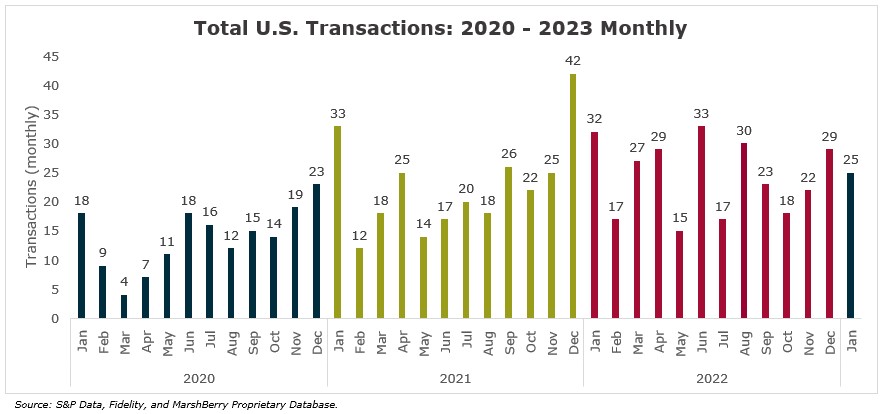

Coming off a record-breaking year in 2022 for merger & acquisition (M&A) activity in the wealth advisory space – no one would have been concerned if deal activity took a breather at the start of 2023. However, it appears that no such breaks are allowed. After a strong December that saw 29 transactions, January 2023 delivered 25 announced deals, similar to the fast start of last year when 27 deals were announced in January of 2022.

Private equity-backed buyers continue to play a large role in transactions accounting for 15 of the 25 wealth advisory transactions (60%) in January, as they continued expanding their presence in the marketplace. Independent firms accounted for five of the total deals so far, with public firms also accounting for five deals in January.

Perhaps the robust financial markets in January played a role, as year-end economic news created some buzz. A better-than-expected GDP of 2.9% and decline in the consumer price index to 6.5% in December (down from 7.1% in November) created enough excitement to help drive the S&P 500 up 6.2% and the Nasdaq up 10.7% in January. After all – wealth advisory firms’ revenue is intrinsically tied to market performance.

However, what we are seeing in January for transaction announcements is more likely tied into what happened in August and September of 2022. With financial markets struggling through the Summer as inflation raged and interest rates rose – wealth firms that were already thinking about partnering, started to take calls from interested buyers. The typical lag time for M&A deals is roughly 4-6 months from start to finish. January may have been the recipient of finalized deals for conversations that started back in August and September.

Whatever the reason may be, there is no doubt that there continues to be excitement and increasing interest in retirement and wealth advisory firms and early signs in 2023 point to another robust year for partnerships.

More insurance brokerages targeting wealth advisory firms

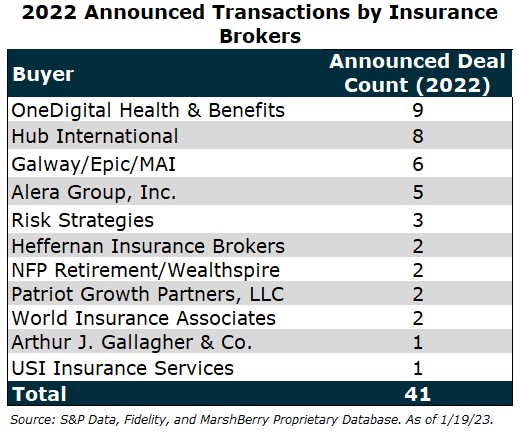

The number of wealth advisory businesses acquired by insurance brokerage firms has been on the rise, going from only 10 transactions in 2020 to 41 in 2022 – a 310% increase. In 2022, insurance brokerage represented 14% of the total number of deals. Of the 25 deals in January – one was by an insurance brokerage firm, Alera Group, Inc. However, we expect the previous year’s trend of insurance brokerage interest to pick up again as we continue to monitor the space.

Not only have insurance brokers, as a category of buyers, picked up the pace – but more individual firms have joined the hunt. In 2020, a total of six insurance brokers were responsible for 10 transactions, while 2022 saw 11 insurance brokers make 41 deals.

Deal Spotlight: Cetera Financial Group

January 25, 2023: Cetera Financial Group (Cetera) announced that it has entered into a definitive agreement to acquire the retail wealth business of Securian Financial Group, Inc. (Securian Financial). The deal gives Cetera access to thirty independent firms with more than a thousand financial professionals. As of December 31, 2022, Securian Financial had $47.4B in assets under administration (AUA) and $24.8B in assets under management (AUM). Cetera plans to go to market with Securian Financial as a unique platform under the new brand called Cetera Wealth Management Group, which would fall under the greater umbrella of the Cetera Advisor Networks community.

Outlook for 2023

The momentum for investment in the wealth advisory space has been building over the past few years. And despite the higher cost of debt capital and recent market volatility, demand continues to outpace supply with over 40 private equity buyers actively pursuing acquisition strategies. 2022 showed this by delivering a record number of deals during a down financial market and less-than-optimal capital raise environment.

With the fast start in January – there is cautious optimism that the momentum will continue to carry throughout 2023.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your wealth management strategies, please email or call John Orsini, Director, at 440.220.4116.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230