An insurance brokerage’s compensation plan impacts nearly everything related to a firm’s strategic goals for growth, profitability, and overall value. A strong compensation model motivates producers to drive new business, supporting organic growth, and can create a competitive edge in attracting and retaining top talent. However, as a firm’s largest expense, it’s important to understand the entire compensation ecosystem across your organization and the changes that can impact success the most.

One of the best starting points for firms looking to measure and optimize their compensation plan is understanding what other firms, especially top-performing ones, are doing. Benchmarking your approach to peers, competitors, and top performers can help you create better long-term salaries, benefits, and overall budget planning decisions.

MarshBerry’s 2025 Insurance Agency & Brokerage Compensation Report reveals what top-performing firms are doing to remain competitive. It includes details about how brokerages structure salaries, commissions, and bonuses and their methodologies for driving maximum revenue and growth. This annual study, conducted in the beginning of 2025, surveyed firms on their 2024 compensation policies, processes, and strategies for roles commonly found across most insurance brokerages as well as their expectations for 2025.

Study Overview

This study is intended to help brokerages better understand the landscape of total compensation, benchmarks to measure against, and evolving trends. It is broken out across four employee categories:

- Executive and management

- Production personnel

- Service personnel

- Support personnel

Executive & Management

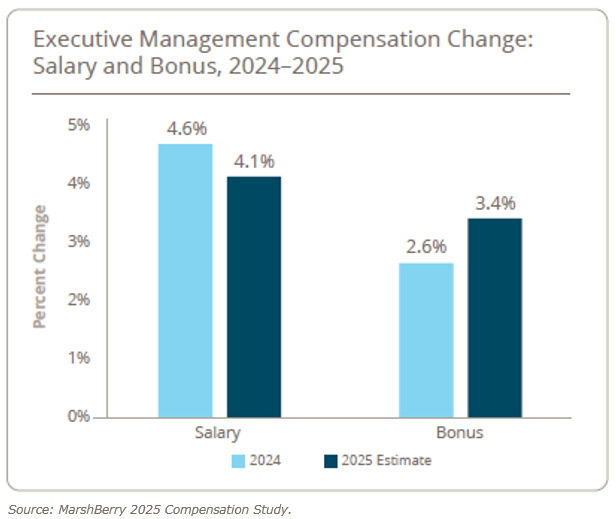

Executive and management base salaries rose 4.6% in 2024, up from 3.1% in 2023, reflecting sustained demand for leadership talent in a competitive market. Bonus growth was more modest at 2.6%, likely reflecting some moderation in organic growth and profitability across many firms in 2024, as rate increases across several lines began to normalize. Respondents maintain a strong look for 2025, projecting steady increases for both base salaries and bonuses.

Production Personnel

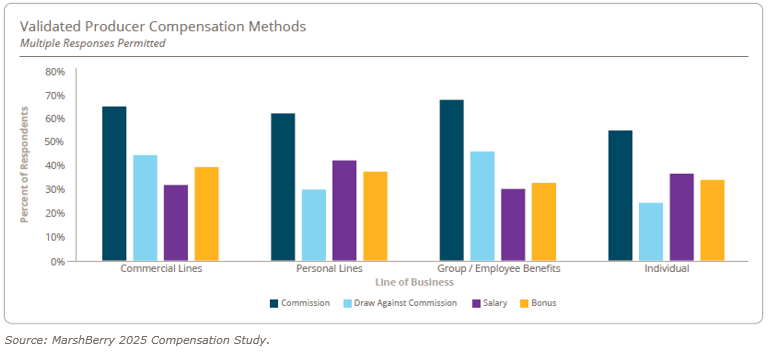

When evaluating producer compensation, MarshBerry segments producers into two categories – validated and unvalidated producers – because they are in different stages of their careers and tend to be compensated differently. Validated producers usually generate enough business to merit a higher compensation (including benefits). Unvalidated producers are typically newer employees (less than three years) and are not generating enough business to cover their compensation.

Compensation for validated producers is often tied to commission and linked to their books of business. However, firms use various compensation methods for these producers, some incorporating a salary.

Service Personnel

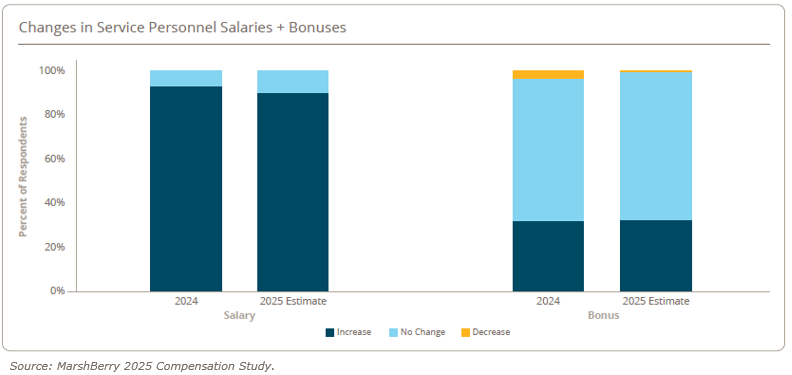

In the average firm, service personnel comprise 58% of total personnel and service payroll makes up 39% of total payroll expense. On average, there are 2.9 service staff to every producer. In 2024, service personnel compensation recorded the largest percentage increase of all functions, with salaries rising by an average of 5.8%. Looking ahead, 90% of respondents anticipate further salary increases in 2025.

Support Personnel

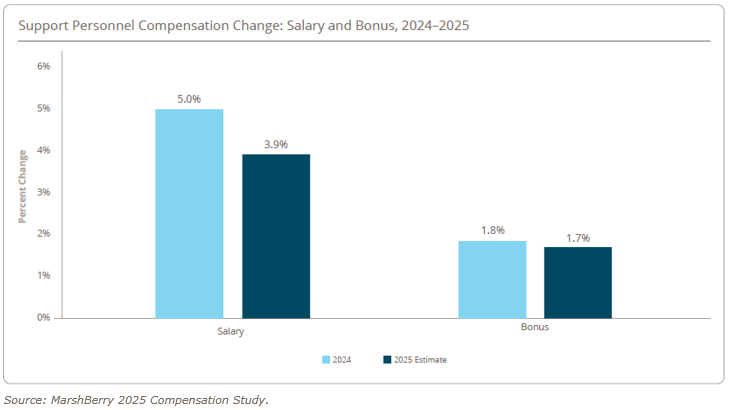

Support personnel support the entire organization rather than a specific department. Support functions include accounting and finance, general office management, human resources, and information technology personnel. In 2024, the average firm had one support staff member for every

8.1 full-time equivalent (FTE) employees — a slight decrease from 8.6 in 2023. Support staff salaries advanced 5.0% in 2024, with participants expecting an additional 3.9% increase in 2025. When it comes to bonuses, over 70% reported no change in 2024 or anticipated any changes in 2025.

The Value of a Compensation Study

MarshBerry’s comprehensive, one-of-a-kind industry report evaluates compensation trends across multiple roles in insurance brokerage. It provides over 100 charts illustrating respondent data and detailed insights into the results. The report allows insurance brokerages to benchmark where their firm sits in the range of industry peers on compensation approaches. It can reinforce their current approach or reveal areas for change.

As insurance brokerages continue to look for ways to grow their business, whether through their product offerings, service capabilities, or technology upgrades, people will always be at the root of everything they do. Having a top-performing organization with top-performing personnel starts with a top-performing compensation strategy.

Learn more about MarshBerry’s 2025 Insurance Agency & Brokerage Compensation Study.