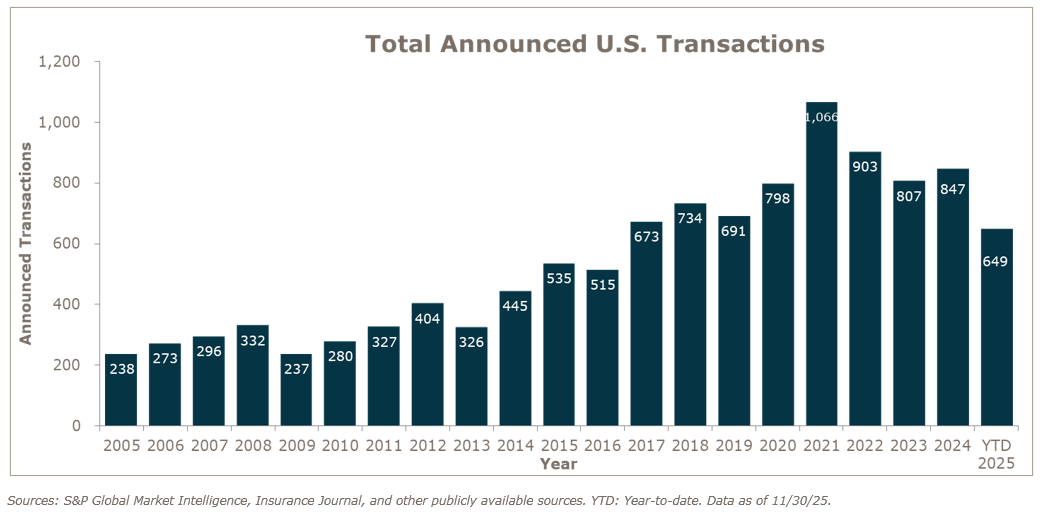

Insurance brokerage merger and acquisition (M&A) deal activity continues at an elevated pace, tracking to outperform last year, and potentially end as the second or third highest volume year on record.

This is despite a softening insurance cycle that has seen the public brokers’ stock values drop dramatically amid investors’ rotation out of the sector. Since collectively peaking at the end of March 2025 the public brokers have seen their values go from historic highs to a sudden freefall, dropping collectively by 21.0% since March and down 10.2% year-to-date (as of 11/21/25) as calculated by the MarshBerry Broker Composite Index. This recent decline in the value of public brokers’ equities in 2025 is glaring in light of the positive performance of the broader equity benchmarks, where the S&P 500 and the Dow Jones Industrial Average are up 12.3% and 8.7% respectively year-to-date (as of 11/21/25).

Even with these rising headwinds, strategic and financial buyers continue to pursue acquisitions aggressively. Several factors underpin the expectation for continued M&A activity through 2025 and into 2026. First, private equity remains a dominant force, leveraging existing dry powder and now looking to take advantage of declining capital costs.

Second, as brokers seek to offset slowing organic growth and prepare for continued volatility in property and casualty (P&C) rates and exposures – M&A will become even more important to achieve growth goals. Larger, well-capitalized firms are using M&A to strengthen balance sheets, expand specialty capabilities, and enhance geographic reach.

While public broker valuations have come back down in 2025, the private brokers have remained flat and are expected to maintain course, with top performing platform firms continuing to fetch record high multiples.

It is MarshBerry’s belief that valuations will continue to be influenced by limited supply vs. high demand. Now, as interest rates drop, the expectation is that with more affordable capital, compounded by the pressure to generate revenue to replace slowing organic growth – demand will increase even further.

Keep in mind, not all valuations are created equal. Quality firms are being highly rewarded today, even more than in the past. How firms are growing, the quality of that growth and their leadership capabilities (not just top tier, but the next generation of leaders) is going to become even more important, now that the insurance rate cycle is shifting.

M&A market update

As of November 30, 2025, there were 649 announced M&A transactions in the U.S. – putting deal activity on 1.3% higher pace than last year, which saw 633 transactions announced through this time last year. While last year ultimately closed with 847 transactions, 2025 continues to track ahead of last year’s performance on a year-to-date basis.

Private capital-backed buyers accounted for 471 of the 649 deals (72.6%) through November. Independent agencies were buyers in 89 deals so far in 2025, representing 13.7% of the market. There have been seven announced transactions by bank buyers in 2025. Deals involving specialty distributors as targets accounted for 102 transactions, about 15.7% of the total market, continuing the trend of low supply of specialty firms.

Deal activity from the top ten buyers accounted for 45.1% of all announced transactions, while the top three (BroadStreet Partners, World Insurance, and Hub) account for 20.2% of the 649 total transactions.

Notable transactions:

- October 28: Ryan Specialty signed a definitive agreement to acquire Stewart Specialty Risk Underwriting Ltd. (SSRU), a Toronto-based managing general underwriter (MGU) specializing in large-account, high-hazard property and casualty insurance. The transaction is expected to close in Q4 2025 and will integrate SSRU into Ryan Specialty Underwriting Managers (RSUM). Founded in 2016 by Stephen Stewart, SSRU has built a strong presence across Canada, underwriting risks in sectors such as manufacturing, utilities, construction, real estate, and oil and gas. The acquisition expands Ryan Specialty’s footprint in the Canadian specialty market and enhances its capabilities in complex, high-hazard risk underwriting. MarshBerry is serving as advisor to SSRU on this transaction.

- November 4: Wright National Flood Insurance Services, an affiliate of Wright National Flood Insurance Company and part of Arrowhead Programs (a Brown & Brown subsidiary), acquired the assets of Poulton Associates. Poulton, based in Salt Lake City, Utah, is a leading provider of private flood insurance in the U.S. and operates the CATcoverage.com platform, offering coverage through its National Catastrophe Insurance Program (NCIP). The acquisition will make Wright Flood the largest provider of flood insurance in the country, expanding its capabilities across federal, excess, and private flood markets. MarshBerry served as an advisor to Poulton Associates on this transaction.

- November 12: Alliant Insurance Services acquired Highpoint Insurance Group, a Friendswood, Texas-based multi-line insurance broker. The firm, which has 44 employees, will now operate under the Alliant brand. Highpoint serves the middle market in the Greater Houston area across commercial, personal, and employee benefits lines, with notable strengths in oil and gas, construction, and surety. This acquisition expands Alliant’s presence in Texas and aligns with its strategy of partnering with entrepreneurial firms focused on organic growth. Highpoint President and Co-Founder Brandon Smyrl emphasized the alignment in values, particularly in client service, employee empowerment, and growth orientation. MarshBerry served as an advisor to Highpoint on this transaction.