Insurance brokers once again reported overall positive results for Q4 2022 and the full year, which were attributed to a combination of improving new business, strong retention and continued insurance rate increases. These companies were also optimistic around 2023 growth targets. Organic growth figures reported in Q4 2022 were comparable to slightly higher than those seen in the prior Q3 2022. Most brokers reported organic growth rates in a wider range of 5%-12% in Q4 2022 vs. 6%-8% in Q3 2022.

Marsh & McLennan Companies, Inc. (MMC) reported organic revenue growth of 9% for full year 2022, vs. 10% in full year 2021. MMC noted this continues its “best period of growth in more than two decades.” On a quarterly basis, the company reported 7% organic growth in Q4 2022, compared to 8% organic growth in Q3 2022 and 10% organic growth in Q2 2022.

Brown & Brown, Inc. (BRO) reported organic growth of 7.8% in Q4 2022, vs. 6.7% in Q3 2022. For the full year 2022, BRO had 8.1% organic growth, vs. 10.4% in 2021.

Arthur J. Gallagher & Co. (AJG) had 11.7% organic growth in Q4 2022, vs. 8.4% in Q3 2022. AJG’s all-in organic growth for full year 2022 was 10%, vs. 8% for full year 2021.

Willis Towers Watson Public Limited Company (WTW) published consistent organic growth rates for Q4 2022 of 5%, coming in just below the previous quarter’s 6% and bringing the total year organic growth to 4%.

Aon plc. (AON) released a steady organic revenue growth of 5% in Q4 2022, matching that of Q3 2022, bringing their total 2022 organic growth rate to 6%.

Ryan Specialty Holdings, Inc. (RYAN) saw strong growth in 2022, with reported organic growth of 16.4% for full year 2022, vs. 22.4% in 2021. Its Q4 2022 organic growth was 10.3% for Q4 2022, vs. 15.4% in Q4 2021. The company expects continued growth across its portfolio of products and solutions, bolstered by a continued robust E&S market.

BRP Group, Inc. (BRP) once again reported organic growth that was far above the public broker group average, with full year 2022 organic growth of 23% (vs. 2021’s 22%); and Q4 2022 organic growth of 26% (vs. Q3 2022’s 28%). BRP sees their differentiated operating model and significant recent investments resulting in outsized growth. While BRP expects global economic conditions continuing to be a challenge, the company sees its business as very resilient and well positioned.

Brokers Noted Ongoing Macroeconomic Challenges

While management at many brokers noted uncertainty about the macroeconomic environment, many also see their companies as being well positioned for continued growth.

For example, AJG Corporate VP & CFO Douglas K. Howell said on the firm’s Q4 2022 earnings conference call: “Looking forward to ’23, we’re currently not seeing a slowdown in our clients’ business activity.”

President and CEO of MMC, Daniel Glaser, noted that the macro backdrop continues to be uncertain, MMC has a record of being resilient through economic cycles.

AON Executive VP & CFO Christa Davies said on AON’s Q4 2022 earnings call: “While we’re seeing signs of economic uncertainty, we remain confident in the strength of our firm and our financial guidance for 2023. Overall, our business is resilient and our Aon United strategy gives us confidence in our ability to deliver results in any economic scenario.” For full year 2023, AON continues to project mid-single-digit or greater organic revenue growth, margin improvement and double-digit free cash flow growth.

Merger & Acquisition Activity

AJG had an active Q4 2022 with 17 new tuck-in mergers completed, accounting for over $140 million in annual revenue. For 2022, AJG completed 36 mergers, with annual revenue of $250 million. The company announced the agreement to acquire Buck, a business providing retirement, HR, and employee benefits consulting with around $280 million in annual revenue. AJG also noted on the call that it has about 45 term sheets signed or being prepared, representing more than $300 million of annualized revenue.

RYAN noted on its Q4 2022 earnings call that its merger & acquisition (M&A) pipeline is robust, “both in tuck-ins and some larger platform opportunities.” RYAN’s focus for M&A is on quality specialty distributors including delegated authority, wholesale and benefits.

In contrast, BRP expects to have slower M&A activity in 2023 as the company focuses on organic growth. CEO Trevor Baldwin said on the Q4 2022 earnings call that “the M&A marketplace is one in transition right now. If you look at the M&A activity in 2022, while the nominal number of transactions was not down precipitously, the volume of acquired revenue was, I think, which speaks to some of the underlying health in that market and transition. The reality is the cost of capital is up meaningfully. We have not yet seen that be fully reflected in valuations.”

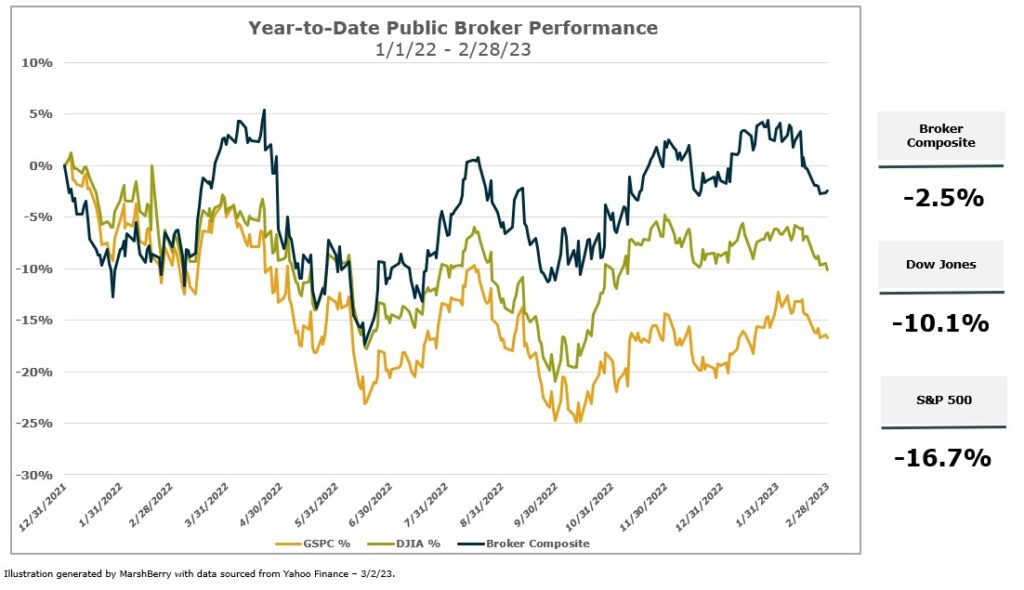

Stock Performance of Public Brokers vs. Major Benchmark Indices

Amidst the current market volatility, six public brokers, as measured by MarshBerry’s Broker Index, again outperformed benchmark indices in the period from January 1, 2022 through February 28, 2023, highlighting the strong fundamentals of the insurance brokerage industry.

The following publicly traded insurance brokers are included in the Broker Index: Arthur J. Gallagher & Co. (AJG), Aon plc. (AON), Brown & Brown, Inc. (BRO), Marsh & McLennan Companies, Inc. (MMC), Willis Towers Watson Public Limited Company (WTW) and BRP Group, Inc. (BRP).

While these brokers, as well as the S&P 500 and the Dow Jones Industrial Average (DJIA), ended the January 1, 2022 through February 28, 2023 period in negative territory, the public broker composite declined by a smaller percentage than both major indices.

2023 Outlook

While many brokers saw greater uncertainty from the impact of continued inflation, possible further federal fund rate increases, and geopolitical tensions, they remained confident in their abilities to meet their growth targets for 2023.

WTW’s 2023 guidance is for mid-single-digit organic revenue growth, adjusted operating margin expansion and improvement in free cash flow, after one-time cash outflows mainly related to its divested treaty reinsurance business is done.

WTW CEO & Director Carl Hess commented on WTW’s Q4 2022 earnings call: “Our clients are facing many uncertainties, including inflation, rising interest rates, softer GDP growth, a tight labor market, ESG risk and potential recession. The regulatory focus on pensions in an uncertain economic environment is also heightened. As we’ve seen historically, such volatility can create strong demand for specialist work and products that our unique combination of businesses provide.”

MMC noted on its Q4 2022 earnings call that it expects mid-single-digit or higher organic revenue growth in 2023, with margin expansion and strong adjusted earnings per share growth.

Overall, Q4 2022 and full year results from the public insurance brokers came in fairly strong with management teams confident around meeting their guidance for 2023.

If you have questions about Today’s ViewPoint, or would like to learn more about services available to your firm including customized financial advising, investment banking, and consulting services – email us today.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

The MarshBerry Broker Index is a composite of market data sourced from Yahoo Finance: BRP, BRO, AON, AJG, MMC, WTW. It is prepared for analytical purposes only. This information is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy.

This earnings summary has been prepared by Marsh, Berry & Co., LLC. and is not intended to provide investment recommendations on any company. It is not a research report, as such term is defined by applicable laws and regulations, and it does not contain sufficient information upon which to make an investment decision. It is not to be construed as an offer to buy or sell or a solicitation of an offer to buy or sell any securities, financial instruments or to participate in any particular trading strategy. These materials are based solely on information contained in publicly available documents and Marsh, Berry & Co., LLC has not independently attempted to investigate or to verify such information.