A shift in the talent narrative

The later days of June typically signal the beginning of summer and the end to the second fiscal quarter of the year. In 2020, both milestones are still true, but government officials, economists, and business owners alike may still be wrapping their arms around the interruptions of COVID-19 and the potential impact that may be felt the remainder of the year. In January, not many could predict a global pandemic that would debilitate business growth, skyrocket unemployment rates, and change the way we interact with one another in both business and social settings. Nonetheless, MarshBerry has been committed to keeping a pulse on the insurance industry’s trends and experiences to provide insights and perspectives on what the future operating model could look like.

‘Talent’ has been a hot topic for the insurance industry as several resources frequently warn about the dangers of an aging workforce coupled with record-low unemployment rates. However, the talent narrative changed quickly as firms were forced to migrate to a work-from-home environment.

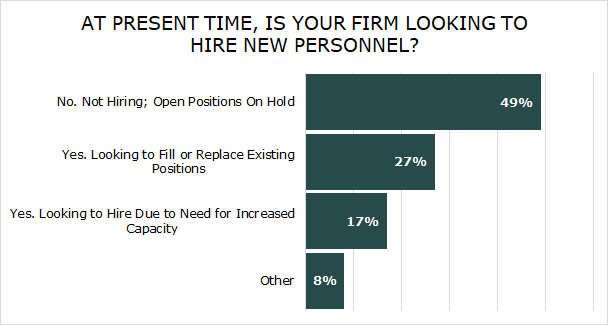

In a recent pulse survey, MarshBerry learned almost 50% of insurance distribution firms have implemented a hiring freeze, and activities related to re-forecasting revenue and new business generation have taken higher priority. MarshBerry’s Talent Acquisition team saw recruiting projects come to a similar halt – even firms with multiple, promising candidates cleared their calendars of interviews since the prospect of hiring and onboarding a new employee in a remote environment seemed unfathomable.

Source: MarshBerry Pulse Survey, May 2020

In addition to hiring freezes, MarshBerry consultants have heard multiple stories of firms using the recent months to make departures with teammates with performance and cultural alignment concerns. These departures may not be directly tied to expense-cutting actions, but it’s become apparent firms are willing to run with a leaner team.

According to the Bureau of Labor Statistics, Insurance Carriers and Related Activities experienced an increase in unemployment from February to May, but the increase is not as drastic as the national numbers. In February 2020, insurance unemployment was at a mere 1%, and today unemployment in the industry is 3.6%, which is almost 10% better than the overall national numbers. These statistics reinforce MarshBerry’s mantra that insurance distribution remains a long-term, viable and resilient industry.

This week, MarshBerry will continue to report how COVID-19 impacted talent strategies within the insurance distribution industry thus far. In addition, we look forward to sharing best practices to building your candidate pipeline during this pandemic as well as our talent outlook for the remainder of 2020.

If you have questions about Today’s ViewPoint, or about how to build your talent strategy in today’s marketplace, please email or call Brooke Lugonjic, Director of Organic Growth at 616.828.0741.

Subscribe to MarshBerry’s Today’s ViewPoint blog for the latest news and updates and follow us on social media.