Merger and Acquisitions (M&A) activity in the specialty insurance distribution space (MGAs, MGUs, program managers, wholesale brokerages) is coming off a record shattering year. With 153 announced transactions in 2021, representing a Compound Annual Growth Rate (CAGR) of 29% since 2018, the specialty space has experienced remarkable growth in deal volume, valuations, and transaction size during this period. However, similar to the reduced M&A activity seen in early 2020 and 2021 following record setting years, the unprecedented highs of the last half of 2021 have seemingly contributed to a slower start in 2022.

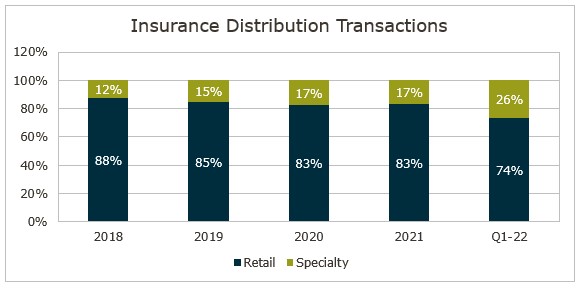

As of March 31, 2022, there have been 24 announced specialty distribution transactions in the U.S. This is down considerably from the 40 transactions seen in Q1 2021 but still represents an increase from Q1 2020 activity. Most notably, specialty firms continue to constitute an increasing proportion of transactions within the broader insurance distribution peer group, making up over a quarter (26%) of total transactions in Q1 2022. This represents a significant expansion of market share when compared to specialty’s 17% of total transactions in 2021.

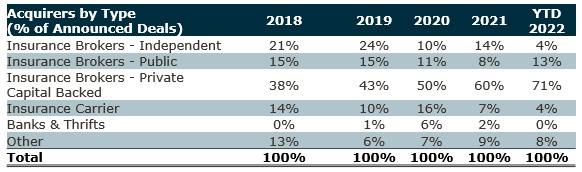

Private Capital (PC) backed buyers have continued to drive transaction activity within the specialty space, accounting for 17 of the 24 (71%) transactions year-to-date through March 2022. This demonstrates the trend of growing interest in the specialty space from the PC world, whose share of specialty acquisitions climbed from 50% in 2020 to 60% in 2021. Conversely, insurance carriers announced only one transaction in the specialty space in Q1 2022, which could be a result of the highly competitive valuations driven by PC backed buyers.

Early 2022 also saw the continuation of the largest players in the specialty space growing even larger. Specifically, Acrisure, LLC’s acquisition of Appalachian Underwriters, Inc., who writes over $400 million in premium, highlights the decreasing presence of larger mid-tier independent specialty firms (i.e. those from $300-$2B+ in premium). Several other active specialty buyers have made like-sized acquisitions over the past few years, including Ryan Specialty Group’s acquisition of All Risks, Ltd., CRC Insurance Services, Inc.’s acquisition of Constellation Affiliated Partners LLC, and AmWINS, Inc.’s acquisition of Worldwide Facilities, LLC. This activity suggests buyers are either aiming to acquire platform firms or have grown so large that only significantly sized sellers can help move the needle.

Looking ahead to the balance of 2022, an increase in specialty M&A activity is anticipated. While it’s expected that there will be a general rebound in M&A announcements, uncertainty and “what-ifs” are impacting the longer-term view, specifically, how high inflation rates will influence interest rates. The historically low interest rates have been a primary catalyst in the valuation climb seen over the last decade. As such, a sharp increase in interest rates could adversely impact valuations in the years to come. Combining escalating interest rates with the (seemingly) ever-present threat of tax rate increases could dampen the historically high valuations the market has been experiencing and/or reduce after-tax proceeds resulting from a transaction.

If you have questions about Today’s ViewPoint or would like to learn more about M&A trends for specialty firms, please email or call George Bucur, Director & Specialty Practice Co-Head, at 440.392.6543, or email or call Pete Kampf, Associate, at 440.392.6568.

MarshBerry 360 Forum – Registration Now Open!

Join MarshBerry for a day of learning, networking, and strategizing with leading growth consultants, analysts, and industry experts. Sessions are designed to help improve firm performance, earnings, value, and market resiliency. In addition, gain valuable insights, methodology and resources from MarshBerry’s team of in-demand industry speakers.

Seating is limited and reserved on a first-come, first-served basis. Reserve your spot now at www.MarshBerry.com/360.