As buyers in the insurance merger & acquisition (M&A) market continue to close deals – and the value they agree to pay continues to rise – it calls into question how much room is left for valuations to continue to increase even further.

Well, it starts with the answer to “why do they continue to buy?” They buy because they know the dirty little secret about the insurance industry. They know that the return on investment in insurance brokerage has been very high, especially considering the low risk of this industry. The risk-return paradigm states that investors should be satisfied with a lower return on an investment with lower risk. But returns have been downright exceptional in this low-risk industry.

If you consider the beta (the volatility of an industry compared to all other industries) of the Property & Casualty (P&C) insurance industry, insurance is among the lowest of all betas – almost as low as groceries. In fact, while other industries, such as healthcare, banking and technology, are feeling the impact of economic headwinds on M&A valuations, the insurance brokerage industry continues to remain strong.

Average insurance brokerage transaction value increased 4% in Q2 of 2022 (compared to 12/31/2021) despite high inflation, increasing cost of capital and a looming recession. For firms over $20 million in revenue, deal valuations increased almost 7% in Q2 of 2022 (compared to 12/31/2021)2.

But low risk and favorable returns aren’t the only factors helping insurance brokerage valuations rise. Private Equity (PE) continues to gain momentum and has changed the game.

Private Equity Has Changed How Insurance Brokerages Are Valued

Prior to 2006, there was very little private equity involvement in the insurance brokerage industry, and the world was different in terms of how insurance brokerages were valued. The litmus test for what was considered maximum value of an insurance brokerage was based on history. Public brokers, private buyers, even banks historically always based value on a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization) or to a lesser degree, on a multiple of revenue.

In 2006, there were 232 M&A insurance brokerage deals. Only one deal involved a PE buyer. Fifteen years later, in 2021, out of the record-breaking 923 publicly announced transactions, 703 were done by PE backed buyers. So, excluding PE there were only 220 transactions during 2021, less than 15 years ago. PE has ramped up and bought with such a vengeance that during 2021, PE backed buyers consummated 76% of all the insurance brokerage deals.3

So, in terms of where market valuation is today – it’s being set by private equity. PE isn’t just interested in multiples of EBITDA or revenue to determine value. They back into value based upon an investment thesis of achieving three turns of multiple on invested capital (MoIC) in five years or less (3x in MoIC). To back into value, PE buyers look at the cost of capital, availability of high yield debt, interest rate trends, tax rates, deductibility, the current rate environment, projected economic growth, the geopolitical environment, strength of brokerage management, the amount of leverage that can be put to work while maintaining favorable guidance, and the projected exit valuation.

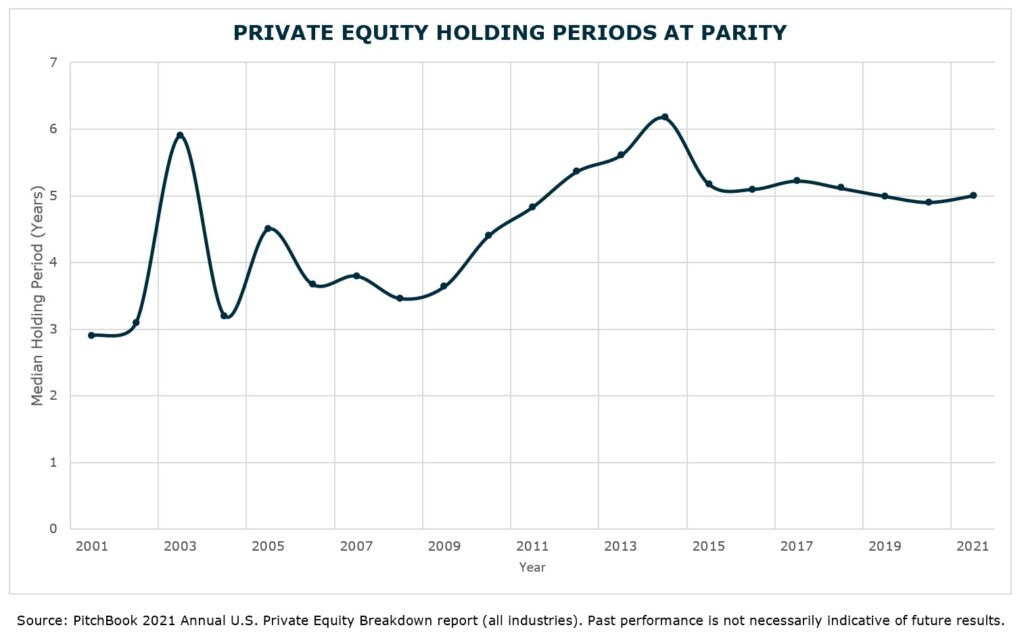

Consider this – the average hold period in middle market private equity was five years during 2021 (all industries). In many respects, pricing is the plug to achieve the 3x in MoIC in five years based upon all the factors described above. If the holding period was longer, pricing would start to decline. If it was shorter, pricing would start to increase (if required) to get deals done and deploy capital. For PE buyers in the insurance brokerage space, returns have been better than expected and outperformed 3x MoIC in five years.

Aside from those that have held their position given the strength of the investment, you can count on one hand how many hold periods were longer because of non-performing investments. It’s no wonder the capital floodgates have opened, and the number of private capital funded brokers has swelled from seven in 2006 to 42 in 2022.

How Does Private Equity Impact Valuations?

If the average brokerage investment thesis is 3x MoIC in a five-year holding period in all middle market PE, but insurance investments are outperforming the target, shouldn’t this drive up valuations for insurance brokerages? If you consider the value of a low beta industry, the high (and increasing) number of buyers in this space and the lower inventory of sellers – the answer is probably yes.

Even with the current economic headwinds, including increased capital costs and the trepid high yield market, there is a strong chance that valuations will continue to rise. At the very least, there is room for longer holding periods, or for investment returns to decline, without negatively impacting deal valuations.

Insurance Brokerages Offer Safe Haven Investments

As signs point toward harder economic times ahead, with interest rates rising, slowing economic growth and increased market volatility, some are questioning if deal valuations for insurance brokerages can go (or should go) higher. When investors are asked “What will happen to valuations in the insurance brokerage space if the cost of capital goes up?” the answer is consistent. Most respond that returns in this sector have been better than expected (having outperformed 3x MoIC in five years), capital has already been raised, and it must be deployed. To illustrate the amount of dry powder that is available from debt capacity alone, over $18 billion dollars has been raised by insurance brokers in the rated institutional debt market during the past 12 months.4 If you add in unrated private and club debt, it is likely more than double that.

So, if hard economic times are nearly upon us, and you were a PE firm with plenty of dry powder, wouldn’t you start to dampen down your investments in industries with a high beta that are historically riskier in a tough economic environment? Wouldn’t you look to amplify your investment in industries that are considered safer by virtue of a lower beta? Right now – capital is chasing industries that perform well in a down economy. Insurance has proven that it does.

How High Can Brokerage Valuation Multiples Go?

With the Foundation Risk Partners (FRP) deal, buzz about how high private broker valuations might go continues to be a storyline. (MarshBerry was an advisor on the deal co-representing FRP.)

FRP, who closed on a recapitalization with Partners Group, a leading global private equity firm, is just another example that supports the philosophy that firms who optimize efficiencies and position themselves for growth continue to be attractive to PE-backed buyers or new sponsors.

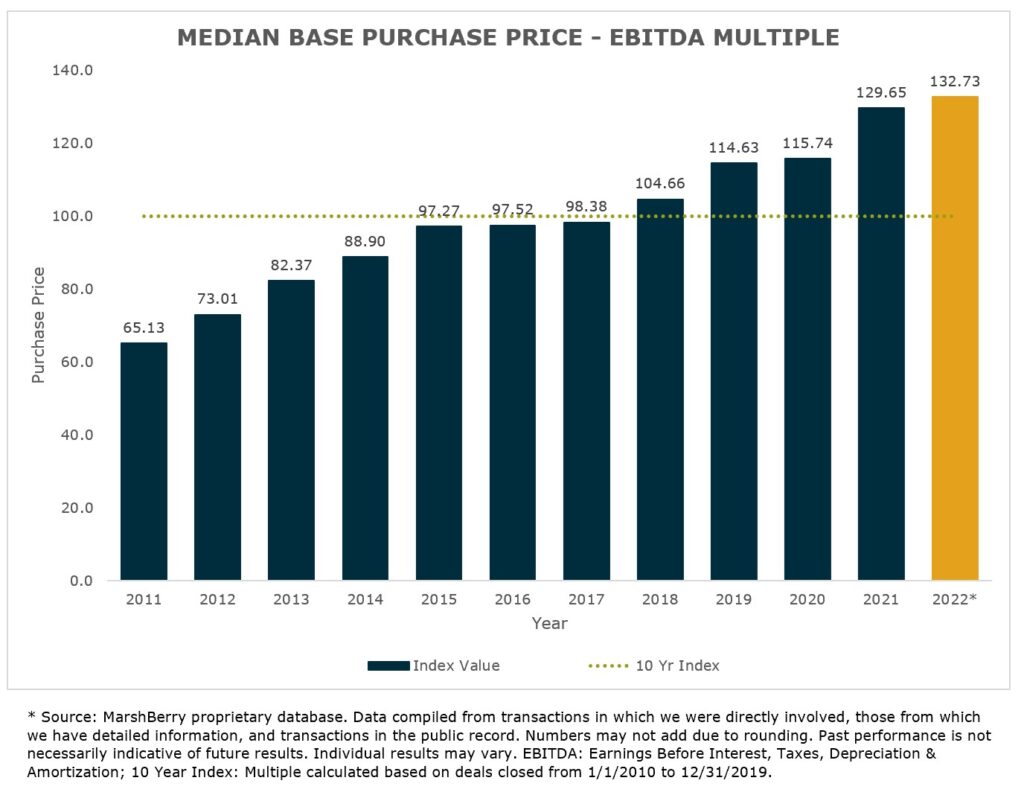

If you look at insurance brokerage valuations over the last 12 months, ending Q2 of 2022, the median base purchase price (EBITDA multiple) is 132.7% of the 10-year average and more than twice what it was during 2011.

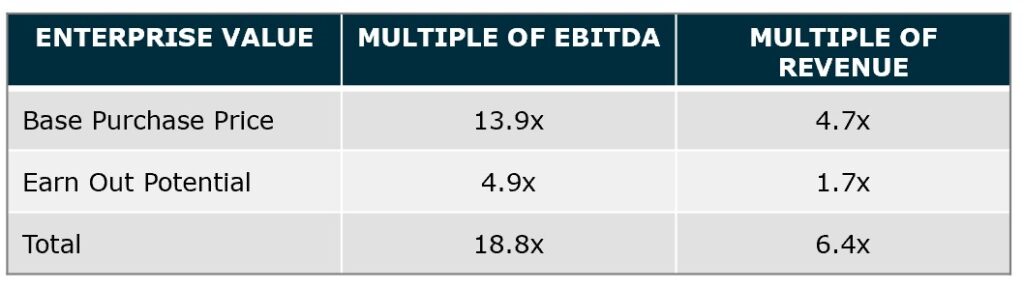

Digging even further, look at the average transaction multiples (on a last 12-month basis through Q2 of 2022) for brokers that transacted that were over $20M in revenue and less than $200M (average Pro Forma Margin of 34%).

For this group, the base purchase price (or the purchase price paid at closing) has increased 39% since the year ending 2019. And based on our estimates, even with the increase in the cost of capital, we believe base purchase price to EBITDA could increase to as high as 16.7x (20% increase over 13.9x), or 5.7x revenue, before average returns fall to 3x MoIC in five years.

By the same measure, should the market start to factor in the low beta of the industry and allow returns to fall to 3x MoIC in seven years, base purchase price could breach 20x for this group, or 6.9x revenue.

The Perfect Storm for Insurance Brokers Looking to Partner

So, it’s not a stretch to imagine valuation multiples reaching or exceeding 20x for the right partnerships. There certainly might be mental hurdles for some to overcome – but think about the possible perfect storm scenario we are currently facing.

We have a crowded market of buyers (most of which are PE-backed) with plenty of dry powder. There are a limited number of high-quality insurance brokerages available. Returns in this industry have been outperforming the investment thesis, even with the rising cost of capital. We have pending economic uncertainty, which may be driving buyers to pursue low beta (low risk) investments. And the insurance brokerage industry has an incredible track record of resiliency during the two most recent financial stress tests. During the Great Recession of 2009, the average insurance broker in America only declined to 3.8%. Then during the 2020 pandemic, the insurance brokerage industry saw its most profitable year on record while achieving organic growth of 4.5%, despite all the risk and uncertainty.

Is it so impossible to imagine that this industry will continue to grow and thrive, despite difficult economic times? We at MarshBerry believe that the high valuations we are seeing today is not a balloon that’s going to pop. It’s a new normal. Because despite hard times, insurance is not a “nice” to have – it’s a “must” have. And as we regularly remind all those that will listen, we believe this is the greatest industry in the history of mankind.

If you have questions about Today’s ViewPoint or want to learn how to differentiate your firm in today’s marketplace, please email or call John M. Wepler, Chairman & CEO at 440.392.6572.

1 Source: https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/Betas.html

2 Source: MarshBerry deal database. Data as of June 2022. Trailing twelve-month comparison as a multiple of EBITDA of the upfront purchase price.

3 Source: S&P Global Market Intelligence, Insurance Journal, and other publicly available sources.

4 Source: Moody’s Investors Services, S&P Global Market Intelligence through June 30, 2022.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230