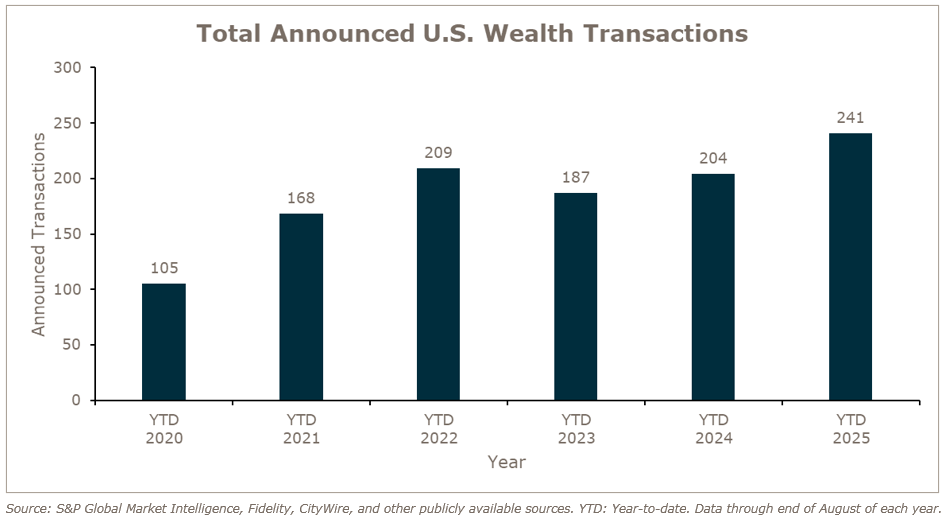

Wealth advisory merger and acquisition (M&A) activity continued its strong pace in 2025, with 241 announced transactions in the U.S. through August – representing a 20% increase over the same period last year. Private capital-backed firms remain the dominant force behind this acceleration, reinforcing their outsized influence in reshaping the industry. With deal volume consistently outpacing 2024 and interest from both strategic and financial buyers showing no signs of waning, MarshBerry holds a confident outlook that the wealth management M&A market will close the year at record levels.

Shifts in client demographics are increasingly shaping wealth management M&A. With trillions of dollars set to transfer across generations, acquirers are prioritizing firms that resonate with younger investors through digital engagement, holistic planning, and long-term retention strategies. At the same time, location has become a subtle but meaningful driver of value. In key markets where demand outpaces supply, firms with an established local presence can command a premium, as acquirers often find it more efficient to acquire their way into a region than to build organically. The convergence of demographic relevance and geographic positioning is setting apart firms that not only serve today’s clients but are also strategically positioned for tomorrow’s growth.

M&A market update

Private capital-backed buyers accounted for 176 of the 241 transactions (73.0%) through August, a figure similar to what was reported in 2024. Independent firms accounted for 50 deals and 20.7% of the market, also in line with 2024’s final percentage of 21.0% (on 76 total independent deals). Insurance brokerages have acquired 18 wealth management and retirement firms in 2025 as of August.

Notable transactions:

August 27: Merchant Investment Management has taken a minority stake in Validus Capital, a California-based registered investment advisor (RIA) and multi-family office with approximately $2.5 billion in assets across 160 client families. Founded by Camden Capital founder John Krambeer in 2022, Validus was launched to focus on ultra-high-net-worth clients with white-glove planning and family office services. The investment marks a shift for Validus from bootstrapped growth to strategic capital infusion to support long-term expansion and succession planning. Validus will retain operational independence, with Krambeer and employees continuing as majority owners. The deal adds to Merchant’s recent streak of RIA investments and reflects its strategy of non-controlling, long-term equity partnerships aimed at enabling scalable, sustainable advisor growth.

September 3: Aon has reached an agreement to sell a majority stake in NFP’s wealth business to Madison Dearborn Partners (MDP) for $2.7 billion. The transaction includes Wealthspire Advisors, Fiducient Advisors, Newport Private Wealth, and related platforms. The deal implies a valuation of approximately 21x EBITDA based on the trailing 12-month EBITDA of $127 million and is expected to generate about $2.2 billion in after-tax cash proceeds for Aon. The divested assets represent less than 20 percent of the NFP business and primarily serve high-net-worth and individual advisory clients. Institutional advisory services will remain part of Aon. After the deal closes, the acquired businesses will operate independently under their existing brand names.

Looking forward

MarshBerry remains confident in the outlook for another strong year of M&A activity in 2025, with the potential to surpass prior records. Business owners are increasingly choosing to take control of their future by pursuing transactions that position their firms for long-term success, rather than waiting for market conditions to dictate their options. Potential policy changes, including the possibility of new tariffs under a renewed Trump administration, add a layer of uncertainty but may also encourage strategic sales in sectors facing financial headwinds. Although public sector layoffs could create pressure on employment levels, the steady flow of private equity capital into the RIA market continues to provide stability and momentum. MarshBerry will continue to monitor these factors and share insights on how they may influence the M&A environment in the months ahead.