How well do you know your organization’s key numbers like sales velocity, employee turnover, or revenue per service or salesperson? More importantly, how do they compare to the competition? Tracking metrics is paramount to driving organic growth, talent attraction, new business, client retention, and more. All of these numbers tell a story about an insurance brokerage business and its future outlook. But it’s more than just tracking a few stats, it’s about uncovering all measurement opportunities and benchmarking those results against the best in the industry.

What should insurance brokerage firms measure?

According to MarshBerry Connect, an executive peer exchange, insurance firm executives are typically focused on the same goals and target areas. These include profit, productivity, perpetuation, growth, and culture. Some leaders have a general sense of how they’re performing in these categories, but when they drill down on the details, there’s a lot to learn. Did you know that employee turnover can be good? Or that measuring sales velocity can offer a clearer picture of growth? Did you know you could measure and improve technology and tools? Organizations who are measuring and learning from these insights are ahead of the competition and have better plans for future growth and how to overcome common challenges.

Why firms should measure their performance

Tracking key metrics is about more than just ensuring profitability or a productive staff, measuring results across a business provides crucial insights into where the firm is thriving and easily identify areas to prioritize improvement.

What can data and insights help firms do to improve? Specifically, firms should seek to:

- Identify strengths and weaknesses: Benchmarking data helps firms recognize where they excel and where they lag. This insight allows them to capitalize on strengths and address weaknesses before they become critical issues.

- Set informed goals: Deep analysis of a firm’s performance enables leaders to establish realistic and strategic growth objectives based on data, not just intuition. It enables businesses to refine their strategy, improve efficiency, and allocate resources effectively to achieve long-term success.

- Enhance competitive edge: Staying ahead of the competition requires continuous improvement, and benchmarking offers the roadmap to remain a market leader. Benchmarking provides an objective comparison against industry peers and methods to proactively adapt to industry trends.

But benchmarking isn’t a one-time exercise, it should be a tool to monitor progress over time and allow firms to track improvements, measure the impact of strategic initiatives, and continuously adapt to market changes.

How top firms use data to improve

Taking action and executing after reviewing data findings is perhaps the most important takeaway when firms begin to measure. Based on data from MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP), participating firms have used their individual findings to drive better results in key areas mentioned earlier. For example, a firm falling below the average of 8.7% organic growth might prioritize hiring sales staff or putting energy toward new business initiatives. Commercial lines books with less than 16.9% profitability margin should consider increasing their average account size and implementing a Small Business Unit.

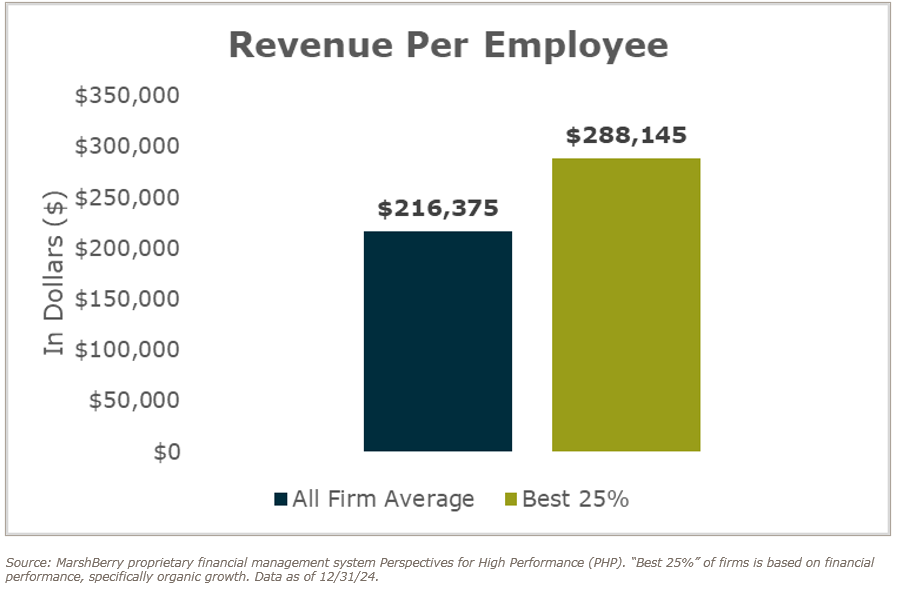

Productivity is an example of another key area that insurance firms should measure and improve. One firm used data on “revenue per employee” (see the chart below) to identify that their teams were falling behind on bringing in commissions and fees compared to the best 25% of firms. After some reflection, the business took steps to automate manual processes, outsource tasks that were not client-facing, and remove or reassign underperformers. Then they measured revenue per employee again over time to confirm progress and effectiveness of these strategies.

Data and benchmarking often reveal hidden potential – even in areas once thought to be strong. By embracing a cycle of data-driven insight, strategic improvement, and continuous measurement, insurance brokerage firms have unlocked extraordinary growth and profitability. Just imagine what breakthroughs await when you take a closer look beneath the surface. As competitors enhance their business results with data and benchmarking, it will become essential for firms to stay informed on their position in the industry – or risk being left behind.