When it comes to the future of managing and selling their insurance agency business, many owners keep their plans close to the vest. Even afraid to say it out loud for fear that they won’t be able to change their mind. If an owner decides to reveal their plans for retirement or perpetuation of the company, there may be an impact on how partners, employees or clients will react. A change in direction for a firm can create some jitters for those closely tied to that business, whether it be employees starting to abandon ship or clients starting to lose confidence. And once an insurance agency starts to make decisions based on the trajectory of those plans, the owner will have difficulty changing course.

Without the forethought involved in answering the question, “What do you want your life to look like?”, owners often simply react to an opportunity – rather than seeking a solution that helps them reach their goals. They may receive a phone call from a potential buyer that prompts a decision without consideration of the full spectrum of options. This may yield a good outcome, but isn’t likely to result in the best outcome. When a business owner is ready to sell, they should look for the best deal rather than just a good deal, and that requires understanding both their options and their ultimate goals.

How Can Insurance Agency Owners Achieve their Personal and Professional Goals?

As opposed to reacting to a proposition, no matter how good an opportunity may seem, there is significant value in taking a step back to see what other options or solutions are available. Options that might be more aligned with what they really want out of life, and what might be better for their company.

For some, selling your insurance agency might be the answer. For others, taking on capital could offer a solution. And then for others, digging in and growing for another few years and perpetuating internally could be a viable path. If selling your insurance agency is the answer, it is important to consider sell side M&A advisory services.

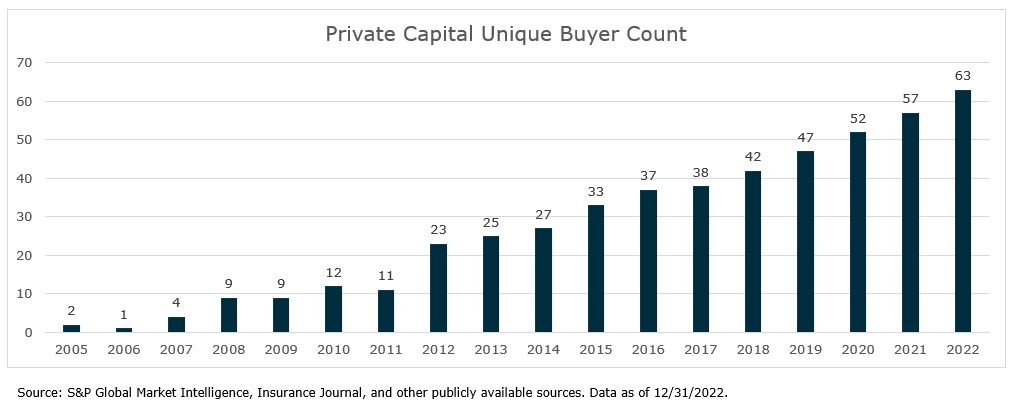

The good news is, in this industry, there are a lot of options available to businesses and business owners looking to sell their insurance agency. The insurance brokerage landscape has changed rapidly over the past ten years, even the last five years. There are more buyers than ever, with a huge influx of private equity (PE) investors, sovereign wealth funds, pension funds or family office entities. Even in this heightened interest rate environment, there are plenty of options to secure debt capital.

So, no matter where you are in your journey – ask yourself the question: What do you want your life to look like? Obviously, it would be better if you asked it sooner, rather than later, and you may need to ask that question a few times during the journey – but it’s important to ask. Once you’ve asked, take that step back and understand all the viable options you have to help you reach your goals.

Insurance Brokerage M&A Market Update

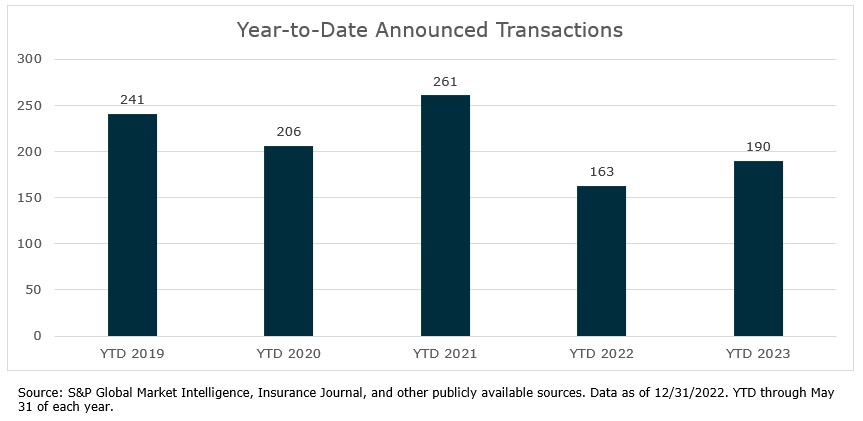

As of May 31, 2023, there have been 190 announced insurance brokerage merger & acquisition (M&A) transactions in the U.S. through May. Activity has increased by 16.6% compared to 2022, with 163 transactions being announced through this time last year.

Private capital-backed buyers accounted for 138 of the 190 transactions (72.6%) through May, which is consistent with the proportion of announced transactions over the last five years. Total deals by these buyers increased at a Compound Annual Growth Rate (CAGR) of 26.9% since 2018. The percentage of announced transactions by independent agencies have continued to decline since 2021. On average, 15.9% of total deals were done by independent agencies from 2018 to 2021, compared to 12.8% in 2022 and 10.5% in 2023. High valuations, coupled with limited availability of capital, are likely contributing to this decline in share of deal activity.

Deal activity from the marketplace’s most active acquirers has remained strong in 2023. Ten buyers account for 53.7% of all announced transactions, while the top three (BroadStreet Partners, Hub International and Risk Strategies Company) account for 23.2% of the 190 total transactions.

Notable Insurance Brokerage M&A Transactions in 2023:

- April 26: Risk Strategies announced that it acquired Johnson Insurance Services (JIS). JIS, a top 10 independent agent in Wisconsin, is a full-service agency offering personal and commercial coverages, as well as employee benefits insurance products and services to individuals and businesses.

- May 30: Arthur J. Gallagher & Co. announced the acquisition of Nashville, TN-based Bernard Benefits and Bernard Healthcare Financial Planning. Bernard Benefits is a health and employee benefits brokerage firm that focuses on small group business, while Bernard Healthcare Financial Planning advises individuals and families on health insurance coverage.

- June 5: Hub International Limited announced that it acquired the employee benefits assets of HORAN Associates, Inc. and HORAN Smart Business, LLC (collectively HORAN Health). Cincinnati, Ohio-based, HORAN provides employee benefits solutions to more than 650 small and mid-size companies and works with both corporate and individual clients in 48 states.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230