Wealth advisory firms are seeking strategic partners to help them overcome hurdles such as the cost of investing in updated compliance capabilities and other technologies. Firms are also seeking buyers to help alleviate their internal perpetuation struggles as some firms do not want to burden the company and next generation with crippling debt.

Conversely, wealth advisory firms are being targeted by buyers because of their broad range of offerings, their recurring revenue, scalability, and their service-based business models. Over the past two years, wealth advisors have seen an increase in client engagement and investments possibly due to a rise in wages and accumulated cash due during the pandemic.

2022 Mergers & Acquisitions Market Update

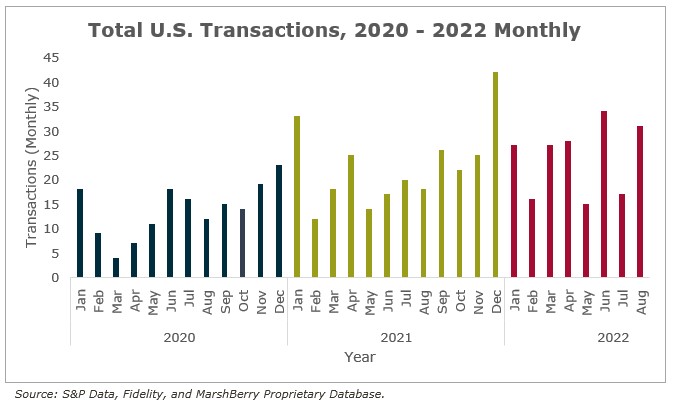

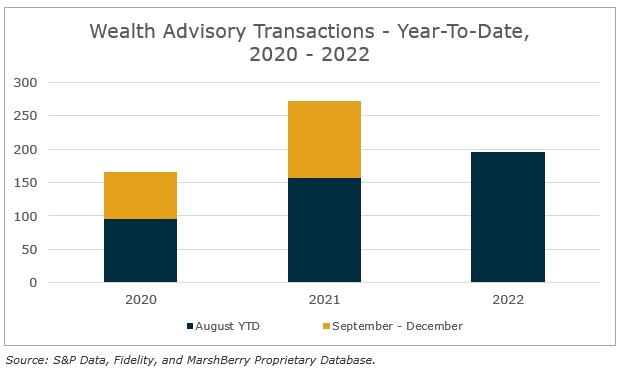

As of August 31, 2022, there have been approximately 195 announced M&A wealth advisory transactions in the U.S. this year. The current volume of deal announcements represents a 24.2% increase compared to last year. Despite a dip in July transactions (17 deals), the industry bounced back in August (31 deals) and is gearing up for a record last four months of the year.

Private capital-backed buyers accounted for most of the transactions through August, remaining atop the various buyer classes. This trend is expected to remain constant throughout the rest of 2022 as dry powder continues to be readily available and strategically deployed.

Geographically speaking, California continues to be atop the podium as the number one destination for M&A activity and represents 13.3% of deals year-to-date 2022. Florida and Pennsylvania make up spots two and three at 7.7% and 6.7%, respectively.

Looking Forward

Historically, there has been a strong increase in deal activity during the fourth quarter. The last two years saw deals in the fourth quarter represent over one-third of the total deal volume for the year. As the year-end approaches, the 2022 total deal count is expected to continue this trend.

There are several upcoming events that could have a potential to alter deal activity. As midterm elections approach, along with potential tax changes, sellers may try to lock in current tax rates which could lead to the biggest fourth quarter in recent memory. In addition, with the Fed continuing to raise rates we may see firms with larger amounts of relatively inexpensive debt deploy their dry powder as a means of competitive advantage.

Deal Spotlight

On August 3, 2022, two Registered Investment Advisors, One Seven and MGO Investment Advisors, announced their merger. Merchant Investment Management, a private equity firm, has also backed the deal and taken a minority stake in the new registered investment advisory (RIA) firm. MGO, who specializes in retirement plan consulting and other wealth advisory services, will combine with One Seven’s specialty platform for professional development and support for financial advisors. The new entity will oversee a combined $2.8 billion in assets with advisors in 11 states – under the name MGO One Seven.

If you have questions about Today’s ViewPoint or would like to learn more about how MarshBerry can help in your wealth management strategies, please email or call John Orsini, Director, at 610.209.7273.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, LLC. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)