As insurance carriers, distributors, investors, and Insurtech firms prepare to travel to Las Vegas for the annual Insurtech Connect Vegas conference (ITC Vegas), starting on 10/31/23, quarterly performance results will be disclosed through earnings calls and investor presentations. With the latest Insurtech trends being released, a few themes have emerged that will likely be a large part of the ongoing conversations in Vegas this week.

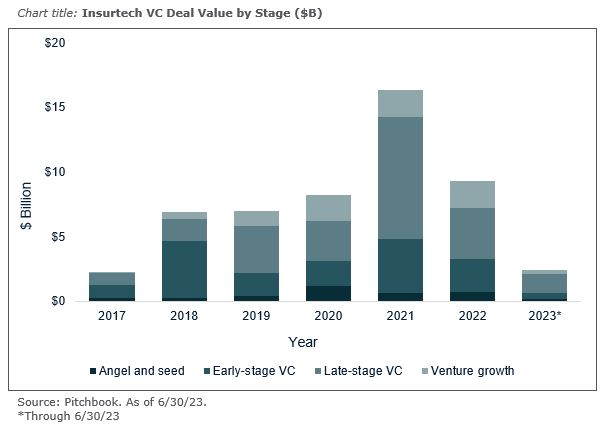

Theme 1: Venture Capital (VC) Funding is Down

It’s no secret that early-stage funding of technology solutions meant to digitize the insurance value chain is down relative to prior years, as recent Insurtech industry insights suggest that there’s a continued “flight to quality” of later-stage firms.

In recent Q2 figures published by PitchBook, 2023 VC spending was the lowest through two quarters since 2017. Unlike in 2017, where deals were distributed between early-stage and later-stage companies, 2023 VC funding has been concentrated on quality, later-stage companies.

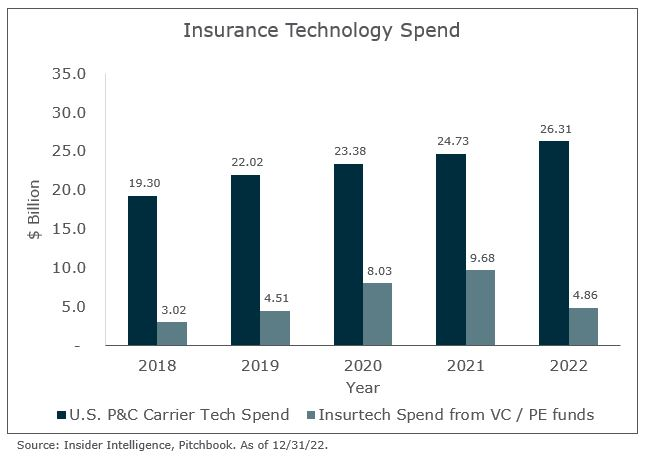

Theme 2: Insurance Technology Spend Remains Strong

Despite the decline in investment from VC and private equity (PE), property & casualty carriers continue to invest in technology, which is expected to continue based on Insurtech industry trends.

In October 2023, AM Best published the special report “US Property/Casualty Downgrades Outnumber Upgrades in First-Half 2023.” The rating agency report identified 32 downgrades vs. 22 upgrades, stating, “Carriers that are slow to address challenges or do not have the means, expertise, or technological capabilities to keep pace with changes in the environment will likely face ratings pressure.”

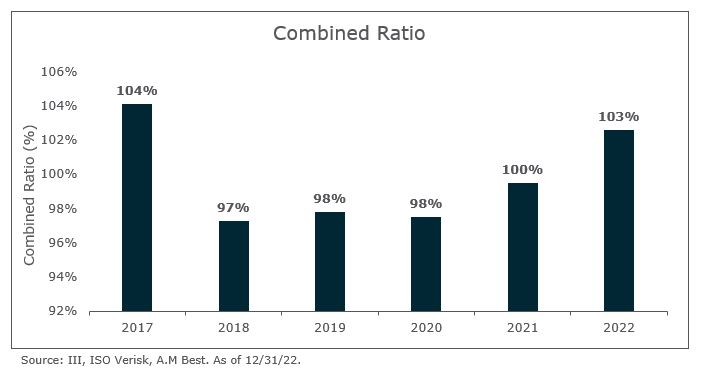

Theme 3: Predictable, Profitable, Organic Growth (PPOG)

In a recent study by Earnix (a global provider of intelligent solutions for insurers and banks) on insurance operations – 48% of participants reported that profitability is a priority vs. growing their business for their 2024 strategic priorities. The survey was published on the heels of Geico announcing that it had laid off approximately 2,000 employees in October. This is not a surprising turn of events considering 2022 was the worst underwriting year since 2017. As loss cost trends outpace rate increases and weather-related events continue to be more extreme, Insurtech insights suggest that the industry should expect triple-digit combined ratios soon.

What Do These Insurtech Industry Trends Mean?

Insurance has always been a silent part of people’s everyday lives. The industry is complex, with digital solutions becoming more accepted as a replacement for manual tasks.

For now, and in the foreseeable future, carriers will continue to focus on lower expense ratios by keeping the independent agent model of distribution. For Insurtechs, this means those with quality business cases, a near-term path to profitability, and a solution that meaningfully solves a problem will continue to be in high demand even as funding levels remain depressed.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230