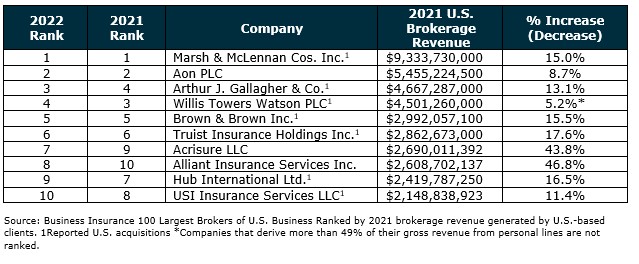

Business Insurance recently published their annual report on the Top 100 Insurance Brokers, ranked by revenue, for 2021. It’s no surprise that the brokers that comprised the top 10 are the same as last year – albeit, some have just swapped places on the list.

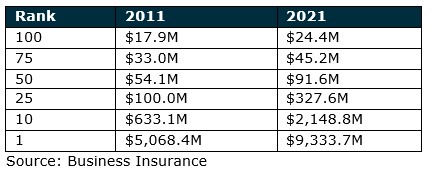

This year, the top 10 brokers’ revenue comprised 66% ($39.7 billion) of the total Top 100 revenue ($60.1 billion). While this ratio has trended down a bit over the years (due to more growth in the 11-50 firms) – a firm will still need a staggering $2 billion+ in revenue to enter the top 10 insurance brokers’ bracket. This is compared to just $633 million needed ten years ago, a 239% increase in revenue growth.

The Top 50 Insurance Brokers is Getting Tougher to Crack

The top 50 firms on the list represent $57.5 billion in revenue – which is 96% of the total revenue for the Top 100 in 2021. In 2011, firms needed $54M to get into the top 50. In 2021, a firm needed over $91M to break into the top 50, a 70% increase in revenue growth over that decade.

Larger firms are gaining more and more market share as they drive growth through acquisitions and presumably organic growth. Merger & acquisition (M&A) transactions hit an all-time high in 2021 with 923 deals, a 29.8% increase over the previous year. And while 2022 may not break that record, firm valuations, consolidation and private capital investments are still expected to be strong for the remainder of the year and possibly beyond.

Big Movers to the Top 50 Brokers

To no surprise, some firms that are contributing to the high growth and dominance of the top 50 firms on the list are private equity (PE) backed brokers. These brokers have been on the list for a while, but picked up the pace significantly, enough to enter the top 50 for the first time.

- PE backed High Street Insurance Partners, Inc. (High Street), jumped from 58th place to 26th place this year with $291 million in revenue (a 330% increase). In 2021, High Street completed 79 partnerships making them the third most active insurance acquisitor in the U.S.

- World Insurance Associates LLP (World), another PE backed firm, had the second fastest-growth rate of 188% and jumped from 53rd place to 34th place this year with $224 million in revenue. In 2021, World completed 49 deals, and since its founding in 2012 has completed 140 total acquisitions.

- PE backed PCF Insurance Services (PCF) made the Top 100 list last year (2020) for the first time at #27. In 2021, PCF continued to move by jumping up to #20 with $590 million in revenue (a 151% increase). They were the second most active buyer overall in 2021 with 99 transactions.

Opportunity to Enter the Bottom 50 Brokers List?

While the overall year-over-year revenue growth of the combined Top 100 firms was 19.1%, it’s interesting to learn 42 of those firms individually failed to grow by double digits in 2021. Of the 42 firms that failed to grow by 10% or more, 32 of them were ranked in the bottom 50.

Given the hardening Property & Casualty (P&C) rate environment (where increased premiums should be naturally bolstering revenue and without inflation as a dilutive factor), it can be assumed that nearly a quarter (24 firms) of the Top 100 firms’ “growth” was either negligible or negative since they failed to exceed 6% growth year-over-year. This includes all growth, from organic and M&A – the latter of which comes at a much higher cost.

For firms on the outside, looking in – this is where the opportunity for entry is relatively open. The barrier for entry into the Business Insurance’s Top 100 hasn’t risen significantly in the past ten years. A broker needed $17.9M to enter the Top 100 in 2011. Today – they would need $24.4M (only a 36% growth in revenue since 2011). A significant task for many firms, but not impossible to imagine.

Five New Additions to the Top 100 List (or the “bottom 50” List – for now)

With an average revenue growth of 74%, five firms joined the Top 100 list this year (as part of the bottom 50). These firms include:

- PE backed Keystone Agency Partners landed at 56th place with $80 million in revenue (a 233% increase).

- PE backed Alkeme Inc., landed at 64th place with $61 million in revenue (a 104% increase).

- Professional Insurance Associates Inc. (PIA) landed at 70th place with $52 million in revenue (a 4% increase).

- Reliance Partners LLC landed at 87th place with $36 million in revenue (an 85% increase).

- UNICO Group Inc. landed at 98th place with $33 million in revenue (a 20% increase).

How can Firms Grow and Compete on the Top 100 Brokers List?

For those firms making waves with triple digit growth rates over the past three years, driving organic growth from acquired revenue will be paramount to continued success – if and when consolidation slows down. While most of the Top 100 list is made up of organizations poised to acquire, buying organizations that have implemented organic growth infrastructure is more the exception versus the norm. Many of the large institutional acquirers’ growth rates will likely plateau if deal flow slows down.

While many of these firms have achieved success in different ways, there are common strategies that firms of all sizes should address.

- Reassess your capital structure to build capacity and capital for growth.

- Re-think your risk tolerance as it relates to debt and leverage.

- Find leadership that can clearly articulate the vision of the agency/brokerage.

- Commit to an aggressive talent reinvestment plan.

- Build a meaningful client value proposition that is most likely supported by technology.

Building a cultural commitment to an organic growth strategy, identifying potential best-in-class agency partnerships, and doubling down on opportunities for reinvestment (capital, talent) can be keys to the future outlook and success of firms that wish to compete and make themselves highly valuable to potential carrier partners.

If you have questions about Today’s ViewPoint or would like to learn more about strategies to help accelerate your growth and success, please email or call us at 440.354.3230.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230