Understanding Business Valuation

Agency and brokerage owners frequently ask “What is my firm worth?” There are many reasons for wanting to know the value of your firm. You may plan to sell your business or offer shares to employees. You may be interested in buying out a partner. You may need a valuation for tax or perpetuation planning purposes or for securing a loan.

If you’re like most business owners, the majority of your wealth is tied up in your business. So, for that reason alone, it is important to understand the value of your largest asset and the levers that you can pull to protect and increase its worth.

How to Calculate the Value of a Business

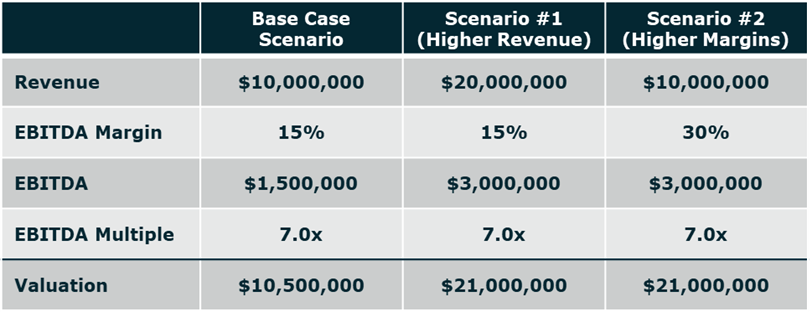

When a company is sold, its enterprise value is often priced as a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization). The valuation metric is an indication of a firm’s “normalized earnings power,” which is the firm’s recurring operating earnings adjusted for non-recurring revenues and expenses. EBITDA margin represents a firm’s EBITDA as a percentage of its revenue. Top independent firms in the insurance brokerage space have EBITDA margins of 25% to 30%+. Overall, average EBITDA margins in the industry are estimated at 15% to 20%. How does your firm compare? Here are three valuation scenarios for you to consider:

- Base Case Scenario: ABC Brokerage is a $10 million revenue firm with an EBITDA margin of 15%. EBITDA is $1.5 million ($10 million of revenue times 15% EBITDA margin). The firm is being sold for a multiple of 7.0x EBITDA. Therefore, the value of the firm is $10.5 million ($1.5 million of EBITDA times 7.0x).

- Scenario #1 (Higher Revenue): If ABC Brokerage would have been able to drive $20 million of revenue instead, and assuming its EBITDA margin is 15%, the value of the firm would now be $21 million, or double the value under the Base Case ($20 million of revenue times 15% EBITDA margin times 7.0x EBITDA multiple).

- Scenario #2 (Higher Margins): If ABC Brokerage would have been able to generate an EBITDA margin of 30% instead of 15% under the Base Case, and assuming revenue is still $10 million, then EBITDA would have been $3 million ($10 million of revenue times 30% EBITDA margin). The firm value would now be $21 million, or double that under the Base Case ($3 million of EBITDA times 7.0x EBITDA multiple).

In the above scenarios, every $1 of increased earnings (achieved through either higher revenue or a higher margin) leads to $7 of additional value.

Valuation Example: Scenario Illustration

In reality, EBITDA multiples vary based on market conditions and on characteristics of the agency or brokerage. Conditions can include firm size, growth prospects, profitability, risk profile and industry. Firms in the insurance brokerage market typically transact at EBITDA multiples ranging from the mid-single digits to the mid-teens. Those that command higher than average multiples tend to be firms that are larger in size, have high growth, and/or have exhibited strong and steady profitability.

How to Increase Company Valuation

Levers to Maximize Value

As the example illustrates, larger, more profitable businesses command higher valuations. So, failing to drive operational improvement within your firm can cause you to leave a lot of money on the table. You can maximize your firm’s value by taking action in two key areas: Finding ways to grow and generate more cash flow and reducing risks.

Options for growth and increased cash flow include:

- Drive higher levels of revenue and new business through cross-selling to existing clients, selling to new clients, developing new product and service offerings, expanding into new market niches, and forging new carrier partnerships.

- Boost firm profitability/margins. This could involve right-sizing compensation, being more disciplined in reducing non-essential expenditures, and investing in technology to increase efficiency.

Ways to reduce risk include:

- Generate higher levels of predictable recurring revenue.

- Reduce reliance on key customers and/or carriers by building a diversified revenue base.

- Make the business less dependent on the owner by building a strong bench of talent.

While easier said than done, actively pursuing value enhancing strategies enables you to build a stronger firm and avoid losing out on significant potential value. This is true regardless of whether you plan to maintain ownership of your firm over the long-term or ultimately sell.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your firm uncover opportunities for improvement, please email or call Kristen San Marco, Vice President, at 440.392.6707.

MarshBerry 360 Forum – Registration Now Open!

Join MarshBerry for a day of learning, networking, and strategizing with leading growth consultants, analysts, and industry experts. Sessions are designed to help improve firm performance, earnings, value, and market resiliency. In addition, gain valuable insights, methodology and resources from MarshBerry’s team of in-demand industry speakers.

Seating is limited and reserved on a first-come, first-served basis. Reserve your spot now at www.MarshBerry.com/360.