Special Purposes Acquisition Companies (SPACs), or “blank check” companies, exist to buy private companies and take them public while avoiding the arduous process of a traditional initial public offering (IPO) and potentially providing the benefits of a partner for the target. SPACs are publicly traded but exist as a shell company with no operations and no material assets other than cash. Merging with a SPAC allows a company to go public in just a few months compared to a traditional IPO process that can take up to six months. The process is significantly expedited given that there are fewer regulatory requirements and filings needed than in a traditional IPO process.

SPACs are historically associated with high growth industries – focusing more on earnings potential and less on the balance sheet. This has made industries such as tech, the electric vehicle market, and green energy prime targets for acquisitions. In the insurance universe, companies at the intersection of insurance and technology (e.g. InsurTech) seem to make the most sense for SPAC mergers given their high growth potential. On the opposite end of the spectrum, carriers may not be great candidates given the heavy reliance on the balance sheet for their valuation.

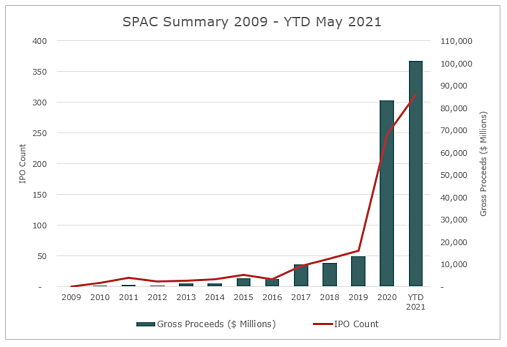

InsurTech companies are particularly attractive SPAC candidates due to their innovative and defensive natures, the substantial growth in M&A activity in the segment, and the total amount of capital invested in the recent years. Case in point, in 2020 and 2021, the InsurTech segment saw an unprecedented number of IPOs, and a record amount of capital raised in 1Q2021 (exceeding all of 2020), despite the global pandemic.1

Several notable insurance related SPAC transactions were completed in 2020 and YTD 2021:

- Tiberius Acquisition Corporation acquired International General Insurance Holdings Ltd. in March 20204.

- Insurance Acquisition Corp merged with Shift Technologies Inc. in October 20202.

- Hippo Enterprises will merge with a SPAC called Reinvent Technology Partners Z, valuing Hippo at $5 billion3.

- Pine Technology Acquisition Corp. is a SPAC backed by Barry Zyskind, CEO of AmTrust Financial Services, who filed for an IPO in February 2021 with the goal of raising $300 million and targeting an acquisition in the InsurTech sector4.

All SPACs are operating with a time limit to find an acquisition. As more are formed, more SPACs will compete for the finite set of opportunities available. This will be good for sellers, but likely bad for SPACs.

If you have questions about Today’s ViewPoint, or would like to learn more about the rise of SPACs in the insurance industry, email or call Gerard Vecchio, Managing Director, at 212.972.4886.Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.

Sources: 1Willis Towers Watson Insurtech Report 4Q2020; 2S&P Global; 3Barrons; 4Insurance Journal

MarshBerry continues to be the #1 sell side advisor in the industry (as ranked by S&P Global). If you’re considering selling your firm, we are the best choice to help you through the complicated process. If you don’t hire MarshBerry, hire a reputable advisor that can help you navigate one of the most important business decisions you will ever make. You will be much better off having an advisor in your corner that knows the industry than trying to do this on your own.

Investment banking services offered through MarshBerry Capital, Inc., Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, Inc. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)