As platform consolidation continues across the wealth management landscape, integration capabilities are becoming a decisive factor in buyer selection. No longer viewed as a post-close concern, integration is now central to pre-transaction diligence, with buyers scrutinizing their own operational readiness as closely as they evaluate the target firm’s financials. Successful integration requires more than migrating systems or consolidating back-office functions. It demands intentional planning around advisor transition, cultural alignment, client communication, and ongoing support infrastructure. Buyers that can articulate a proven, repeatable integration process are increasingly viewed as lower-risk and higher-value partners, particularly by principals concerned about disruption to clients and employees. For sellers, understanding how a buyer plans to preserve the firm’s legacy while enhancing growth post-acquisition is becoming just as important as the terms on the Letter of Intent (LOI).

M&A Market Update

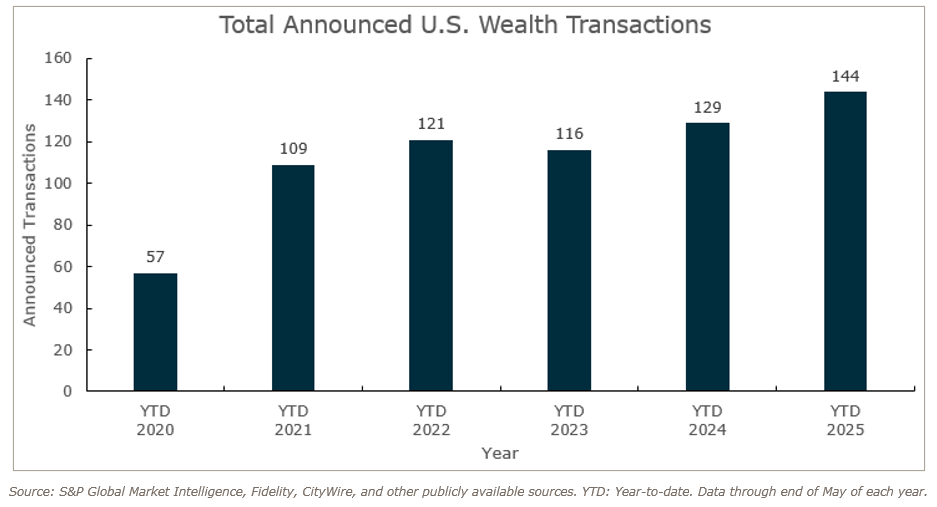

Wealth advisory merger and acquisition (M&A) activity continues to accelerate in 2025, with 144 announced transactions in the U.S. through May, an 11.6% increase over the same period last year. Private capital-backed firms remain the dominant force, accounting for a significant majority of deal volume and driving consolidation across the sector. As transaction activity outpaces 2024 and both strategic and financial buyers remain active, MarshBerry maintains a positive outlook for the remainder of the year.

Private capital-backed buyers accounted for 105 of the 144 transactions (72.9%) through April, a figure similar to what was reported in 2024. Independent firms accounted for 31 deals and 21.5% of the market, a slight increase from 2024’s final percentage of 21.0% (on 76 total independent deals). Insurance brokerages have acquired thirteen wealth management and retirement firms in 2025 as of April.

Notable Transactions:

May 29: Focus Partners Wealth, LLC, a subsidiary of Focus Financial Partners, has announced its acquisition of Churchill Management Corporation, a Los Angeles-based investment management and financial planning firm managing approximately $9.4 billion in assets as of March 31, 2025. The deal, expected to close in the third quarter of 2025, marks the first acquisition by Focus Partners Wealth since its rebrand earlier this year. Churchill will initially operate as a division of Focus Partners Wealth, bringing a nationwide team of advisors and business development professionals that align with Focus’s client-centric and growth-focused strategy.

May 30: Cerity Partners has expanded into Arizona with the acquisition of Canopy Wealth Management Arizona, a Scottsdale-based advisory practice managing approximately $433 million in client assets. The deal, which closed shortly after being announced, brings advisors Chad Wing and Dustin Brutton, along with four team members, into Cerity Partners as partners. Originally launched in 2021 as an extension of Wisconsin-based Canopy Wealth Management, the Arizona office marks Cerity’s latest move in its ongoing national expansion strategy. MarshBerry served as advisor to Canopy Wealth Management in this transaction.

Looking forward

MarshBerry remains optimistic that 2025 is shaping up to be another robust year for M&A activity, with the potential to exceed previous records. Many business owners are taking a proactive approach, choosing to define their firm’s trajectory rather than leaving it to be shaped by external economic forces. While policy uncertainty, such as the possibility of tariffs under a second Trump administration, has introduced some volatility, it may also accelerate deal activity in sectors looking to stay ahead of potential financial pressures. At the same time, rising public sector layoffs could place strain on employment trends, but the continued flow of private equity investment into the registered investment advisor (RIA) market provides a strong counterbalance. MarshBerry will be closely monitoring these dynamics and will continue offering perspective on how they may influence M&A activity in the months to come.