There are increasing salary transparency laws in the U.S., where companies need to list salary ranges on job postings. This is part of a trend towards equitable workplaces where people in comparable roles are paid similar wages, across different industries. As equity and inclusion become more important, these laws are likely to spread to more states. This shift could potentially impact hiring and retention as employees gain insight into colleagues’ salaries and the pay offered by other industries and companies.

Salary transparency laws have spread in many U.S. states, including Colorado, Maryland, Connecticut, California, and Washington. Each jurisdiction has different terms regarding which companies are covered. On November 1, 2022, New York City started requiring employers with four or more employees to post salary ranges on job opportunities. California’s new salary transparency bill will go into effect on January 1, 2023, and applies to companies with over 15 workers.

Experts believe that companies may want to consider long-term strategies around navigating this new trend and shift in legislation. Dave Carhart, VP of advisory services at Lattice, a provider of performance and compensation management services, stated, “Once people work at companies where salary transparency is the norm, it will seem odd, or secretive, for companies not to share it, even if there’s not a legal requirement to do so.”

Salary transparency laws may make hiring more competitive for insurance brokers.

The increased visibility into salaries or more competitive packages in other industries could increase competition in recruiting talent for insurance brokerages. This could also increase job switching as employees can see when there are more lucrative opportunities. About 1 in 20 employees said they would quit if they learned that they’re making less than their coworkers, based on a ResumeBuilder.com survey of 1,200 U.S. workers in November 2022.

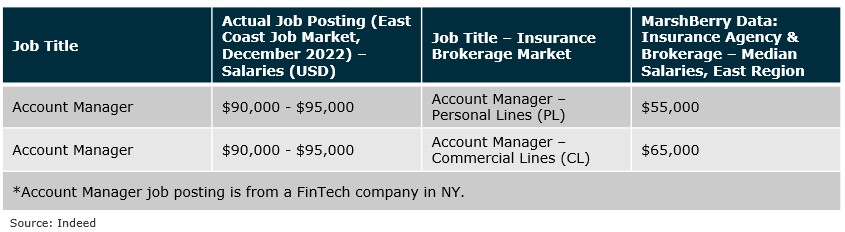

For example, according to Indeed, a FinTech company with over 50 employees in New York currently has an account manager job posting offering a salary range of $90,000-$95,000. This compares to a $65,000 median salary plus bonus in the East region for account manager roles at commercial lines insurance brokers.1

“With salaries for new employees becoming more transparent, it could force the hand of many businesses to raise salaries for all employees,” said Ben Johnston, chief operating officer of Kapitus, which provides financing to small and medium-sized businesses.

How can insurance brokers navigate these shifts and hire top candidates?

Despite changes to salary visibility in recruiting, there are other factors that play into candidates’ decisions for accepting roles with companies. Insurance agents and brokers can improve their chances to recruit and retain the best talent by creating a more meaningful candidate experience. Here are some important steps you can take.

- Identify your ideal candidate: Targeting specific candidates based on attributes such as experience, soft skills, attitude and cultural fit can help narrow down candidates to focus on those most likely to succeed in the position and company.

- Have a plan: Come to all interviews prepared with all key players on the same page. Discuss surface level concerns about positions and candidates early on. Clearly and continuously communicate the timeline and steps with the candidate and recruiting team.

- Be transparent: Keep everyone informed throughout the process, from the recruitment team, to interviewers to candidates to ensure everyone is on the same page with similar expectations.

- Respect the candidate’s time: Be flexible and accommodating. Make it easy to schedule and reschedule interviews. Consolidate interview steps to minimize the amount of time candidates need to take away from their current jobs.

- Utilize up-to-date technology: Using modern recruiting technology to simplify and speed up the process can benefit firms and candidates.

While the trend toward salary transparency will likely see greater adoption in the U.S., firms can take action. Working with a professional talent acquisition agency that has the knowledge and experience to scout the right candidates for the insurance industry may ensure that insurance brokerage firms remain competitive and are able to hire the right talent as hiring becomes more challenging.

1MarshBerry Perspective for High Performance (PHP) data – 12/12/22.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230