average Shareholder Age (WASA). This metric shows the average of the shareholders’ age weighted by the percentage of stock they own. Seeking predictable growth by reinvesting in future generations is key to a company’s future success. According to MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP), the Best 25% of firms (based on their financial performance, specifically organic growth) have a WASA of 43.2 years old, compared to the average firm of 53.9 years old.

A younger WASA indicates a firm has a clear plan for growth, is identifying the next generation of leaders and ensuring those folks have enough runway to purchase stock. The value and appeal of a business lies in the company’s ability to drive future growth and profitability; therefore, buyers may see a limit to the potential growth and profitability of a company when there is a shorter runway with existing leadership. Ownership sharing should be part of the plan to transition a producer’s focus away from their W-2 and toward wealth creation. Principals of high-growth firms educate producers on the merits of sacrificing short-term compensation gains for long-term gains in net worth through ownership.

When a company has a clear plan to grow its value, everything from perpetuation to daily operations and profitability becomes more manageable. By prioritizing long-term goals and adopting a sustainable, forward-looking strategy, insurance brokerage firms can enhance their value – regardless of market conditions or industry challenges.