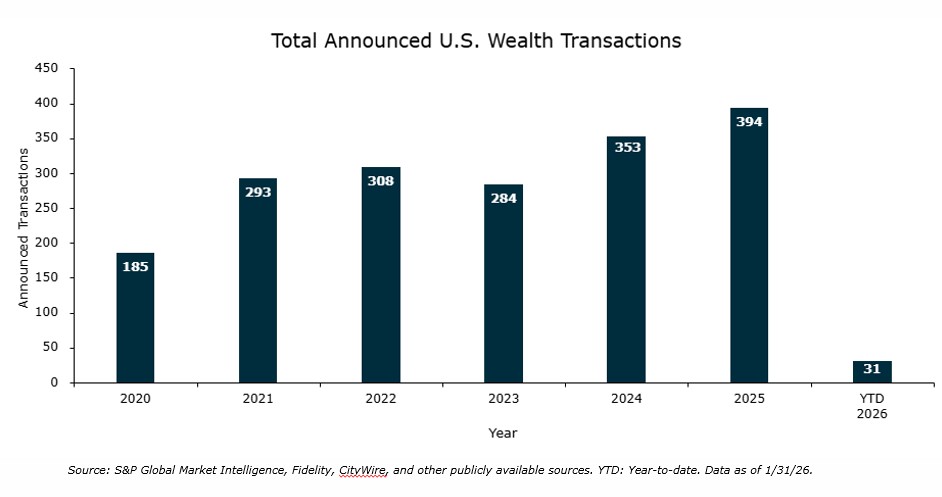

With final data now in hand, 2025 has firmly established itself as the most active year on record for U.S. wealth management mergers and acquisitions (M&A). Our preliminary year-end count of 372 transactions has been finalized at 394 total announced deals, materially exceeding the prior record of 353 transactions set in 2024. This revised total not only widens the gap over last year but underscores just how durable and broad-based consolidation has become across the RIA and wealth advisory landscape.

Importantly, this surge was not driven by a single market catalyst. As discussed in our 2025 Wealth M&A Year End Review, activity accelerated in the absence of election shocks, tax changes, or market dislocation. Instead, 2025 reflected a market that has matured. Buyers entered the year with sharpened investment theses, deeper integration capabilities, and long-term capital to deploy. Private capital-backed acquirers continued to expand their influence, while established platforms demonstrated repeatable, disciplined acquisition strategies rather than episodic bursts of activity.

At the same time, seller motivations evolved. Increasingly, firm owners pursued partnerships not solely for liquidity or succession, but to accelerate growth, invest in infrastructure, expand capabilities, and position their firms for the next phase of competition. As valuations remained strong and buyer depth expanded, alignment, cultural fit, and strategic clarity carried as much weight as headline economics. M&A has become less opportunistic and more foundational to how firms scale, professionalize, and remain relevant in a consolidating industry.

That momentum has carried directly into 2026. January recorded 31 announced transactions, marking a strong start to the new year and signaling that buyer appetite remains intact. Well-capitalized acquirers continue to lean into opportunities, and high-quality firms are entering the market with intentionality. The early pace suggests that consolidation remains a strategic priority across platforms, particularly as firms weigh internal succession challenges, rising infrastructure demands, and the accelerating role of technology in driving enterprise value.

M&A Market Update

Private capital-backed buyers continued to set the pace in January, completing 20 of the 31 announced transactions and representing 64.5% of total activity. Independent acquirers accounted for eight deals, or 25.8% of the market, while insurance brokerages did not complete a wealth or retirement acquisition during the month. The top 10 buyers represented 54.8% of total transactions, and the top three acquirers, Hightower, Cerity, and Choreo, accounted for 29.0% of all announced deals. At the same time, geographic dispersion reinforces the breadth of the current market environment. A total of 23 states recorded wealth management M&A activity in January, with Pennsylvania leading the country at three transactions, underscoring both the depth and national reach of ongoing consolidation.

Notable Transactions

January 7: Mercer Advisors acquired Long Run Wealth Advisors, a Lake Placid, New York-based RIA managing approximately $640 million in assets, expanding its footprint across upstate New York and into the Capital Region, Northern New York, and Vermont. Long Run serves families, retirees, business owners, and nonprofit organizations through comprehensive financial planning and investment management delivered by a seven-person team. The partnership provides Long Run with access to Mercer Advisors’ broader platform, including advanced estate and tax planning, institutional investment management, family office services, and alternative investment capabilities, while enhancing succession planning and growth resources. The transaction aligns with Mercer’s strategy of partnering with planning-focused firms to scale its integrated wealth management offering and deepen regional density. MarshBerry served as an advisor to Long Run Wealth Advisors in this transaction.

January 15: Bimini Capital Management agreed to acquire 80 percent of Oklahoma City based Tom Johnson Investment Management, which oversees approximately $1.6 billion in assets, in a transaction valued at 2.5 times 80 percent of the firm’s annual revenue, expected to be around $12 million. The consideration will be paid in cash, with any amount above the projected revenue benchmark structured in equal annual installments. The principals will enter into new three-year employment agreements, and Bimini retains the option to acquire the remaining 20 percent interest after the third anniversary of closing or earlier under certain conditions. The acquisition supports Bimini’s shift toward a more diversified asset management platform while maintaining continuity of leadership at the RIA.

Looking Forward

The wealth management M&A market enters 2026 with constructive conditions: strong valuations, an experienced and competitive buyer universe, and continued interest from private capital. However, valuation environments are cyclical. As firms evaluate their options, the decision increasingly centers on strategic clarity rather than timing alone. Owners who proactively define their long-term objectives, assess leadership readiness, and understand their enterprise value will be best positioned to navigate what comes next. If January is any indication, 2026 is poised to build on an already historic foundation.