Historically, fourth-quarter mergers and acquisitions (M&A) volume is driven by acquirers and sellers working intensely to finalize transactions before year-end deadlines. This year-end is particularly notable in that the elevated activity is occurring without an easily identifiable external catalyst, such as an election-driven shift, impending tax changes, or other policy-driven urgency. The absence of a singular catalyst suggests that current M&A strength is rooted in structural fundamentals rather than reactive behavior.

Buyers continue to pursue scale, operating leverage, and talent acquisition, while sellers remain motivated by succession needs, rising platform costs, and the competitive advantages associated with larger, better-capitalized partners. This sets up an especially interesting year-end stretch where the numbers will reflect pure market conviction and strategic alignment, not deadline-driven urgency.

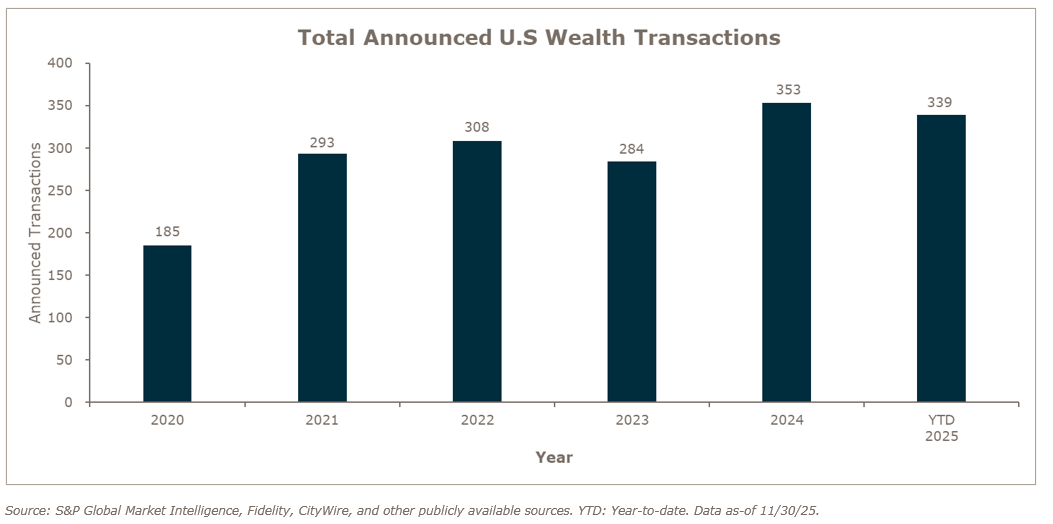

With 339 transactions announced through November, the market is well on pace to surpass last year’s record of 353 deals. The primary question now is whether year-end activity will be strong enough to push total volume past the 400-deal mark, setting a new all-time high for the wealth management M&A market. Given November’s performance and the industry’s historical pattern of elevated December closings, a finish above 400 is within reach, underscoring both the depth of buyer demand and the long-term structural drivers supporting consolidation.

M&A market update

Private capital-backed buyers accounted for 248 of the 339 transactions (74.0%) through November, a slight uptick over the 72.0% that was reported in 2024. Independent firms accounted for 71 deals and 20.0% of the market, in line with 2024’s final percentage of 21.0% (on 76 total independent deals). Insurance brokerages have acquired 27 wealth management and retirement firms in 2025 as of November.

Notable transactions:

November 17: Matter Family Office and IWP Family Office merged to create a unified multi-family office serving over 140 ultra-high-net-worth families with more than $10 billion in assets under advisement. The combined firm integrates comprehensive family office services, public and private investment expertise, and proprietary cultural and educational offerings. The new platform brings together 90 professionals across offices in St. Louis, Denver, and Dallas-Fort Worth. The merger is backed by BW Forsyth Partners, an evergreen investment firm focused on supporting founder-led businesses. This partnership aims to scale the platform and enhance its ability to serve multigenerational families through integrated financial, administrative, and family engagement services. The firm will maintain its client-centered approach, emphasizing continuity and collaboration across generations. Terms of the deal were not disclosed.

December 1: Mercer Global Advisors has acquired Glass Jacobson Wealth Advisors, a Maryland-based registered investment advisory (RIA) with approximately $1 billion in assets under management. The acquisition expands Mercer Advisors’ presence in the Mid-Atlantic, particularly in the Baltimore and Washington, D.C. corridor. Founded in 2001 and backed by a legacy in tax and accounting dating to 1962, Glass Jacobson combines deep tax expertise with full-service wealth management. Led by CEO Jonathan Dinkins, the firm serves over 660 families and operates with a team of more than 20 advisors and support staff. Joining Mercer Advisors gives Glass Jacobson access to an integrated platform of services including estate and tax planning, family office solutions, and institutional-grade investment management. The merger also provides long-term continuity for clients and career growth opportunities for the next generation of Glass Jacobson leaders. MarshBerry served as advisor to Glass Jacobson on this transaction.

Looking forward

MarshBerry remains confident in the outlook for another strong year of M&A activity in 2026, supported by the momentum seen through year end and reinforced by durable industry fundamentals. Business owners continue to take a proactive approach to shaping their future by pursuing transactions that strengthen long term positioning rather than waiting for external forces to determine their path. Potential policy developments tied to a new administration, including trade or tax adjustments, may introduce uncertainty but could also motivate strategic sales in sectors facing cost or margin pressures. While shifts in government employment may influence broader labor trends, the continued flow of private equity capital into the RIA market offers meaningful stability for buyers and sellers alike. MarshBerry will closely track these dynamics and provide ongoing insight into how they may influence the M&A landscape in the months ahead.