In April, CEOs and other executives from over one hundred firms gathered at MarshBerry’s semiannual Connect Spring Summit to benchmark their firm’s performance, share best practices, and ask for business advice from peers in the industry. It is no surprise that MarshBerry facilitators that report the most popular discussion topics continue to be focused on all things talent: from attracting, recruiting, and onboarding to recommendations to retain the best insurance producers.

Navigating Insurance Producer Staffing Concerns

Post-pandemic, firms across the country increasingly report the negative impacts as a result of the talent shortage. Talent leaders share horror stories of their top talent being stolen away by competitors for astronomical compensation increases that aren’t sustainable for most independently held shops. Leaders are keeping an eye on their revenue per employee metrics in hopes of striking a balance between being productive versus understaffed. While organic growth numbers are on the rise to their pre-pandemic glory, being understaffed or being top-heavy in inexperienced talent threatens a firm’s ability to grow.

How Insurance Industry Ownership Statistics Factors Into Producer Retention

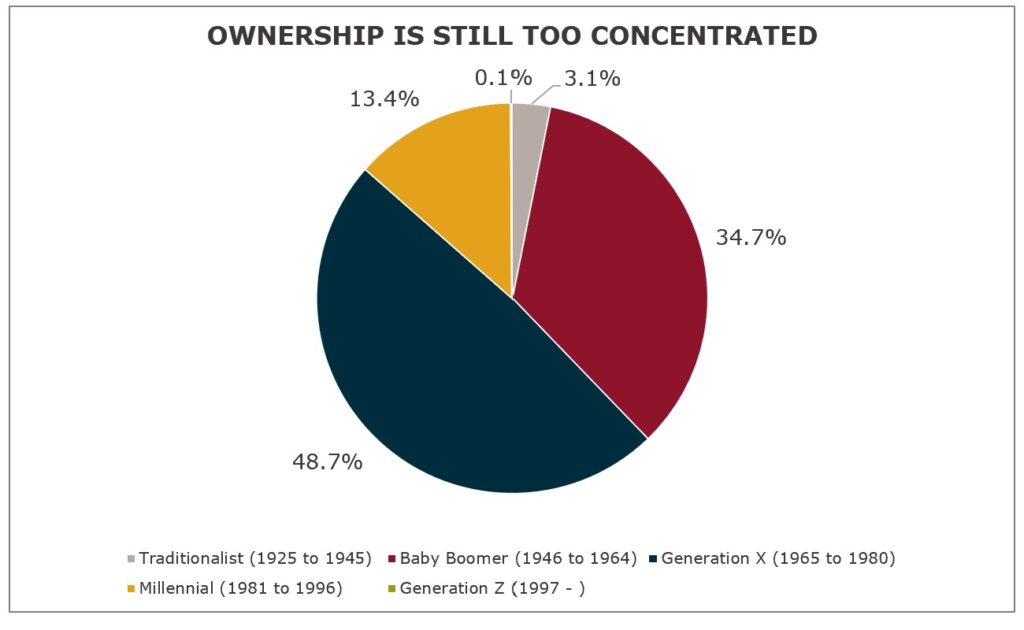

Typical organic growth strategy questions like, “How large will this company be in five years?” and, “How much new business do we have to write to get there?” always require a conversation about people. As a result, the subject of talent is earning its own spot on strategic planning agendas, and Talent Champions (HR, recruiters, etc.) find themselves a new seat at the strategic planning table. The reality is that 25% of the insurance industry will retire within the next 5-10 years; conversely, less than 27% of the insurance industry is under the age of 35. Therefore, most insurance firms are at risk of institutional knowledge and client relationships walking out the door with retirees and not enough new talent to perpetuate the business. To aid in the urgency for talent strategy, firms striving to remain independent are not broadening out ownership fast enough since over 80% of ownership is held by Baby Boomers and Generation X. Offering ownership to top insurance performers can not only help retain your team, but it can also secure your firm’s future.

Recommendations to Assess & Retain the Best Insurance Producers & Service Staff

So how do you dig your talent well before you’re thirsty?

- Assess your current team. Who will most likely retire or turnover next? How many producers and service staff do you need to accommodate new business goals? Determine what boxes on your organizational chart will be open and when to outline your talent strategy.

- Always be recruiting. Keep an eye out for talent that could be a good fit for your team in the future. Grab coffee with that salesperson you frequently run into at network meetings or that former colleague you admired even if you don’t have a job posted. You may not know when you need these people in the future, but you’ll already have introductions out of the way.

- Hire when found. Sometimes candidates aren’t quite a fit for what they applied for but their skills could match a future initiative. Be open to the possibility that you might find more than one candidate for only one opening.

Trusted and talented insurance producers and support staff with a strong culture fit don’t grow on trees, so hire them when they are at your fingertips!

If you have questions about Today’s ViewPoint or would like to learn more about strategies around talent acquisition that can help drive predictable, profitable organic growth for your firm, please email or call Brooke Lugonjic, Vice President, at 616.828.0741.

The Hiring Continuum—Are You Hiring the Future Owners of Your Firm

With firms across the country feeling the effects of a talent shortage, immense pressure to grow organically, and 25% of the insurance industry looking to retire within the next 5-10 years—is your firm’s talent strategy prepared to find and grow your next generation of owners? Join MarshBerry on Thursday, May 26 at 1 pm ET/10 am PT to learn tips on how to dig your talent well to proactively support your talent needs now—and down the road. Register here.