The Fed’s fight against inflation continues. On November 2, 2022, the Fed raised interest rates for the sixth time this year with a 0.75-point rate hike, bringing the total 2022 increase to 3.75 percentage points. It’s the fastest U.S. interest rate increase in 30 years.

While the stock market and financial news continue to overreact to the Fed’s tactics, the debt markets are still open for business. It’s true that access to debt capital has gotten more expensive and access may not necessarily be available to all industries – but those looking to invest in insurance distribution are not having trouble raising capital.

Debt market talk is a lot like recession talk. All signs point to something bad, but then Starbucks reports record earnings and raises the price on a latte. The debt market is similar. There are stories of a few firms looking to raise debt, only to find it too expensive or unavailable to them. Then top brokerages AssuredPartners, Inc., Hub International, Limited, and Acrisure, LLC raise $500 million, $825 million and $1 billion in debt capital, respectively, for future acquisitions.

Are Valuations Starting to Flatten in the Insurance Industry?

If cracks are starting to show as a result of some buyers getting squeezed on access to debt and/or the higher cost of debt – it’s within valuations. Multiples are still at all-time highs, driven by Private Capital Backed buyers – but there is some evidence of a slowdown in multiple growth over the last twelve months (LTM).

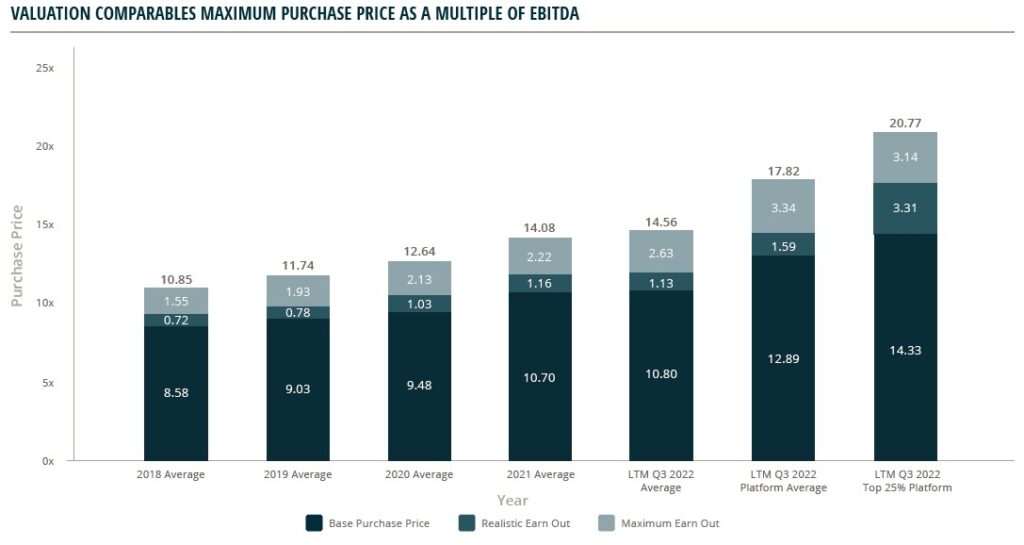

The average total potential deal value for the LTM ending Q3 2022 is 14.56x Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA). Compared to year end 2021, which produced an average total potential deal value of 14.08x EBITDA – only an increase of 0.48x EBITDA LTM, or a 3.4% increase year-over-year.

Comparing this to the prior period, where valuations saw a 1.44x EBITDA increase in 2021 over 2020, representing an 11.4% increase.

While the average deal is topping out at 14.56x EBITDA, platform deals in the last twelve months continue to push even higher. The average of the top 25% of platform transactions are commanding close to 14.33x EBITDA on a Base Purchase Price with a maximum transaction value averaging 20.77x EBITDA. There are numerous additional deals slated to close in Q4 2022 that have valuations that will likely top these trailing values.

So, regardless of a pending recession and/or the rising cost of debt – people are still buying lattes and investors are still raising cash and paying top dollar for investments in the insurance business.

Insurance Business Market Update

As of October 31, 2022, there have been 455 announced merger & acquisition (M&A) transactions in the U.S. The current volume of deal announcements represents a 22.2% decrease compared to this time last year. As the end of the year approaches, it’s anticipated that deal activity will be similar to that of 2019 and 2020.

Private Capital backed buyers accounted for 342 of the 455 transactions (75.2%) through October, remaining atop the various buyer classes. As previously mentioned, this trend is expected to remain consistent throughout the rest of 2022 as dry powder continues to be deployed. Public brokers have remained consistent with last year in terms of total deal count, making up 6.4% of total announced transactions.

Deals involving specialty distributors as targets currently account for 26.0% of the total 455 deals year-to-date. This trend is anticipated to continue as traditional retail brokers expand into the wholesale and delegated authority space.

Additionally, there has been a 63.3% decrease in deals completed by independent brokers compared to 2021. This can likely be attributed to historically high valuations in the market outpricing brokers who do not have private capital backing and sufficient capital to bring to the table.

Strong deal activity from the marketplace’s most active acquirers has remained constant through October. Ten buyers accounted for 54.8% of all announced transactions observed, while the top three (Acrisure, LLC, Integrity Marketing Group, LLC, and Hub International Limited) account for 23.6% of the 455 total transactions.

Notable M&A Transactions in October:

- October 3: Scottish American (Novatae Risk Group) announced that it has acquired Hawkeye Wholesale Insurance Services, Inc. (Hawkeye). Hawkeye is a managing general agent and wholesale broker based in Washington. The firm has a niche focus in underwriting policies for habitational, contractors’ liability, and lessors’ risk.

- October 17: Alera Group, Inc. announced its acquisition of Haylor, Freyer & Coon, Inc. The firm is a Top 100 independently owned insurance agency, as ranked by Business Insurance, that has dedicated divisions focused on providing insurance solutions to commercial enterprises, municipalities and individuals.

If you have questions about Today’s ViewPoint or would like to learn more about M&A activity for insurance agents and brokers, please email or call Phil Trem, President – Financial Advisory, at 440.392.6547.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Co., LLC. 28601 Chagrin Blvd., Suite 400, Woodmere, Ohio 44122 (440.354.3230)

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2022 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.