Global funding volume in the insurtech segment decreased significantly by over 40% between 2021 and 2022, while deal count only declined by about 25% resulting in lower average fundraising rounds. The continuous decline in quarterly fundraising volume in 2022 suggests that the worst is yet to come with insurtechs facing a very challenging market environment in 2023.

The decline in large fundraising rounds is primarily driving the drop in fundraising. Large fundraising rounds – with $100 million-plus of capital raised – saw more significant declines in 2022 compared to small- to mid-sized rounds, due to many large insurtechs still struggling to prove the viability of their business models. When insurtechs are unable to show a clear path to profitability, investors have pulled back. Hence, there’s been deep cuts to operating costs to extend the runway and adapt to the changing fundraising environment.

Implications of current market environment for Insurtechs

So, what does this mean for the hundreds of insurtechs that may need new capital within the next 12-24 months?

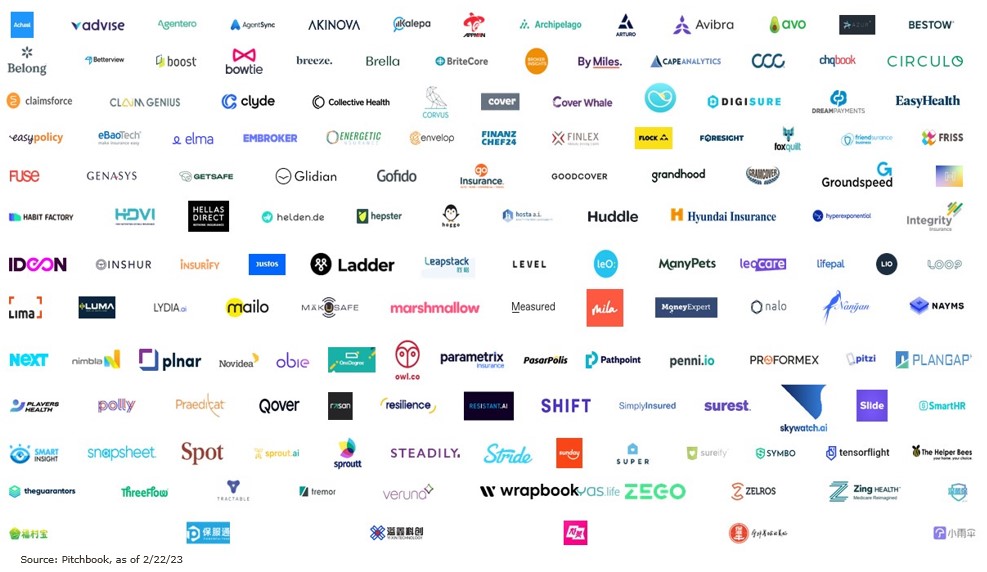

The dynamic market environment may lead to an accelerated consolidation of the insurtech segment. While some of these firms may go out of business, other firms may be forced to partner with a strategic acquirer as they are unable to obtain additional funding. Only best-in-class insurtechs will continue to receive funding.

One challenge for successful insurtechs that raised excessive amounts of capital at or near the peak of the market is to justify their lofty valuations. To minimize the dilutive impact on existing equity holders, firms set high growth goals, which they tried to achieve at all costs. For quite a few, this meant inefficient capital spending.

Carriers will likely be the ones taking advantage of these strategic M&A opportunities since they are under tremendous pressure. Carriers face multiple challenges including:

- Squeezed profit margins due to high combined ratios.

- Brokers are becoming more powerful and have more leverage.

- Additional competition from other market participants (e.g., fronting companies/insurtechs).

In a nutshell, carriers have several main strategic goals when it comes to acquisitions of insurtechs, including broadening their distribution networks and distribution channels, entering new market segments and/or improving their data analytics capabilities. The increased merger & acquisition (M&A) activity of carriers will likely lead to an accelerated transformation of the insurance industry as carriers seem to be committed to deploying additional resources and capital to pursue their long-term strategic goals.

Market conditions also present M&A opportunities for insurance brokers

Despite the current market dynamics in insurtech, it is believed that the technological evolution of the insurance industry will accelerate from here. Brokers need to do more in the future to stay up to date on recent developments and adopt new technology solutions.

History has shown that we often overestimate the short-term impact of new technology and underestimate its long-term effect. As public markets cratered when the dot.com bubble burst, not many people expected that a few of those firms would dominate global markets two decades later.

While acquisitions will need to be valued using different methodologies compared to traditional M&A transactions, the strategic value may justify the acquisition costs as they can help brokers retain leadership and advance critical capabilities in a dynamically changing market environment.

If you have questions about Today’s ViewPoint, or would like to learn more about current developments in insurtech or the insurance brokerage market, email or call Tobias Milchereit, Vice President, at 646.599.6589.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230