Economists have long monitored the market for U.S. Treasury notes as an indication of the overall health of the U.S. economy. In a typical economy, the longer the term of the U.S. Treasury note, the higher the interest rate, or yield, that it pays to the note holder, and vice versa. The yield curve, or the chart comparing the yields of short and long-term notes, becomes inverted when the yields on short-term Treasury notes become higher than those of notes with a longer term.

Notwithstanding the interesting scenario this creates from an academic perspective, the problem with an inverted yield curve is that it has been an ominous warning sign that has preceded almost every recession over the past 60 years. When the yield, or return, on a longer-term note is lower than a short-term note, it can mean investors are more pessimistic, as shorter-duration notes normally offer lower yields because risks are considered more predictable over a shorter time frame.

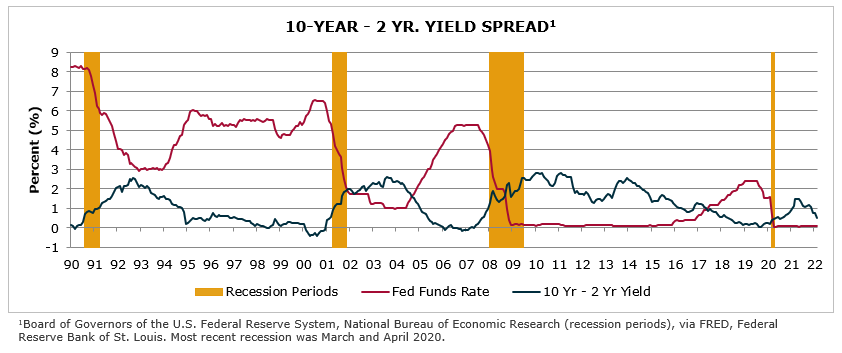

Early today, the yields on 2-year Treasuries exceeded those of their 10-year counterparts, therefore creating an inverted yield curve. There were indications this would occur, as the difference between these yields dropped from 0.78% in December 2021 to 0.49% in February 2022. When that difference drops below 0, the yield curve becomes inverted for a period, and the likelihood of a recession is significantly increased.

There’s been an inverted yield curve preceding all nine U.S. recessions since 1955, with a recession occurring within two years of the inversion, according to the Federal Reserve. However, there was an exception in late 1966, where the inverted yield curve only preceded an economic slowdown, but not a recession. Notwithstanding this exception, the difference between the 10-year and 2-year yields was negative from June 2006 – May 2007, which preceded the Great Recession (December 2007 – June 2009). The yield curve was also inverted between February 2000 and December 2000, which preceded the 2001 recession. Such was also the case in March 1990, prior to the short recession between July 1990 and March 1991.

Whether the yield curve becomes inverted and remains that way for a meaningful period of time has a lot to with the Federal Reserve’s fiscal policy. On March 16, 2022, the Fed announced that it was raising the federal funds rate a quarter point to a range of 0.25%-0.5%. This was the first federal funds rate increase since 2018. The Fed has also indicated its intention to increase rates several more times in 2022. In fact, many policymakers are projecting that the Fed will increase the federal funds rate target range to 1.75-2.0% by the end of 2022, which means six more quarter-percent increases at each Fed meeting this year.

As interest rates increase, the yields on shorter-term Treasuries (e.g., 2-year) increase to a greater degree than longer term notes. As a result, despite the Fed’s stated intention of implementing a series of future rate hikes, it will undoubtedly be cautious not to be overly aggressive in tightening, and therefore increasing the likelihood of an inverted yield curve and potential recession. Given that GDP growth is projected to decrease in 2022 and 2023, if rates were to rise too quickly, there could be a risk of growth stagnation increasing the chances of a recession.

Whether the yield curve becomes inverted and ultimately leads to a recession is unknown at this time. However, in the event that it does occur, it’s important to understand how insurance carriers will be affected.

- During a recession, insurance carriers may see slower revenue expansion as business investment decreases and asset prices soften.

- Insurers with long-tail liabilities or longer settlement periods may see more impact to their results, given that they will be paying for claims that may not be settled until after policy expiration. With lower long-term rates, these insurers may have less investment income from long-term securities to pay for claims. Furthermore, given inflationary pressures, claims may become more expensive when paid further out in the future.

- Carriers may experience lower returns from their investment portfolios in slowdowns compared to higher growth periods.

- Insurers tend to invest more of their portfolio in fixed income investments. Because of increasing inflation currently, insurers could risk income from bond investments falling short in comparison to the rising costs. Given the risk of higher volatility to asset portfolios, insurers may want to look at methods to boost underwriting margins.

Even if the yield curve becomes inverted, it could take several years for a recession to set in. However, insurance brokerages and carriers may want to consider various scenarios and assess how they will maneuver through potential volatility and macroeconomic changes.

If you have questions about Today’s ViewPoint, or would like to learn more about how market activity may impact your firm, email or call Brian Ambrosia, Director, at 440.220.5430.

MarshBerry 360 Forum – Registration Now Open!

Join MarshBerry for a day of learning, networking, and strategizing with leading growth consultants, analysts, and industry experts. Sessions are designed to help improve firm performance, earnings, value, and market resiliency. In addition, gain valuable insights, methodology and resources from MarshBerry’s team of in-demand industry speakers.

Seating is limited and reserved on a first-come, first-served basis. Reserve your spot now at www.MarshBerry.com/360.