Business Insurance recently published their annual report on the Top 100 Insurance Brokers, ranked by revenue, for 2022. It’s no surprise that the brokers that comprised the top 10 are the same as last year – with only Truist Insurance Holdings edging out Brown & Brown to move up one spot on the list.

This year, the top 10 brokers’ revenue totaled a resounding $44.4 billion and represents 64.7% of the total top 100 revenue ($68.7 billion). While total revenue for the top 100 and the top 10 is up year-over-year (YoY) by 14.3% and 12.0% respectively – the top 10’s percentage of revenue has actually trended down over the last few years – due to more growth in the 11-50 firms.

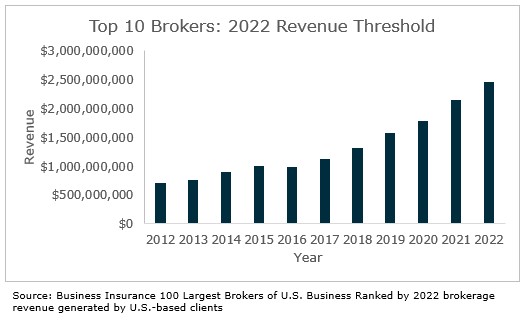

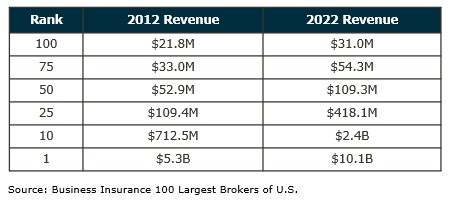

Even so, a firm will still need a staggering $2.4 billion in revenue to enter the top 10 insurance brokers’ bracket. This is compared to just $712.5 million needed 10 years ago in 2012, a 244% increase in this revenue threshold.

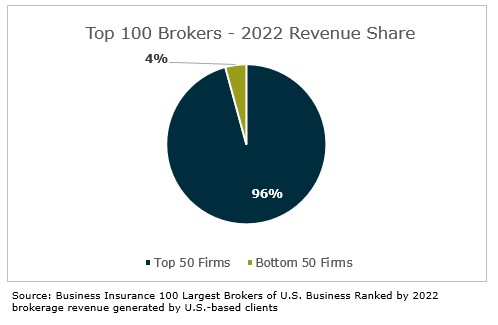

The top 50 firms in 2022 represent $65.7 billion in revenue – which is 96% of the total revenue for the top 100. In 2022 a firm needed over $109.3M to break into the top 50, a 107% increase in this revenue threshold vs. 2012 when firms needed $52.8M to get into the top 50.

Six big movers in the Top 100

Larger firms are gaining more and more market share as they drive growth through mergers & acquisitions (M&A). There were 903 announced M&A transactions in 2022, a drop of 15.3% from the previous year. However – high firm valuations, consolidation goals and private capital investments were still drivers of strong M&A deals activity in 2022. Of the top 100 brokers, 45 of them transacted one or more deals in 2022, representing 68% of all deals in 2022.

To no surprise, firms that are contributing to the high growth and dominance of the top 100 firms, and moving up quickest on the list, are all private equity (PE) backed brokers. While M&A activity in 2022 was down from the record year of 2021 – some of these big movers are still conducting a significant number of deals that are helping them accelerate their growth. Here are six firms who have moved up five or more spots on the list.

- Patriot Growth Insurance Services LLC (Patriot), backed by GI Partners, has moved up nine spots from #35 in 2021 to #26 in 2022, with $387 million (a 79.9% YoY increase). In 2022, Patriot completed 11 publicly announced M&A deals, down from 21 deals in 2021.

- After jumping up 19 spots in 2021, World Insurance Associates LLP (World), backed by Charlesbank, jumped another six spots to #28 on the top 100 list – with $347 million in revenue (a 54.7% YoY increase). World also completed 35 publicly announced M&A deals in 2022, down from 52 deals in 2021. Since its founding in 2011 – World has completed over 195 total announced acquisitions.

- After debuting on the top 100 list in 2021 at #56, Keystone Agency Partners, backed by Bain Capital Credit, moved up ten spots to #46 (into the top 50) with $137 million in revenue (a 72.3% YoY increase). Revenue was helped by the 22 publicly announced deals completed in 2022, which was down slightly from 24 deals in 2021.

- Sunstar Insurance Group, LLC (Sunstar), backed by BBH Capital Partners, breaks into the top 50 in 2022 at #48 (up five spots from 2021) with $121 million in revenue (a 40.5% YoY increase). Sunstar announced three M&A transactions in 2022, after completing five in 2021.

- Alkeme Inc., backed by GCP Partners, who debuted on the top 100 list in 2021 at #64 – has moved up nine spots in 2022 to #55 with $94 million in revenue (a 53.3% YoY increase). Alkeme completed six publicly announced transactions in 2022, after completing four in 2021.

- Reliance Partners LLC (Reliance) debuted on the top 100 list in 2021 at #87. With $45 million in revenue (a 24.7% YoY increase) they moved up five spots to #82. While Reliance did not publicly announce any transactions in 2022, the firm announced its partnership with Carousel Capital in August 2022.

Opportunity to enter the bottom 50 brokers List?

While the overall YoY revenue growth of the combined top 100 firms was 19%, it’s interesting to note that 38 of those firms individually failed to grow by double digits in 2022. Of the 38 firms that failed to grow by 10% or more, 22 of them were ranked in the bottom 50.

For firms on the outside, looking in – this is where the opportunity for entry is relatively open. The barrier for entry into the Business Insurance’s Top 100 hasn’t risen significantly in the past ten years. A broker needed $21.8M to enter the top 100 in 2012. Today – they would need $31.0M (a 43% growth in revenue since 2012). A significant task for many firms, but not impossible to imagine.

Five New Additions to the Top 100 List

As the consolidation of firms continues, several firms from last year are no longer on the top 100 – either because of acquisition or having not kept pace with the average YoY revenue growth rate of 19% for this years’ top 100.

But with vacancy comes opportunity and five firms have joined the top 100 list this year for the first time. These firms include:

- Inszone Insurance Services (Inszone), backed by BHMS, enters the top 100 list at #65 with $69 million in revenue (a 40.3% YoY increase). Inszone completed 25 publicly announced transactions in 2022, after completing 17 in 2021.

- OneGroup, which is owned by publicly traded Community Bank System, debuts on the top 100 list at #89 with $40 million in revenue (a 17.7% YoY increase). OneGroup did not publicly announce any M&A transactions in 2022 or 2021.

- King Insurance Partners (King), backed by BHMS, enters the top 100 list at #94 with $34 million in revenue (but with the best YoY revenue increase of 274.9%). King had an aggressive M&A year in 2022, completing 16 publicly announced deals, after completing 7 in 2021.

- Turner Surety & Insurance Brokerage (Turner), a subsidiary of HOCHTIEF USA, an engineering-led global infrastructure group that owns several major construction firms including Turner Construction, debuts on the top 100 list at #95 with $34 million in revenue (a 6.6% YoY increase). Turner did not publicly announce any M&A transactions in 2022 or 2021.

- Privately owned Commercial Insurance Associates LLC (CIA) debuts on the top 100 list at #99 with $32 million in revenue (a 32.5% YoY increase). CIA did not publicly announce any M&A transactions in 2022 or 2021.

How can Firms Grow and Compete on the Top 100 Brokers List?

For those firms making big moves over the past three years, driving organic growth from acquired revenue will be paramount to their continued success – especially if market conditions deteriorate and consolidation slows down.

While 45 of the 100 firms on the list announced an acquisition this year, buying organizations that have implemented an organic growth infrastructure is more the exception versus the norm. Thus, many of the large institutional acquirer’s growth rates will likely plateau if deal flow slows down and the P&C market softens.

Sustainable organic growth fueled by predictable sales velocity continues to be the most controllable method for taking a firm to the next level – for increasing revenue and for attracting possible partners. Here are common strategies that firms of all shapes and size should address.

- Reassess your capital structure to build capacity and capital for growth.

- Re-think your risk tolerance as it relates to debt and leverage.

- Deliver a process driven new client acquisition strategy.

- Embrace aggressive new business goals and real production accountability.

- Build industry vertical specialization supported by data analytics.

- Double down on hiring new production talent.

- Design a wealth creation perpetuation plan to attract and retain talent.

Building a cultural commitment to an organic growth strategy, identifying potential best-in-class agency partnerships, and doubling down on opportunities for reinvestment (capital, talent) can be keys to the future outlook and success of firms that wish to compete to make the coveted Top 100 Broker List.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230