Often, when people think of creating growth, they think of setting increased sales goals. But truly sustainable growth doesn’t begin with goal setting. It begins with a shift in mindset — from a purely goal-driven approach to one rooted in intentional and innovative planning. In this new way of thinking, every team member is empowered to contribute meaningfully. And everyone is expected to stay informed about the latest industry developments in order to identify emerging opportunities — because that’s where real growth comes from.

Don’t be a Blockbuster

Think of Blockbuster Video. While they were setting goals to increase video rentals, Netflix was tracking new technologies and applying them to the video rental business, moving from mail to streaming in the blink of an eye. That’s the essence of a growth mindset, and it serves as the foundation for any successful agency. To achieve that mindset, firms must move beyond the “we’ve always done it this way” mentality. Because, just like Blockbuster, firms that fail to adapt to change – risk becoming obsolete. Setting sales goals simply isn’t good enough anymore; success in today’s marketplace requires intentional planning across repeatable processes.

The power of intentional planning

Goals alone are meaningless. To be truly successful, you must have an intentional plan tied to every goal you establish. Whether it’s prospecting, rounding out accounts, adapting new technology or increasing staff, every activity must be measured and aligned with the firm’s broader growth strategy. Agencies that track activity metrics and adjust based on results are more likely to outperform their peers. This starts with three questions: How are we finding business today? What could we do differently? And if we were our own competition — what would we do to outperform ourselves?

Traditional sales tactics — cold calls, quoting without context, or relying on outdated scripts — no longer suffice. Instead, a modern, repeatable sales process will include pre-qualifying leads, delivering value in every meeting, and positioning producers as strategic partners. Sales growth comes from understanding every client’s business holistically, not just selling policies on a one-off basis.

Here’s the surprising truth: most people will buy from you based on what you know about their business as opposed to what you know about yours (i.e., the policy you’re selling). So, as you develop your own plans, talk to your clients about theirs. Not only can you confirm that you’ve covered them correctly for their current needs, but you may very well discover new needs emerging on the horizon.

Cross-selling and rounding out accounts

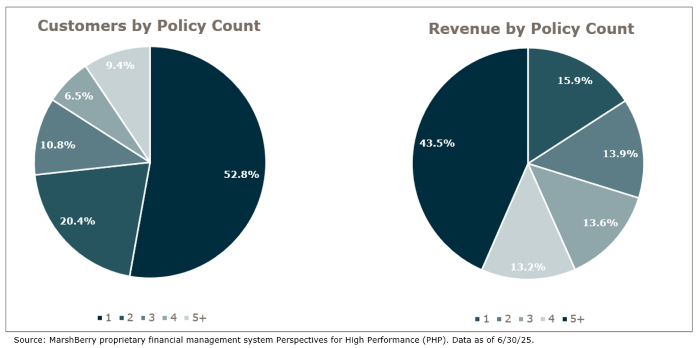

One of the most overlooked growth opportunities can be found within existing accounts and using account rounding strategies. Data shows that clients with multiple policies generate significantly more revenue. Yet the metrics reveal that nearly half of all clients hold only one policy with an agency.

By equipping service teams with the right tools and talk tracks, agencies can empower them to identify gaps and offer additional coverage. In that way, services teams can be transformed from purely administrative personnel into essential contributors to agency growth. Simply put: a major opportunity to grow may already be sitting right in your agency. In addition, given today’s predatory environment, filling coverage gaps for current clients also creates obstacles against competitors finding a wedge to come in and fill those gaps themselves.

Creating a culture of accountability

Professionals at high-performing agencies hold themselves – and each other – accountable at a different level and in different ways than at lower-performing agencies. This culture of accountability includes regular check-ins, coaching, and a commitment to professional development. Proven techniques include role-playing and using data to identify areas that need attention.

True accountability is also not about establishing a group of company commanders who monitor results from a distance, “yell” at the troops who are underperforming and then finally fire the ones who fail to reach their goals. It’s not about after-the-fact criticism and punishment — it’s about proactive, thoughtful improvement that lifts everyone to higher levels of performance and job satisfaction.

Building the growth culture

Culture is not accidental. It’s built day by day with intentionality across countless interactions. A true growth culture is one in which every team member, from producer to service staff, is aligned around shared goals, continuous improvement, and mutual accountability. This starts at the top when leaders create environments where wins are celebrated, learning is prioritized, and everyone is encouraged to contribute to the agency’s success. To accelerate growth, agencies must take intentional action. And to do that, they must know their numbers. They must know where the opportunities are emerging in order to capture new niches. They must create and track growth plans and get the entire team engaged in the growth process. Only in this way will an agency build a culture in which growth accelerates because everyone is contributing.

Plan for In Motion 2026

This article is based on a presentation given at In Motion 2025. Every year, the FirstChoice In Motion Annual Member Conference brings together top-performing insurance agency owners and producers for interactive educational sessions, panel discussions and workshops led by industry trailblazers.

If you are a FirstChoice member and missed this year’s In Motion conference, save the date for In Motion 2026 on October 14-16, 2026, in National Harbor, Maryland.

Is FirstChoice, a MarshBerry Company, right for you?

FirstChoice is your go-to resource to build agency value through our investments in carrier relationships, increased revenue, education, and technology. There is a reason FirstChoice is the top agency partnership three years running. Learn more about FirstChoice growth solutions if you are not already a member and are interested in the nation’s number one agency partner.