Is your firm utilizing the most effective mix of motivation and accountability tactics for your producers? Data from MarshBerry’s 2025 Insurance Agency & Brokerage Compensation Report shows that the answer is most likely “no.”

Boosting productivity requires the proper combination of rewards and consequences. And beneath that truth, two facts stand out: First, the firm’s goals must be clearly defined, promoted (and backed up with action) at the individual level, with all expectations openly communicated in order to inspire and maintain consistent growth. Second, compensation must encourage activity that directly supports those well-defined goals.

How are firms holding producers accountable?

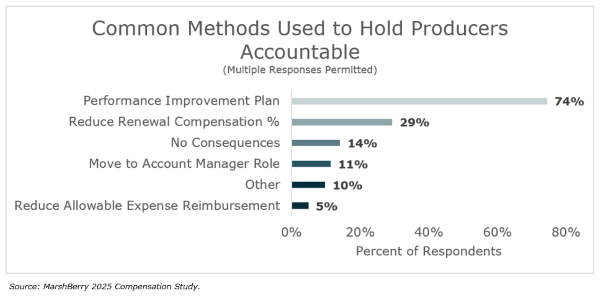

MarshBerry research has revealed that while there are many accountability approaches available to help boost producer productivity, few firms utilize them all, and the vast majority continue to rely (imperfectly) on one particular method while foregoing approaches that might prove more impactful. As this chart demonstrates, a performance improvement plan (PIP) is by far the most favored consequence for underperformance, more than doubling the number two choice of a reduction in renewal compensation. Even more interesting – the third most-popular accountability strategy: no consequences at all.

But there’s an even deeper issue hidden beneath the surface of this “PIP” strategy: It’s rarely defined exactly what it is used for. For many managers, a PIP is just a tough conversation, as opposed to a formal process designed to help get a producer back on track. Even worse, when PIPs are used, it’s often as a way to get someone out of the company. The true purpose of a PIP is to move someone back to performing at their full potential. However, in many firms, when leaders decide to implement a PIP, it’s probably six months overdue and is now being relied on as a way to exit an employee.

On its own, this accountability data reveals obvious opportunities for implementing policies to boost productivity, but the effective implementation of accountability strategies requires a clear definition of what goals producers are being held accountable for.

Clearly communicate expectations through effective goal setting

Goal setting exists on many levels, from firmwide annual goals to individual goals for the year to individual goals for a quarter (or shorter). To build a system of rewards and corrective measures based on performance, sales goals must be clearly defined, performance must be monitored regularly, and there must be a variety of consequences in place if expectations are not met. In MarshBerry’s experience, high-growth firms are far more likely to evaluate producer performance regularly and take corrective action quickly – including transitioning underperformers out of the role when necessary.

Effective goal setting includes:

- Minimum Goal: The baseline required for anyone to maintain producer status

- Individual Goal: Each producer’s personal target

- Stretch Goal: Aspirational targets for top performers

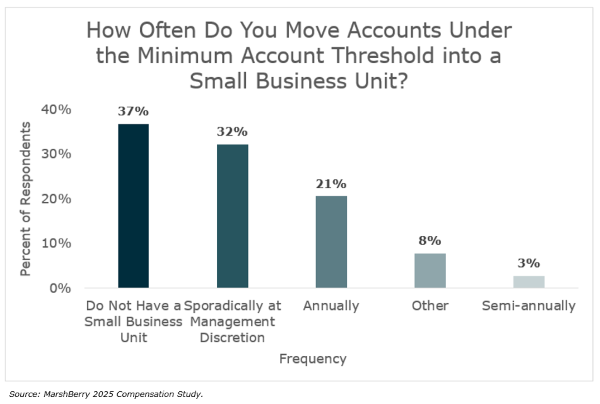

These goals should be informed by historical performance and market conditions, tied to meaningful incentives – and then communicated clearly. In addition, top performing firms are more likely to set minimum account thresholds for commission eligibility and move small accounts to dedicated service units. The movement of sub-threshold accounts out of the hands of producers is a proven way to redirect producers’ attention toward more profitable activities, yet a majority of firms do this either sporadically (and somewhat randomly) or not at all.

In general, producers’ number one complaint is not having enough support. But support is expensive. It’s important to make clear that support is tied to performance, and resources will be directed where they’re most likely to generate the highest return – that means the producers who reach or exceed goals are proving that they could do more with more.

Setting goals and utilizing multiple methods of accountability will almost certainly boost producer productivity on its own, but the reward side is where the complex art of strategic motivation mostly takes place.

Structure compensation (and processes) to create laser-focused motivation

To be sure, it can be hard to determine exactly how to structure the complete compensation mix –commission, draw against commission, salary and bonus – in a way that drives the most desirable outcomes. But this much is simple: the commission structure must always reward the actions that are most beneficial to the firm’s overall strategic plan, which means there is no one-size-fits-all model.

To ensure that compensation is making the right impact, every firm must be nimble in customizing and refining its compensation. Each firm has to consider size, location, lines – and more – when designing compensation plans.

MarshBerry’s recent study reveals that not only do commission rates vary by business line within a region, but rates can also vary by as much as 16% across different regions, and by as much as 31% based on company revenue size. The most successful firms know their benchmarks and then align compensation with strategic objectives. Given that the primary, strategic objective for creating growth is to generate new business, a 15 to 20 percentage point difference between new and renewal commission rates is typically recommended. A producer’s job is to produce new business. It is an appropriate strategy for them to be paid less on service because every firm has a team of experts to manage that.

Business retention is also vital, so it’s absolutely necessary that firms, looking for growth, reinvest dollars into a service and support process that serves as the primary point of contact for the insured, taking lower priority responsibilities off of producers’ plates. This not only helps to institutionalize the account, but it also creates capacity for producers to focus on new business generation, meaning that the proper process for handling renewals can contribute directly to an overarching growth strategy.

Many firms can do more to improve sales and organic growth strategies by implementing new compensation structures and accountability methods that include clear consequences beyond a performance improvement plan. An insurance brokerage that commits to planning and execution in this area can potentially achieve double-digit organic growth and an overall increase in the value of the company.

MarshBerry’s 2025 Agency & Brokerage Compensation Report: Available for Purchase

MarshBerry’s 2025 Insurance Agency & Brokerage Compensation Report explores the prevalent compensation trends concerning insurance agents and brokers. This one-of-a-kind report comprehensively examines current compensation data for 38 roles commonly found across insurance agents and brokers. The report offers insight into Executive & Management Compensation, Production, Service Staff, and Support Staff.