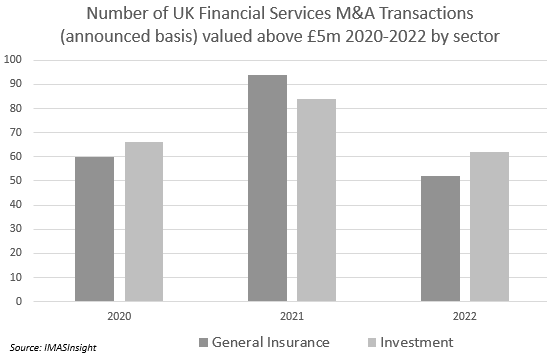

Similar numbers, but different realities?

We have tracked M&A activity across General Insurance and Investment, two key sectors in UK financial services, shown annually and quarterly in the graphs above and below, respectively. Both sectors appear to perform in a broadly similar manner. 2021 was a record year (certainly since we started collecting detailed M&A records in 2011), which seemed inconceivable when we entered into lockdown in April 2021 and buyers put their pens down. 2022 saw a sharp drop from 2021 but only slightly lower activity than in 2020 against the backdrop of Russia’s invasion of Ukraine and rising inflation and interest rates. Over this period, both General Insurance and Investment have seen significant amounts of private equity capital being deployed in consolidating the sectors. Last year’s 25% drop in deal volumes in the Investment sector partly reflected the volatility in stock markets and their impact on reduced appetite for risk among buyers in the wake of pressures on funds under management, revenues and, more significantly, earnings in the sector. Conversely, revenues in general insurance have remained robust and the 45% fall in transaction volumes in this segment reflects an increasingly limited supply of quality assets. Demand from buyers remains strong which has resulted in prices increasing markedly in 2022.While the number of announced deals in the two sectors were similar, our records show the total population of independent entities in the General Insurance sector is only 1/3 of size of the Investment sector, where much of the M&A consolidation is being played out among businesses worth less than £5m (and, therefore, does not appear in our data in the graphs). The consolidation of the General Insurance sector is significantly more advanced, suggesting supply side constraints will keep prices high in 2023. We expect to see a significantly higher number of deals in Investment over time, but volumes may remain somewhat subdued until stock market conditions stabilise.

Insurance

UK Insurance M&A activity ended 2022 with a bit of a whimper, with only nine new UK deals to report on. We are working through the numbers and will publish detailed M&A statistics with our UK Insurance Distribution annual review in a few weeks’ time, but based on initial analysis sector M&A volumes for the whole of 2022 were around 35% lower than 2021, with fewer than 100 announced transactions (vs. 148 in 2021).

The most active buyer in December was Jensten Group, which rounded out a busy 2022 with two new acquisitions, adding both motor trade and fleet specialist Bellegrove in Kent and specialist commercial broker Basil Fry & Company, which focuses on the removals, storage and self-storage sectors. Together the two deals will add around £40m of GWP and 80 staff to Livingbridge-backed Jensten.

Two notable deals by commercial broking consolidators were announced in the first week of January 2023 but are reported on here. Specialist Risk Group announced that it had acquired Oxfordshire-based commercial broker Fleet & Commercial, and Global Risk Partners added Christopher Trigg, a long-established commercial broker in Rickmansworth that is also a leading member of GRP’s own Hedron Network.

Elsewhere, acquisitive credit specialist Xenia Broking revealed that it had added the credit insurance business of Linda Scott Associates in Glasgow, Howden-owned Aston Lark announced that it had acquired the marine trade book of business of Navigators & General, which will complement their existing personal marine offering under the Haven Knox-Johnston brand, and UKGlobal Leeds (also part of Howden) announced that it had added Logic Insurance Services.

In insurance technology, Stubben Edge announced another deal with the acquisition of Insurercore, a distribution platform that connects brokers with underwriters by linking relevant risks with risk appetite.

Finally, in the largest deal of the month, BMS Group revealed that it had secured new investment from leading private equity group Eurazeo, which will invest as a minority alongside existing backers British Columbia Investment Management Corporation (BCI) and Preservation Capital Partners in a transaction reported to value BMS at £1.75bn.

Investment

2022 ended with a slightly quieter month of M&A activity across the Investment sector. In the wealth management sector, Schroders-owned Benchmark Capital bought a 51% stake in Harrogate-based advice network Oculus Wealth, which looks after £2bn of client assets. Moneyfarm agreed to acquire Profile Pensions, the UK digital pension adviser and pensions consolidator, with approximately £870m in AUA. AIM-listed IFA consolidator Kingswood, acquired Macclesfield-based JFP Financial Services and Newbury-based Barry Fleming & Partners, adding £360m and £140m in AUA, respectively. Perspective Financial completed the purchases of East Sussex-based Informed Financial Advice adding £100m in AUA and Staffordshire-based Hunter & Co. St James’s Place appointed representative firm Tweed Wealth Management acquired the wealth arm of Inverness-based legal firm Macleod & MacCallum.

In other parts of the sector, it was reported that the private equity-backed wrap platform Nucleus Financial has completed its due diligence on the listed SIPP provider Curtis Banks and is close to agreeing the final terms of an offer for the PLC. NYSE-listed MetLife Inc, through its institutional asset management business MetLife Investment Management, completed the acquisition of London-based Affirmative Investment Management, a specialist global ESG impact fixed income investment manager, adding $1bn in AUM. The open finance, open data and payments platform provider Moneyhub announced it had secured a further £15m in funding from the retirement and savings business Phoenix Group, which joined Legal & General and Lloyds Banking Group in investing in the fintech company.

*IMAS Corporate Finance LLP has been acquired by MarshBerry.