In the independent insurance broker world, growth is often celebrated as the ultimate goal. But behind every doubling of revenue or surge in new business is a quiet truth: a firm’s ability to grow is only as strong as its ability to scale its people.

While many businesses obsess over sales targets and production numbers, few connect those goals to the necessary infrastructure for supporting them. One of the most overlooked, yet mission-critical, relationships in a growing organization is the connection between workforce planning and sales velocity.

While high sales velocity has myriad benefits, including more clients to service, more quotes to market, and more policies to issue, it also means more relationships to manage and more issues to solve. And the faster that number rises, the more stress it places, not just on producers but on every function in an insurance firm. Many leaders wait until staff are underwater—or until key people leave—before considering headcount. That’s not a growth strategy and will quickly lead to burnout.

Defining workforce planning’s relationship with sales velocity

Most insurance executives are familiar with traditional sales velocity metrics often drawn from CRM systems and focused on pipeline performance. But for independent firms, a more meaningful calculation is:

This version isolates organic commission growth from pure earned base. It eliminates one-time or inconsistent fee income and provides a clearer indication of how rapidly the business is expanding its core book of business.

If sales velocity is the gas pedal, then workforce planning is the transmission. Floor the gas pedal without upgrading the transmission, and something will break. Each new client may represent only a few thousand dollars in commission, but to the service team, it’s another set of emails, endorsements, certs, claims, and conversations. Therefore, sales velocity should dictate workforce strategy.

Doubling the business: what it means for staffing

High growth firms double every five years. Using the Rule of 72 (a formula to determine how long it takes to double an investment), this breaks down to 15% growth every year for five years. For most firms aiming to double organically in 3 to 5 years, the producer needs may be obvious, but what about the other positions? Here’s what that kind of growth typically demands:

- Producers: If the firm’s new business goal is $1.5 million, that would take roughly 7-10 productive producers generating on average $150-215k in new business commission, depending on the mix, hit rates, and territory. But don’t just hire—enable. Invest in marketing, data, and CRM so producers spend time selling, not chasing quotes.

- Account Managers (AMs): A seasoned account manager (AM) can handle approximately $500,000-$700,000 in commercial commissions or roughly $400,000-$600,000 in personal lines. Doubling a book could require 2x the AM capacity, unless the business implements tech-driven efficiencies or a tiered service model.

- Marketing & processing: More quoting means more load on marketing teams and a large volume of submissions per day could impact quality. Delays or errors here erode producer trust and carrier relationships—often silently.

- Admin, operations, and compliance: Back-office roles are force multipliers. Every $1M-$2M in revenue typically requires one admin/support role to keep the organization running smoothly.

- Leadership: Growing businesses need new layers of management. When AMs or CSRs report to a single owner or VP, their capacity quickly maxes out. A good rule of thumb: one team lead per 5-6 AMs or frontline staff.

How to prepare for higher-level growth

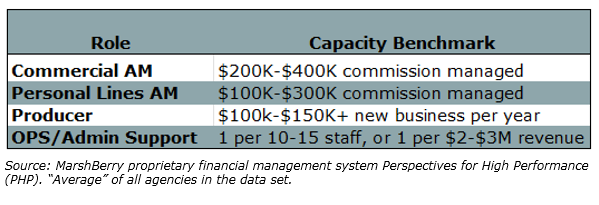

It’s not necessary to hire everyone at once, instead firms should plan deliberately. Start with a capacity-based staffing model. The below table shows recommendations on how many clients, policies, and commission dollars each role can reasonably support across average firms (compare to seasoned performers above). Leaders can use these recommendations to benchmark their own staff’s capacity and uncover when it’s time to hire another AM or producer. Building a forecast for each role can help shift from reactive hiring to proactive planning.

Monitor leading indicators to identify signs of stress before they create turnover. Rising quote volumes, longer onboarding times, increased service errors, producer complaints, and an increasing backlog in carrier submissions or endorsements are all signs of gaps in skills or staffing.

Another best practice is to phase hiring around growth milestones. Don’t wait until the book doubles. Add capacity in chunks—often in anticipation of a new producer ramping up or the launch of new marketing campaigns.

Don’t forget about current top performers. It’s not possible to hire through every stage of growth externally, so invest in internal talent development. Crosstrain CSRs into AMs, promote high-potential staff into leadership and create internal training pathways to scale from within.

Growing fast without planning for workforce needs doesn’t just create stress; it also leads to inefficiencies. It risks reducing client retention, as service quality dips, and decreased producer productivity. It also limits long-term scalability. Insurance firms that sprint ahead without a scalable people plan often find themselves in a cycle of growth followed by contraction or, worse, stagnation.

As an executive, it’s tempting to focus on new business production. However, if leaders don’t build a foundation to support that growth, the cracks will show—first in service teams, then in client experience, and ultimately in the bottom line. Plan accordingly and build a stellar firm reputation with carriers, employees, and customers.